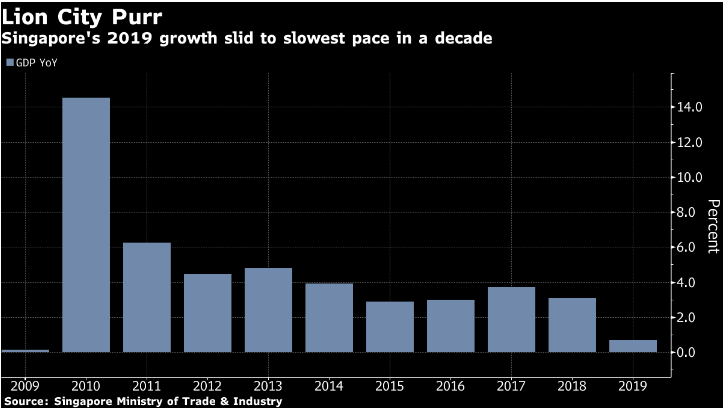

Synchronized Global Growth, R. I. P.

What the Fed Did to Calm Year-End Hissy-Fit of its Crybaby Cronies on Wall Street

…. the Fed’s balance sheet – which include Treasury securities, repos, and MBS, among other stuff – jumped by $108 billion in December to $4.17 trillion. Over the four months since the repo-market bailout started, the Fed has added $412 billion to its balance sheet, the fastest increase since early 2009, when the banking system was on the verge of collapse and the economy in a tailspin. But this time there was no crisis, other than a hissy-fit of the Fed’s crybaby-cronies in the repo market, and they had to be pacified, it seems: