via Zerohedge:

In its semi-annual release of the Financial Stability Report today, The Fed continued to warn that asset valuations are elevated, risk appetite is high, and specifically warned about the perils of risky corporate debt.

The Fed’s view on the current level of vulnerabilities is as follows:

1 . Asset valuations. Valuation pressures remain elevated in a number of markets, with investors continuing to exhibit high appetite for risk, although some pressures have eased a bit since the November 2018 FSR .

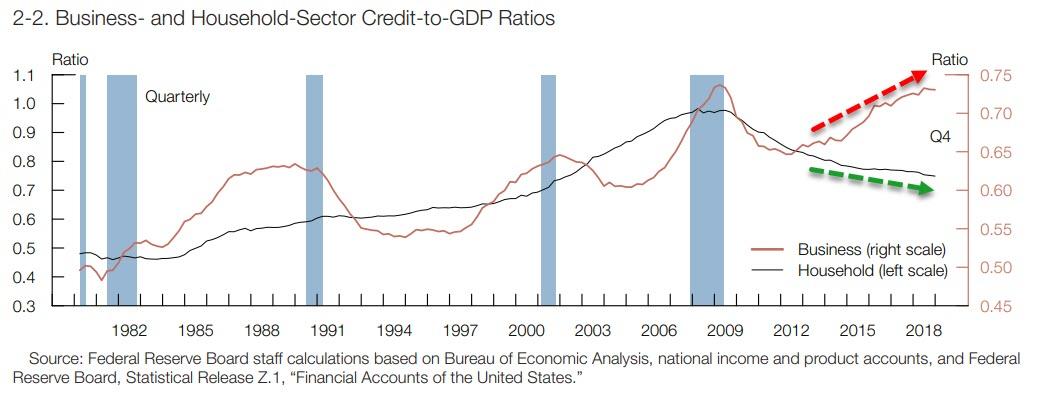

2 . Borrowing by businesses and households. Borrowing by businesses is historically high relative to gross domestic product (GDP), with the most rapid increases in debt concentrated among the riskiest firms amid signs of deteriorating credit standards . In contrast, household borrowing remains at a modest level relative to incomes, and the debt owed by borrowers with credit scores below prime has remained flat .

3 . Leverage in the financial sector. The largest U .S . banks remain strongly capitalized, and the leverage of broker-dealers is substantially below pre-crisis levels . Insurance companies appear to be in relatively strong financial positions . Hedge fund leverage appears to have declined over the past six months .

4 . Funding risk. Funding risks in the financial system are low . Estimates of the outstanding total amount of financial system liabilities that are most vulnerable to runs, including those issued by nonbanks, remain modest relative to levels leading up to the financial crisis . Short-term wholesale funding continues to be low compared with other liabilities, and the ratio of high-quality liquid assets to total assets remains high at large banks.

As Bloomberg reports, in a particularly striking sign, the Fed said the businesses with the biggest existing debt loads are also the ones taking on the riskiest loans. And protections that lenders include in loan documents in case borrowers default are eroding, the U.S. central bank said in its twice-a-year financial stability report. The Fed board voted unanimously to approve the document.

“Credit standards for new leveraged loans appear to have deteriorated further over the past six months,” the Fed said, adding that the loans to firms with especially high debt now exceed earlier peaks in 2007 and 2014.

“The historically high level of business debt and the recent concentration of debt growth among the riskiest firms could pose a risk to those firms and, potentially, their creditors.”

Leveraged loans are routinely packaged into collateralized loan obligations, or CLOs. Investors in those securities — including insurance companies and banks — face a risk that strains in the underlying loans will deliver “unexpected losses,” the Fed said Monday, adding that the secondary market isn’t very liquid, “even in normal times.”

“It is hard to know with certainty how today’s CLO structures and investors would fare in a prolonged period of stress,” the Fed added.

The Fed further warned that debt owed by the business sector, however, has expanded more rapidly than output for the past several years, pushing the business-sector credit-to-GDP ratio to historically high levels .

The central bank also said that assets at hedge funds and broker-dealers grew “at a rapid pace” over the past year.

And finally, is The Fed admitting it is blowing bubbles again?

“… at the end of the quarter, some contacts noted the potential for excessive risk-taking, owing in part to a more accommodative monetary policy stance than had been previously anticipated”

Full Financial Stability Report below: