Warning: The economy is already in full collapse and the consumer is also broke.

This Can’t Be Good

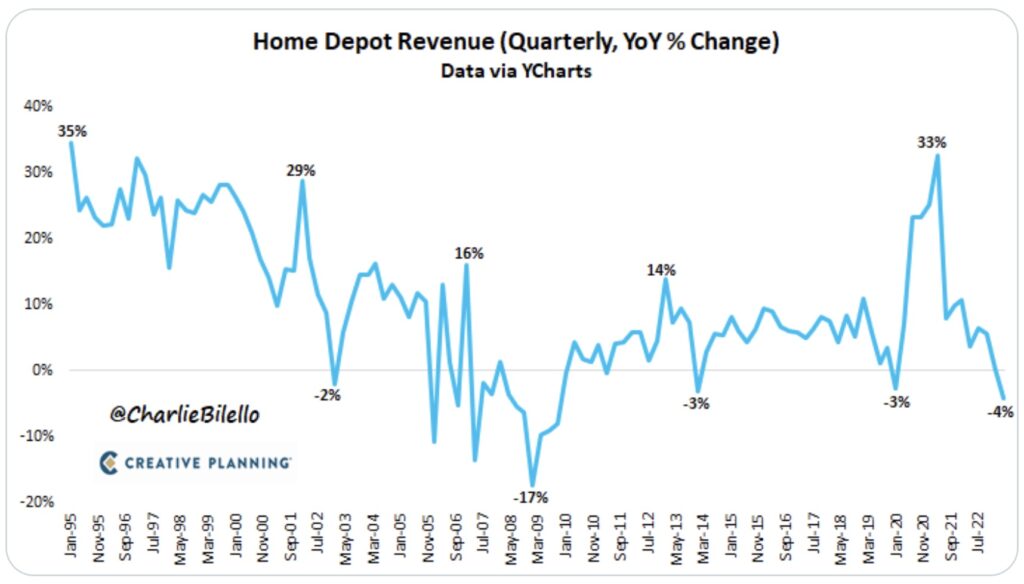

May 16 (King World News) – Charlie Bilello: Home Depot sales fell 4% over the last year, the largest YoY decline since 2009.Home Depot Sales See Largest Sales Decline Since 2009 Global Financial Collapse!

via CNBC:

Higher mortgage rates and a severe shortage of homes for sale are taking their toll on mortgage demand.

Mortgage applications to purchase a home dropped 4.8% last week, compared with the previous week, according to the Mortgage Bankers Association’s seasonally adjusted index. Volume was 26% lower than the same week one year ago.

“Purchase applications decreased to the slowest pace in a month, as buyers remain wary of this rate volatility, but also as for-sale inventory in many parts of the country remains scarce,” wrote Joel Kan, an MBA economist, in a release.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) increased to 6.57% from 6.48%, with points remaining at 0.61 (including the origination fee) for loans with a 20% down payment. That is the highest rate in two months. The 30-year fixed stood at 5.49% the same week one year ago.

Americans are feeling less financially secure now compared to the end of last year, according to a recent poll.

The sense of financial security in the US continues on a downward trend, with the share of those rating their financial security as ‘good’ or ‘excellent’ falling 5% since late 2022, and 7% from the end of 2021, according to a new Country Financial Security Index report that surveyed over a thousand adults in the US over three days in early May.

The Federal Reserve’s aggressive interest-rate hikes and economic turbulence – including the banking turmoil and fears of a possible recession – have also caused people to adjust their spending habits.

Half of Americans are taking steps to cut back on their monthly bills and are dining out less often to save money, per the survey. And now, 70% have said they are most likely to keep cash on hand given the current economic climate.

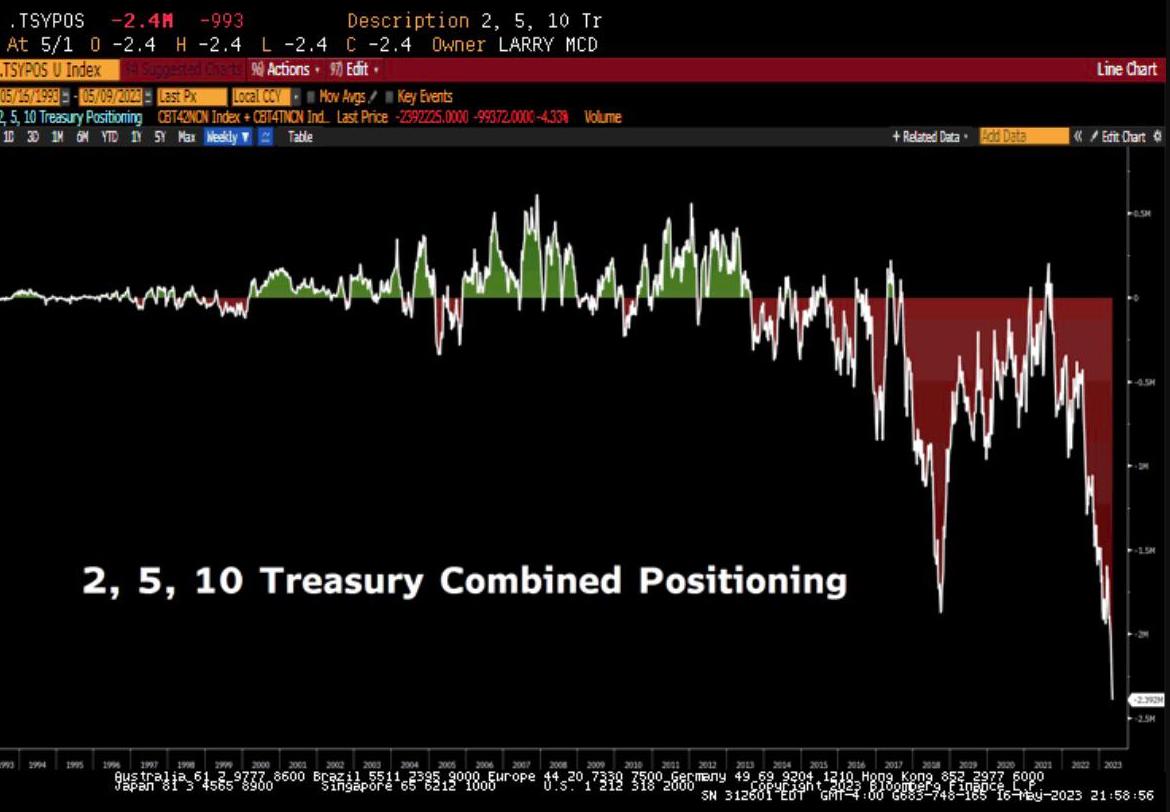

Record Short Treasury Positioning: The positioning in non-commercial Treasury futures across the 2, 5, and 10 year maturities is at record net short levels

Source: Bastien Chenivesse LinkedIn