via valuewalk:

bout 40 million Americans had a credit card declined in the past year, according to a new report from CompareCards.com, a LendingTree company that helps consumers improve their credit health.

Having a credit card declined can be surprising, embarrassing and frustrating. It can be the result of a big mistake you made – like paying late or maxing out your card. However, in today’s world where credit card fraud is a near-constant threat, our survey showed that a decline doesn’t necessarily mean the cardholder is at fault.

CompareCards asked more than 1,000 cardholders about declined cards and found 22 percent of respondents had a card declined at least once over the past 12 months. Younger Americans were especially vulnerable: 30 percent of millennials and 51 percent of Generation Z had a card declined, compared to 23 percent of Generation X and 6 percent of baby boomers. Men were also more likely than women to say their credit card was declined.

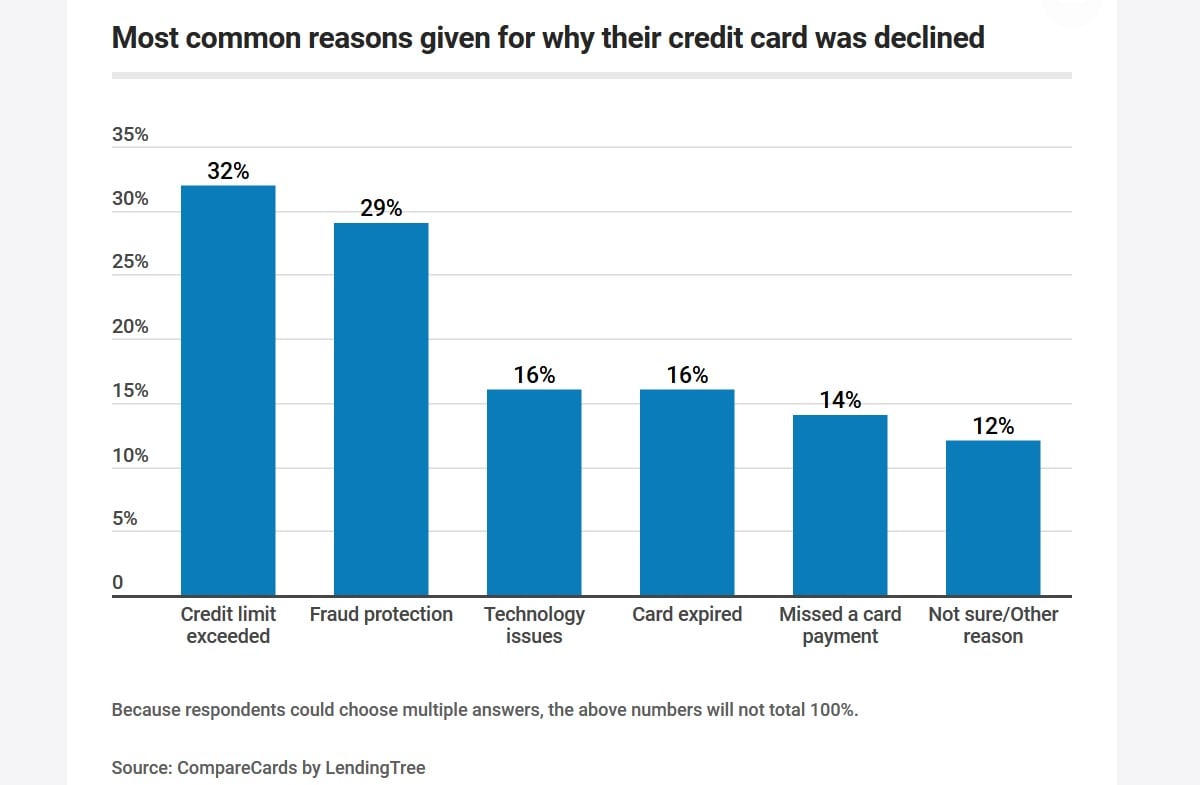

For decades, a card decline felt like a scarlet letter to many people. It was an embarrassing moment, putting an often-public display on a cardholders’ financial struggles to pay their bills on time or to keep their balances low. While many card declines still happen as a result of user error, the report also found many declines occur through no fault of the cardholder. When asked why their card was declined, a variety of reasons were given:

- 32 percent thought they exceeded their credit limit.

- 29 percent cited fraud protection.

- 16 percent blamed technological errors.

- 16 percent blamed an expired card.

- 14 percent blamed a missed payment.