It has been a tough 7 days for Bitcoin, Ethereum and the NASDAQ composite index as The Fed is anticipated to raise their target rate AND engage in quantitative tightening.

While the NASDAQ composite index has been deflating over past 7 days, Bitcoin and Ethereum plunged in recent days. What is going on??

The Russell 2000 value (white) and growth (green) indices are both deflating.

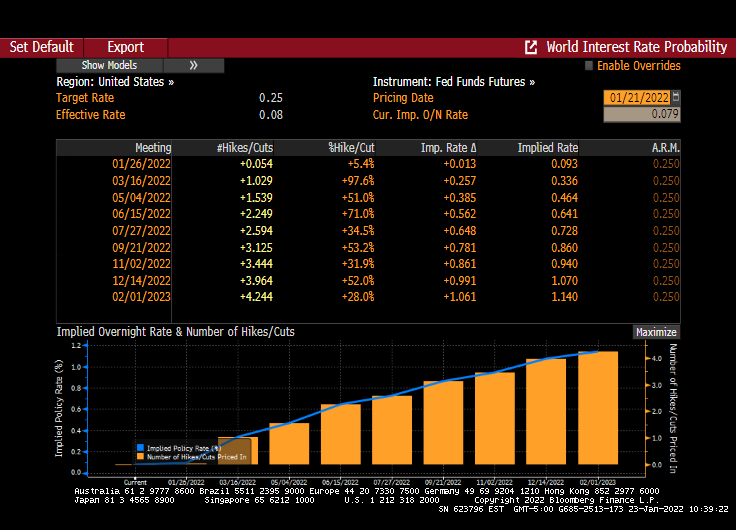

With regards to anticipated Fed rate increases, Fed Funds Futures are signaling almost 4 rate hikes in 2022 and 4 by the February 2023 meeting.

Then we have the massive increase in The Fed’s balance sheet after COVID struck in early 2020. Now, with the S&P 500 skyrocketing (until 7 days ago), why is The Fed buying sooooo much Agency MBS??

With the supply chain broken thanks to Congress/Biden/The Fed pouring trillions into an economic system that was working … we now have an economic system that is broken. Clogged ports, meat-packing labor shortages, etc. It’s as if Park’s and Recreation’s Jerry Gergich is running the economy as opposed to Ron Swanson.