Let’s see how The Federal Reserve is going to compete with other central banks when 19 European nations have negative 2-year sovereign yields. Call them the “Nervous 19.” Note that France has the lowest 2Y yield of the big 3 (France -0.664%, Germany -0.593% and Italy -0.092%).

True, The Fed’s reaction to COVID shutdowns was more extreme than the ECB’s reaction.

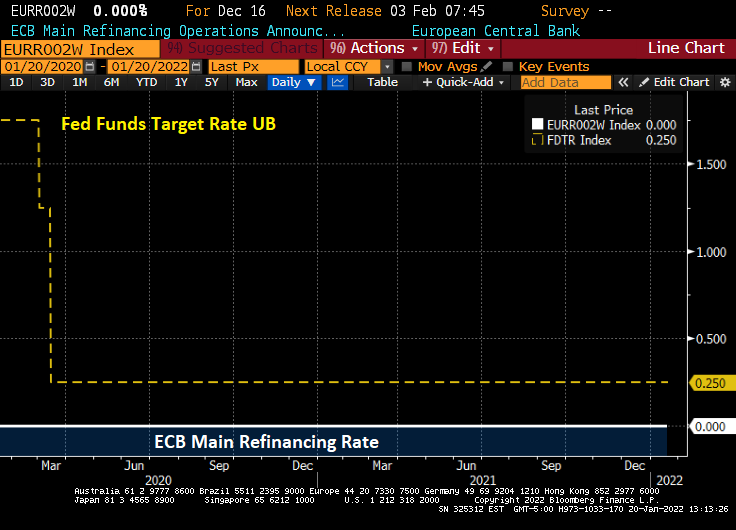

The ECB’s main refinancing rate is 0% and The Fed’s target rate is 0.25%.

Unlike the US with its 4 expected rate increases, the Eurozone is pricing in only 1 rate increase for 2022 … in October.

The ECB’s monetary policy is as stiff as French President Emmanuel Macron.

Views: