by Adam

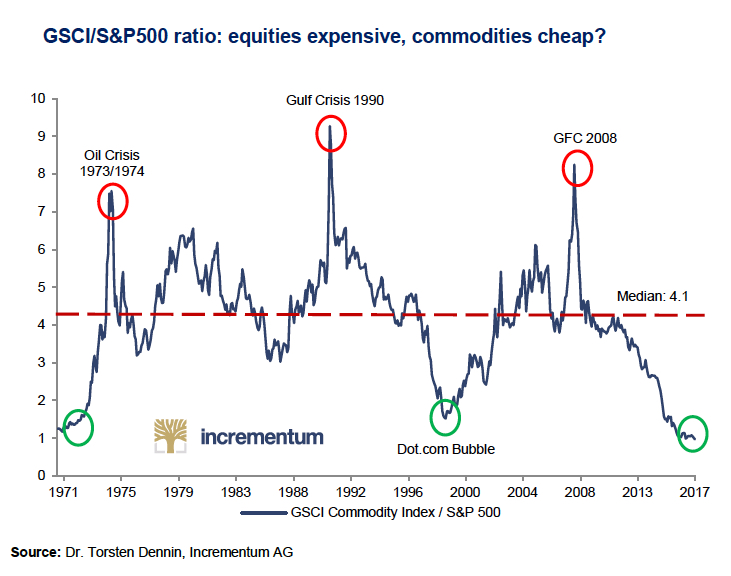

Commodities are at their lowest relative valuation compared to stocks than at any other time in the past half-century. For many reasons, that imbalance can’t last. And it will likely be correct by both equities falling AND commodity prices rising.

I do worry that, in the near term, a market melt-down may send commodity prices lower, too, as everything not nailed down gets sold to meet margin calls, etc.

But when they come into their own, I expect the upward re-pricing to be sudden and sharp (meaning: you’ll very likely need to have had built your position in advance to participate in it)