via Zerohedge:

Many wondered what the driver of the late-day panic-buying across the US equity market was today.

The answer is simple – The Fed… again.

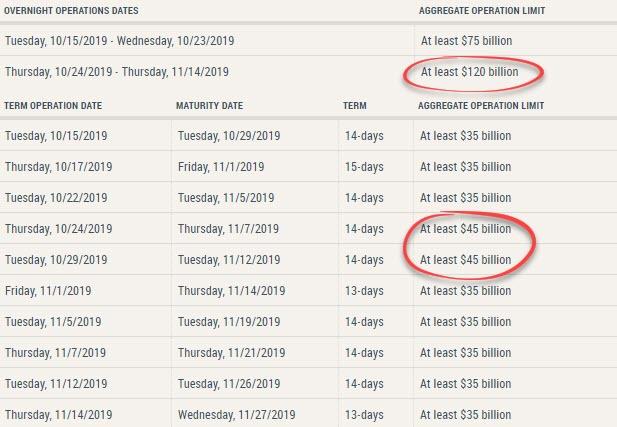

In a statement issued at 1515ET, The New York Fed confirmed it would dramatically increase both its overnight and term liquidity provisions beginning tomorrow through November 14th.

That is a massive 60% increase in the overnight repo liquidity availability (from $75 billion to $120 billion)and a 28% surge in the term repo provision (from $35 billion to $45 billion).

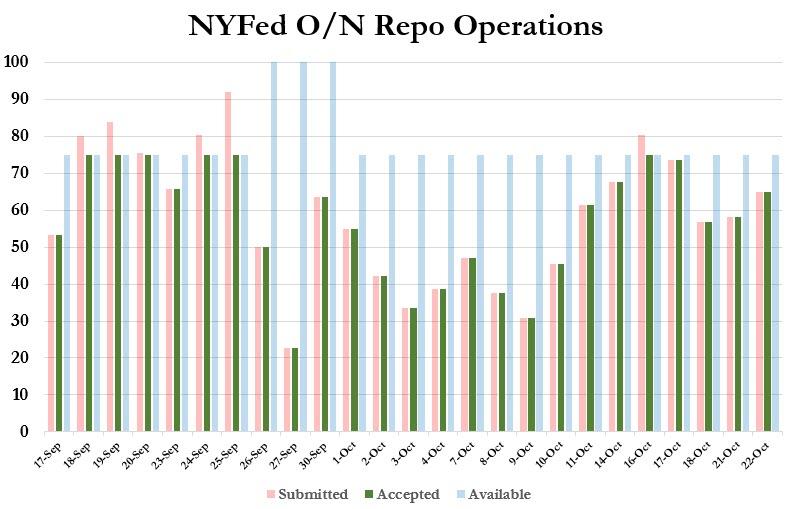

As a reminder, overnight liquidity demands have remained high since initiated...

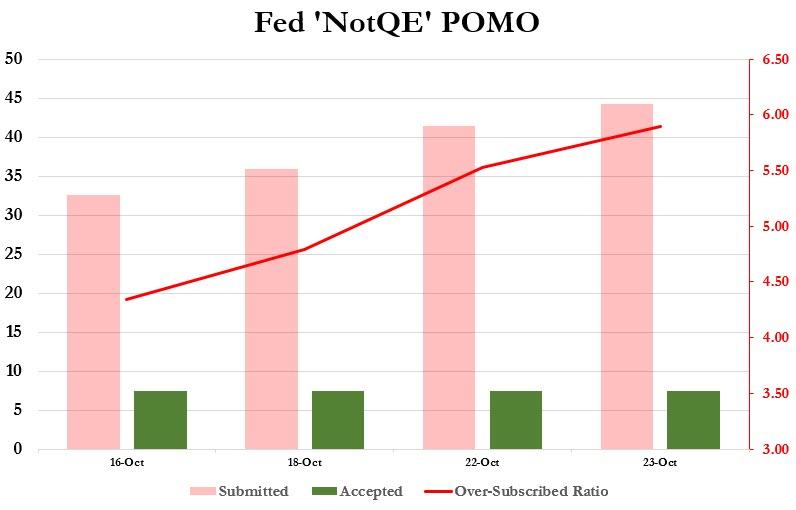

The decision to increase the liquidity provision could be based on the soaring demand for POMO…

“It’s just more evidence the Fed will not back off as yearend gets closer,” said Mike Schumacher of Wells Fargo Securities’ global head of rate strategy.

“The Fed wants to take out more insurance. You had repo pick up last week. That might not have gone over too well.”

Additionally, while there are no details, this time period crosses both month-end (and the normal liquidity issues associated with that) and the UK’s Brexit deadline – which could still very well mean dramatic dislocations and ‘clogs’ in the pipelines of critical liquidity around the world.

$120 billion of liquidity per day?! What is The Fed not telling us?