by Chris

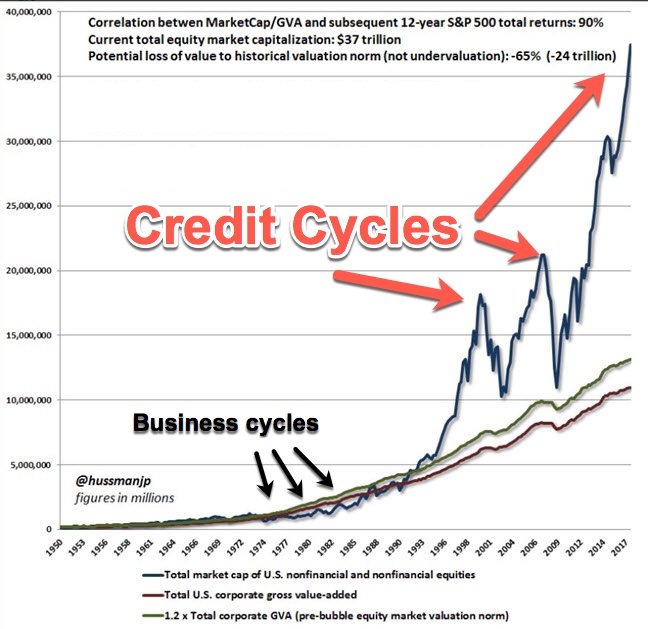

The air gap between the real value added and the credit cycle top in equity valuations, coupled with rising interest rates, suggest that the WACC is about to spike as both equity and debt become more expensive.

When (not if) that happens, then the ~16% zombie companies out there are toast and the rest will be tightening their belts.

Now I don’t know what business segment you are in and how exposed that might be to said zombie companies, trade war tariff effects, etc., but generally speaking everybody is going to get dinged if/when this credit cycle bursts.

The tricky part is not knowing what the authorities will do about it, but we know they are NOT going to willingly let a full deflationary spiral get going. It may happen anyways, but I’d put that chance at <10%.

Instead both Adam and I remain convinced that a deflationary scare gets going (ka) and then “money for the masses” (poom!) starts up.

In a business setting that’s hard to plan for so, again, we feel your pain. Timing this is impossible.

If this all pogresses ‘normally’ I’d say we’re still one to three years away from that. If something happens, such as an oil price spike, a banking crisis in Europe, a vigorous trade war, or any other major hot conflict, then this all could kick off at any moment.

I wish there were a better answer, and even more that we are not enmeshed in the peak of a third ill-advised credit cycle, but here we are. Gotta make the best of it all.