![HM Stoops? (the name signed to 2 of the 6 illustrations on the page of the newspaperâthey all seem to be from the same hand, despite this particular image is unsigned) [Public domain], via Wikimedia Commons](http://thegreatrecession.info/blog/wp-content/uploads/Bull_and_Bear_Fight_1-500x595.jpg)

So, the bull market bounced back, right? Not so fast. When one appreciated reader suggested there would be a huge plunge the day after Christmas, given how badly the market plummeted the day before Christmas, I cautioned against that tempting thought. Herein are some warnings about bull traps in a bear market and how they work and how much they look exactly like what we just saw….

Was this the Plunge Protection Team plunging into action to cut the bear off as soon as he was born?

Maybe. Consider how strenuously Secretary of the Treasury Steven Mnuchin tried to energize the PPT while knocking back piña coladas in Cabo on Sunday. Yet, it didn’t work. I guess the team was too lazy to kick into action on Christmas Eve. I mean obviously even Munchkin doesn’t want to work then, or he wouldn’t have been flying in private jets with is gorgeous wife down to Cabo. (At least, that is how he used to travel on the government dime in headier days. I don’t profess to know how he travels now. Maybe he takes his boss’s jet now that the boss has Air Force I. I don’t follow up on these things.

Maybe the Munchkin clan decided to get off their sorry butts after Christmas was over and work off a little of the egg nog. Of course, we had the president giving them a swift kick in the behind in the last 24 hours by telling everyone (which would include his PPT) to buy the dip because we are in the best of economic times.

So, maybe.

But. don’t think so.

I have three alternative suggestions that I find more compelling:

#1 Bouncing off the 20-yard barrier

Bear markets are notorious for having some of the biggest rallies in history, and this market has taken a fearsome plunge into the bear’s territory. The Nasdaq buried itself below 22% down from its previous summit. The broader Russel 2000 was also well below 20%. Transports are way below 20%, and bank stocks are further down than that. Worst of all are the FAANG stocks, the former leaders, which look like sidewalk splat at the base of a tall Wall Street tower.

However, the S&P 500, arguably the index most astutely watched by market investors, smacked down hard on the 20% line that defies a bear market. What could make a better bearier line than that? If you want support, the 20% line is hard one to break through because of what it means. So, when the S&P stopped out (so to speak) there at Christmas Eve’s close, that makes a solid line for a super-ball-sized bear-market bounce the next trading day.

#2 Year-end Pension Fund Rebalancing

About a week ago, Wells Fargo reported $64 billion dollars held in bonds by defined-benefit pension funds that would have to be rebalanced into stocks in the last few days of year-end.

You may recall that I’ve said a couple of times that the new era we have entered because of the Federal Reserve’s Great Recovery Rewind is pushing up bond yields. That, in turn, causes money to move from stocks to bonds, bringing down the price of stocks and the yield on bonds (because bond sellers don’t have to offer as high a yield once money is flooding their way from stocks).

I called it “seesawing action” because there will be some pretty hard pumping back and forth between those two investment kingdoms. The money flooding over to bonds creates other anomalies in the overall marketplace that have to be rebalanced.

Wells warned about a week ago of a giant seismic wave that would hit in the last few days of this year. Wells reported that a huge end-of-quarter buy order for equities had been placed because of the peculiarly large divergence that had already taken place in the final quarter between equities and bonds — a divergence that got even bigger after they reported. (When you pop the Everything Bubble, everything moves!)

These pension funds define a split of 55% of their value to be held in stocks and 40% held in bonds. With the huge plunge stock values took as bond yields rose, the value of each kind of asset in the funds had moved way outside of this balance. That required buying many more stocks and selling bonds in order to get back into the defined balance by the end of the quarter. You can be sure many funds are doing similar things in order to close the year back in balance. (Not an enviable task because the ground shifts under the fund manager’s feet as everyone else starts doing the same thing, making it a slippery surface to stake a stand on.)

This move appears to be born out by today’s action in government bond auctions. If there are a lot of pension funds that need to rebalance from bonds to stocks in order to maintain their stated balance ratios, then you would naturally expect there would be a lot fewer buyers in today’s bond auction, and such was the case:

Today’s $41 billion government auction in five-year notes saw the number of bids plunge by 20% to its lowest bid-to-cover ratio since 2009. The anomaly here was that one would expect, if the government is finding a lot fewer interested bidders, it would have to sell its bonds at higher yields in order to sell all the bonds it needs to sell to raise its targeted money needs. Yet, yields also fell. Regardless, the number of usual bidders was way down.

