by youtubehead

Everyone here is so focused on the US. But what’s happening in China is really concerning.

Recently, a major property developer had to go out to the debt market and pay 13% yield.

Wynn stated the high rollers arent going to Macau. And they only see this during a recession.

A professor produced a paper saying 22% of Chinese property are ghost and investment vehicles. Ie 50 million apartments.

Shadow banking is 40 trillion in China.

This financial crisis has been hitting global markets and likely to accelerate in the US.

Because of how leveraged the chinese markets are, chaos theory would imply small disturbances in faltering local chinese markets (initial inputs) will have huge impacts on its macro outlook, dovetailing into a global financial crisis.

Were you alive during the great financial crisis? Looking back shouldn’t you have sold when everyone told you to hold?

Lehman brothers is going to have a chinese name this time.

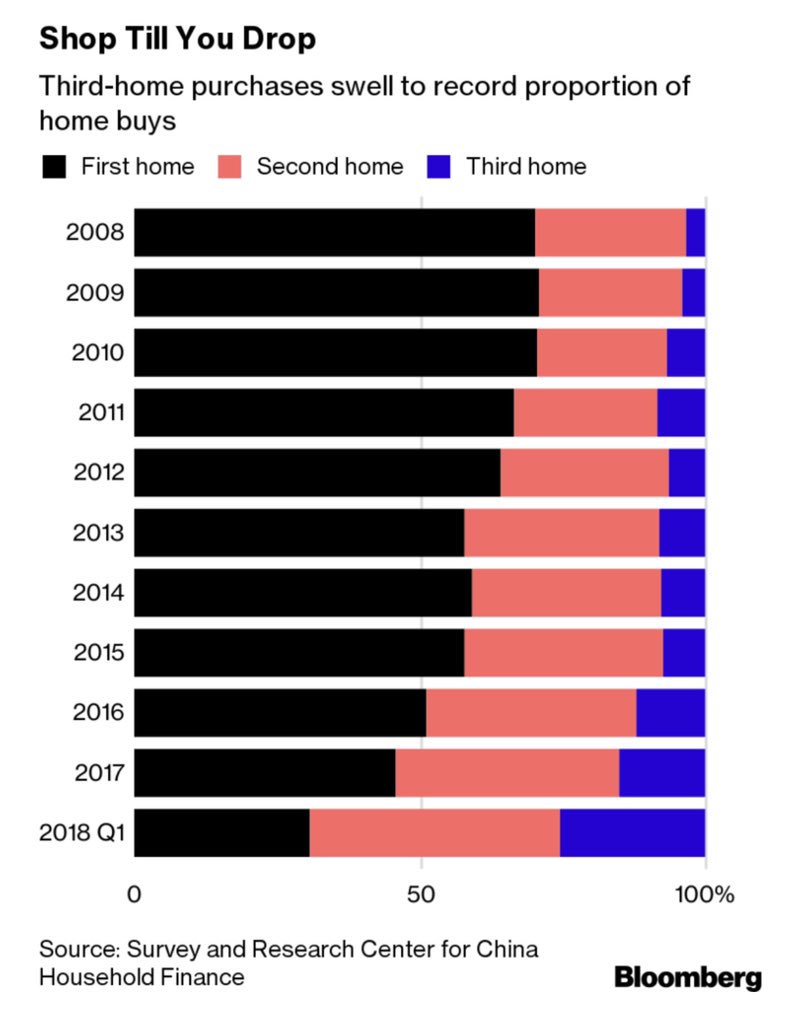

70% of new home purchases in China are second or third homes for the buyer

What do you think about this

50M of China’s Boom Economy Apartments Are Empty

You can’t pretend everything is awesome forever.