via Zerohedge:

The pound sterling has lost nearly 10% of its value in the last 120 days, as a no-deal Brexit has become more likely. The Financial Times Stock Exchange 100 Index, also called the FTSE 100 Index, has fallen into a bear market in the same period. Fear is spreading across the United Kingdom, also affecting the real estate market.

Nested, a London-based “data-driven” real estate firm, is reporting 29% of London homeowners are slashing their asking prices ahead of Brexit’s Oct. 31 deadline, reported Property Reporter.

The new report shows over £2 billion ($2.43 billion) of price cuts have so far occurred in the London Metropolitan Region ahead of the deadline.

About 11% of the listings in London (12,078) have seen at least £37,800 ($46,166) cut from the initial list price. Top areas of where the most substantial price discounts are being observed are in Westminster Kensington & Chelsea, Wandsworth, Camden, and Tower Hamlets.

Another 18% of homes listed in the London area have seen price drops of at least 10% ahead of the Oct. 31 deadline.

Jamie Salisbury, a property expert at Nested, said:

“Amid this endless uncertainty and gloom there are great opportunities out there for buyers if they’re bold enough to seize them. This is particularly true for homeowners who are trading up, presenting an opportunity to buy a new home that might otherwise have been out of reach.”

Brexit fears, along with an economy that is one step away from a recession, have sent real estate markets into turmoil this year.

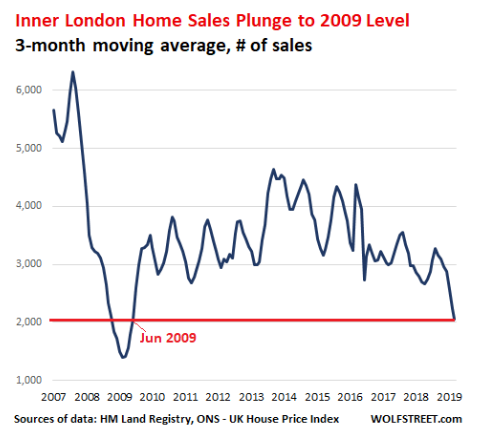

Inner London home sales plunged to 2009 levels this summer:

“In Inner London, sales volume has plunged by 50% from the mid-range prevailing in the three years from mid-2013 to mid-2016. And it’s down about 65% from the peak in sales volume before the Financial Crisis. These numbers are very volatile from month to month. So, to smoothen out some of the sharp month-to-month ups and downs, I used a three-month moving average. At 2,057 transactions, sales volume has now fallen to levels not seen since the depth of the Financial Crisis in June 2009,” noted Wolf Richter of Wolf Street.

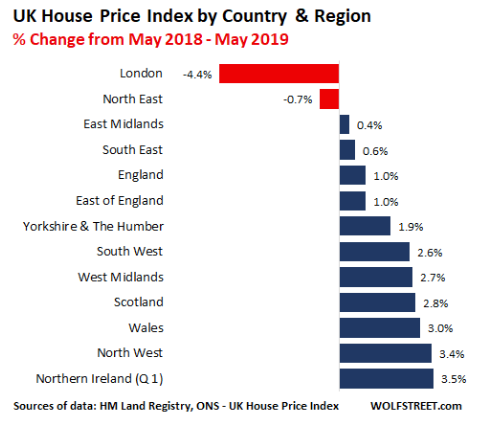

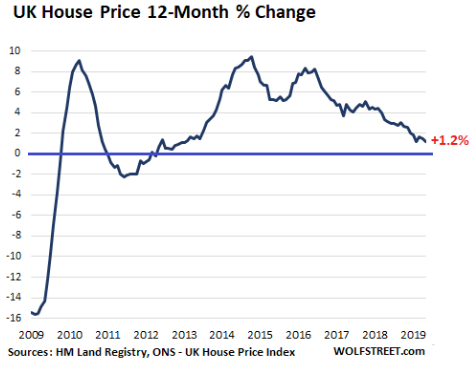

The overall trajectory of UK home prices is down:

“Overall UK home prices, after also peaking in August 2018, have inched down since then. On a year-over-year, they eked out a 1.2% gain in May, weighted down by the decline in the London housing market. May showed the lowest home price inflation, along with February, since January 2013 (by comparison, the UK’s consumer price inflation rose 1.9% through June),” Richter said.

And with the Oct. 31 deadline fast approaching – British Prime Minister Boris Johnson is gung-ho on leaving the EU with a deal, but that it is “do or die,” that he would be willing to leave without a deal so long as it means leaving on the deadline. With the political uncertainty surrounding Brexit and an economy that is stumbling into a recession, it now makes sense why people are racing to sell their homes, even if that means deep price cuts, because the next economic downturn has already arrived.