The worst December to Remember makes for the biggest rebalancing act, which drives stock prices back up and bond yields back down in the kind of violent oscillation we can expect to see as the Everything Bubble comes apart. (That’s why I’m not in either stocks or bonds because the war between them looks to be as violent as well, the war being a hungry bear and a raging bull. Best to just leave the bull pen in my opinion and let them fight it out.)

#3 Drop your shorts, we’re going under

Or there is the following explanation from Zero Hedge, which also sounds quite plausible with strong historic bear-market precedent. It’s all about a horde of people who shorted the market closing their short positions in order to reap the gain from the recent big declines.

When shorting the market, an investor borrows stocks (usually from his or her broker), paying the lender interest on the value of the borrowed shares until they’re returned. In the transaction, the investor immediately “sells them short” to another party, which means the investor sells shares the investor doesn’t actually own, and so the investor’s account is now “short” that number of shares. When the agreed time comes for the investor to make up that number of borrowed shares, he or she has to purchase them on the market at whatever the market price is at that time in order to return the same number of shares to the lender.

Investors do all this because they believe the shares will drop in value so they can borrow the shares and sell them right away at, say, $100 a share, and later buy that many replacement shares when the time comes to replace them at a lower rate. If that’s $60 a share, they buy all the replacement shares at $60 each, retain the $40 difference per share as a profit (less the interest paid) and return the shares to the party that lent them, which is called “covering their shorts.”

With the market having fallen so long and so hard as it did this quarter there were a lot of short positions being gambled on out there, and it may have become time to reap the profits before year end. The downside even in a falling market is that, if you don’t sell your shorts fast enough when there are a lot of positions hanging out there with similar timing (as could easily be the case at the end of a year), the sudden selling of so many accumulated shorts can, by itself, drive the price back up, decreasing your profits. And, of course, if the price winds up higher by the time you cover your shorts, you lose the difference.

It’s a high-risk gamble because the most you can make if prices plummet is 100% of what you sold the stock for when you borrowed the shares; but the most you can lose is whatever amount they rise by. While they can only fall by 100% of their value, there is no limit on how much they can rise. So, if you were the short seller, there is no limit on how much you can lose when you have to replace the borrowed shares.

The action on such short-covering rallies can be frenzied, and probably a lot of shorts were timed so accounts could settle by year’s end; but when all the short covering is over, the market drops again like a rock.

“This is not the kind of price action you see in normal bull markets,” said Robert Baird equity sales trader Michael Antonelli. “This is just a face ripping short cover rally. I am 100 percent not saying we are in a situation like 2008 now, but look at October 10, 2008 to October 13, 2008: the market rose nearly 12 percent in one day. October 27 to October 28, 2008, it rose 11 percent.”

“Bear markets always serve up some very nasty rallies,” said Doug Ramsey, chief investment officer of Leuthold Weeden Capital Management, which manages about $1.2 billion. “There’s a saying that bear market rallies look better than the real thing so I’d expect at some point here a 3 to 4% up day. It’s not unusual at all to see that in a bear market.”

“This type of volatility primarily occurs in bear markets” said Fred Hickey, editor of the High-Tech strategist….

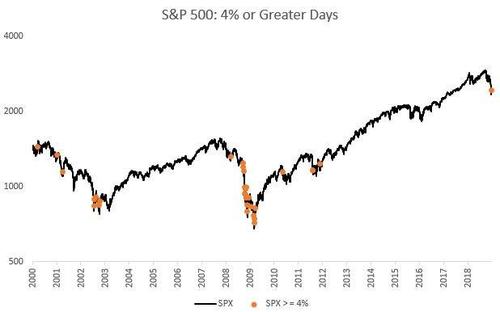

In fact, according to Bloomberg data, in eight previous bear markets the S&P 500 experienced rallies of greater than 2.5% more than 120 times as the benchmark plunged from peak to trough. From the collapse of Lehman to the financial crisis bottom in March 2009, the S&P 500 rallied more than 4 percent on 13 different occasions.

The best visual confirmation that today’s rally was nothing but a “face-ripping” short cover rally in the context of a bear market, comes from Matt Thomson who today tweeted the following chart showing historic market gains of more than 4% since 2000. Not surprisingly, the biggest cluster took place during the financial crisis in late 2008 and early 2009, before the market eventually bottomed.

The most bullish investors are likely to get swept into that buying frenzy, thinking the surge of activity is proof the market’s “correction” is over (because that is how their bias leans). A day or two later, prices plunge to even greater depths. So, bear in mind that vigorous bear rallies make the best bull traps.