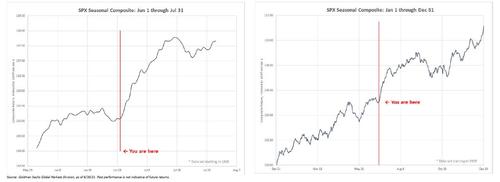

At the start of the month, Goldman trader John Flood correctly said that we are entering the best 2-week seasonal period of the year, with the first 18 days of the month traditionally the strongest period for markets…

… and followed up with a prediction that shorts will have to cover, which they did during a period in which we saw 13 out of 16 trading days hit new all time highs.

Of course, it all came crashing down in the last 3 days when the S&P slide accelerated, culminating with a scary rout on Monday when tumbling yields sparked a panic that the US economy is headed straight into a stagflationary crash.

And yet, with futures rebounding and traders clearly showing a desire to catch what has been the fastest falling knife in months, we were surprised to read that the same John Flood who correctly predicted the market ramp in the first half of July, has now flipped completely and in a note published overnight writes “don’t buy this dip.” He explains why:

I am a consistent buyer of dips but this wobble feels different and I am bracing for a weaker tape this week. Negative Covid headlines are picking up in velocity. Issuance spigots are fully turned on and this paper is getting harder to place from my seat (after some choppy px action related to issuance last week).

99% of S&P500 companies are in buyback blackout period into next week and quant flows remain asymmetric on the supply side (AKA CTA sellers will win this tug of war). Earnings last week were great but were not rewarded (banks)…this week and next are the 2 busiest weeks of the earnings period.

Overall market breadth continues to dissipate with FAAMG complex carrying the weight of the indices on its back. July has not been a fun month for the retail community (underlying retail bid is fading). HF length has recently come in significantly on a 1 year look back but on a 3 year basis is well above 50th percentile for both nets and grosses (still more wood to chop here). Institutional community continues to cut risk in China ADR’s post DIDI development while U.S. / China tensions rise. All eyes remain 10yr yields well below 200dma of 1.26 for first time in 2021. No need to hit the panic button but I plan on being patient with buy tickets over the next several sessions.

…

www.zerohedge.com/markets/goldman-says-dont-buy-dip-and-heres-why