SCPA (statistical crash probability analyses) forecast: 100% probability the first worldwide economic depression has begun! This bold statement is based on statistical crash probability analyses of two new research findings noted below:

- The alarming discovery of nine additional countries whose markets commenced simultaneous crashes on 2/20/20 is now known.

These crashes of the nine new countries share the same genealogy of the crashes for the US, German, Japanese and Canadian markets which also began on 2/20/20. The charts below depict the crashes for all 13 including the ten developed countries and the three BRIC countries from their 2020 all-time or multi-year highs. Notably, the stock market for China, the fourth BRIC country did not crash.

My articles of March 5th and 6th are about the stock markets of four countries: the US, Germany, Japan, and Canada simultaneously beginning violent corrections on February 20, 2020. This was the day after the US, German and Canadian markets had reached all-time highs. Japan’s Nikkei had reached a multi-year high earlier in 2020. The article emphasizes the unprecedented nature of the markets for more than one country, let alone four; commencing crashes simultaneously.

My March 6th article, “US stock market to decline by another 22% by Easter” stated that according to the SCPA (Statistical Crash Probability Analyses) the “probability is 100% that the US, German, Japanese and Canadian stock markets will decline by 34% from their 2020 highs by Easter”. Three reached the 34% threshold by March 23, 2020.

The markets of the nine newly identified countries similarly declined by a minimum of 34% from their 2020 all-time or multi-year highs by March 23, 2020.

The SCPA’s probability is 100% for the markets of all 13 countries in the above tables to continue to decline to a minimum of 79% below their 2020 highs when they reach their final bottoms in Q4 2022. All 13 have the exact same genealogy as the Dow 1929 and the NASDAQ 2000 market crashes. The two crashes, occurring 71 years apart, declined by 89% and 79% with durations of 32 and 31 months respectively.

- The 13 countries in their aggregate represent 57% of the world’s 2019 GDP.

Based on the SCPA of empirical GDP data the probability is 100% for the US and world GDP to decline through at least 2023. The 13 crash afflicted countries rank in the world’s top 14 GDP country rankings. Together they represent 57% of the world’s 2019 GDP. For 2019, the US’ share of worldwide GDP was 23% and aggregated share for the remaining dozen countries was 34%.

In 1929, the US’s share of world GDP was 9.61%. From 1929 to 1932, US GDP declined by 28.6% and world GDP declined by 13.2%.

To put this into perspective, in 1929 the crash of a market for one country representing less than 10% of world GDP from its all-time high resulted in a three consecutive year decline for the world economy. In 2020, the stock markets of 13 countries representing 57% of world GDP commenced crashes from all-time or multi-year highs.

The SCPA’s stated probability is 100% that the markets of the aforementioned 13 countries will decline by a minimum of 79% when they reach their final bottoms in the fourth quarter of 2022. Therefore, based on this probability as well as the empirical data related to the world’s GDP from 1929 to 1934, the SCPA’s probability that the world economy will decline for three consecutive years by a minimum of 13% from 2019 to 2023 is also 100%.

All of the SCPA’s precise forecasts since it was developed in March 2020 have been accurate. For April 27, 2020 update see “Interim relief rally highs for markets has or will soon occur”.

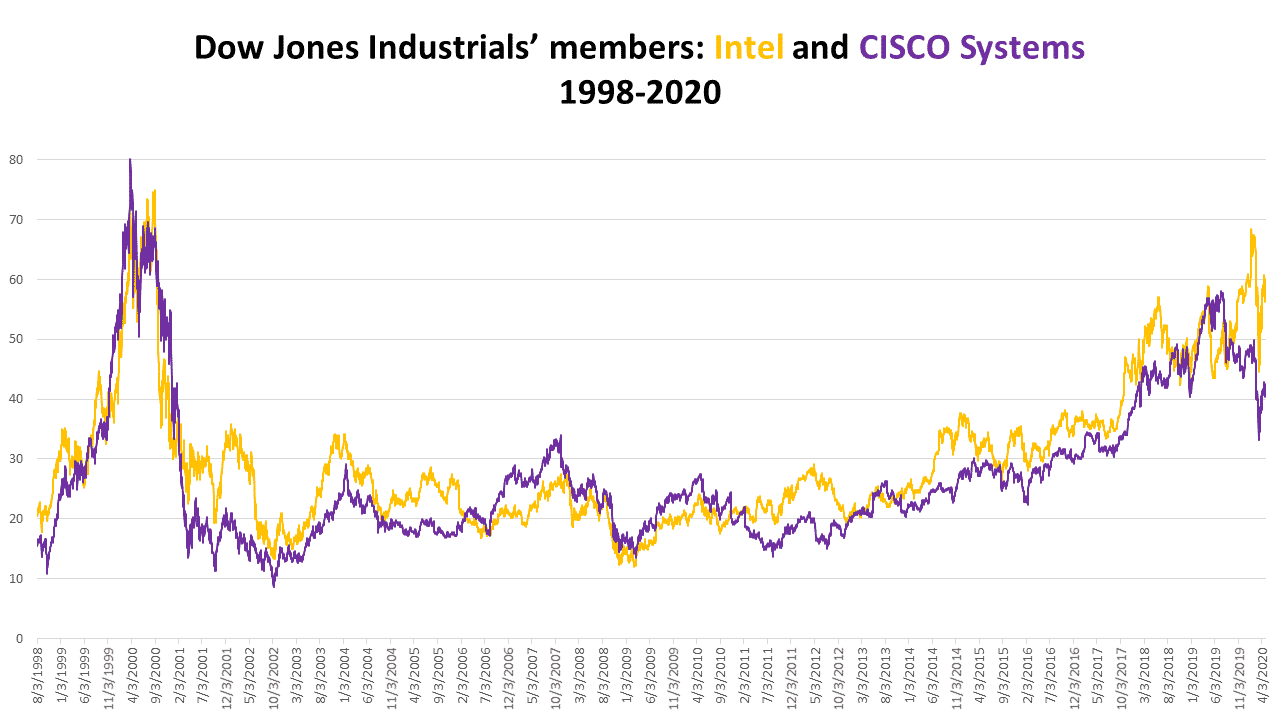

The collateral damage including the social unrest that a swift and deep market decline can cause to the economy of any afflicted country is immeasurable. Market crashes of 70% or more from all-time highs are very rare. The only two over the last 110 years are 1929-1932 and 2000-2002. The bursting of the dotcom double in 2000 is not as famous as 1929. However, the damage that it caused was in the same league. Global corporate profits crashed and US household wealth was reduced by $6.2 trillion. Many tech stocks, including Dow Industrials composite members’ Intel and Cisco Systems, have yet to recover.

My prediction is that the S&P 500’s secular bull market which began in March 2009 ended on February 19, 2020. The ninth secular bear since 1802 began on February 20th.

Read my March 31, 2020, article entitled “Embrace the Bear” to learn about:

- investing strategies that are best utilized during bear markets

- investing in the shares of inverse ETFs which go up when the market goes down

- algorithms including the Bull & Bear Tracker and SCPA which are being utilized by investors

The video of my “Secular Bulls & Bears: Each requires different investing strategies” workshop at the February 2020 Orlando Money Show is highly recommended. The educational video explains secular bulls and bears and includes strategies to protect assets during secular bear markets and recessions, etc.

BullsNBears.com which covers all of the emerging and declining economic and market trends is an excellent resource site. Click here to view a one-minute video about the site.

A strategy to liquidate all mutual fund holdings and stocks above $5 should be deployed immediately. Time is of the essence. To understand why diversification does not work and why penny and low-priced stocks should be held watch MoneyShow workshop video.