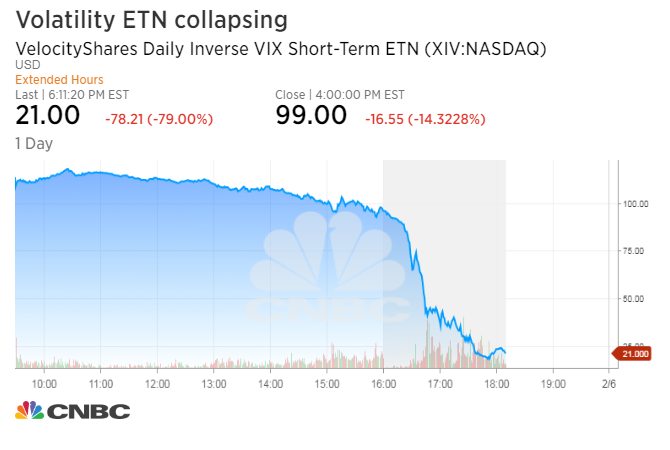

An exchange-traded security which is supposed to be a bet on calm markets was collapsing after hours.

The VelocityShares Daily Inverse VIX Short-Term exchange-traded note (XIV) is down more than 80 percent in extended trading Monday. The security, issued by Credit Suisse, is supposed to give the opposite return of the Cboe Volatility index (VIX), the market’s widely followed turbulence gauge.

The VIX doubled during regular market hours Monday, causing obvious havoc for a product seeking to track its inverse return. Though, the XIV dropped just 14 percent during regular trading.But then after hours trading began and the security, popular with hedge funds betting on an ever-placid market, was off by 80 percent in extended trading.

The move after hours sparked fear among traders that violent declines in exchange-traded notes like this one would cause market volatility measures to spike further and weigh on the broader market.

Volatility ETN crashes from CNBC.

www.cnbc.com/2018/02/05/xiv-exchange-traded-security-linked-to-volatility-plummets-80-percent.html

I read a good explanation of how this could evolve on twitter.

@TN

volatility has returned and will atomize Asia’s “autocallable” yield providing structured products

we could be in for a contagion as many of these were built on foreign indices (US & Europe), if they are triggered, it will mean FORCED buying of volatility globally

if this scenario plays out, it will mean further squeezing of all asset classes into a single one, creating indiscriminate forced selling, which may then hit the next domino: historic margin rates with razor thin cash levels, leading to margin calls and further forced selling

don’t mean to sound like zerohedge, just some thoughts dancing in my head right now

www.zerohedge.com/news/2018-02-05/it-traders-panic-xiv-disintegrates-after-close

And yep sh*t is hitting the fan in the short vol indices. Crazy.

Data is chaotic now but key numbers show $VXX IV value at +96.10 % for the day and $SVXY IV down -96.67%. It's likely $XIV & $SVXY terminated. If so their final values will be set by what value the futures were when they closed out their position. Likely at least down 80%.

— Vance Harwood (@6_Figure_Invest) February 5, 2018

$XIV and $SVXY are inverse funds that track VIX ($VXX), which is an index of volatility (ups and downs) in the market. For the past year, “Short VIX” has become a bit of a meme trade, with people betting that volatility will continue to go down.

Because XIV and SVXY are inverse funds, they go up when VIX goes down ($VXX goes down), and go down when VIX goes up ($VXX goes up).

VIX went up bigly today (because of the big losses, i.e. volatility), and even more so after hours (as of right now). So the inverse funds crashed, and if a fund loses too much money, the managers are usually forced to liquidate it (i.e. sell everything), which means anybody holding $XIV or $SVXY loses all money they invested in them. The tweet estimates loses of at least 80%.

h/t spontaneousdis