Grant’s Almost Daily, submitted by Grant’s Interest Rate Observer

On Friday, online luxury consignment retailer The RealReal, Inc. (REAL on the Nasdaq) made its public debut in style, jumping 45% from its IPO price of $20 a share. Valued at $1 billion in a Series H funding round in March, San Francisco-based RealReal, which was founded in 2011 by Julie Wainwright, former CEO of Pets.com (which famously liquidated nine months after its February 2000 IPO), now commands a $2.1 billion price tag.

RealReal’s experience caps off a bountiful second quarter for U.S. IPOs, which included 62 debuts raising $25 billion according to Renaissance Capital, LLC. That’s the second-best showing in terms of proceeds since 2000. As per tradition, early investors got the worm, with the average IPO return for the quarter clocking in at 30%. Poor showings from ride-share unicorns Uber Technologies, Inc. and Lyft, Inc. were decidedly in the minority, with surges from the likes of Beyond Meat, Inc., Chewy, Inc. and Slack Technologies, Inc. (up 500%, 50% and 40%, respectively) more representative of current zeitgeist. More big names are on the way, with WeWork Cos. Inc., Peloton, Inc. and Postmates, Inc. having filed relevant paperwork with the Securities and Exchange Commission.

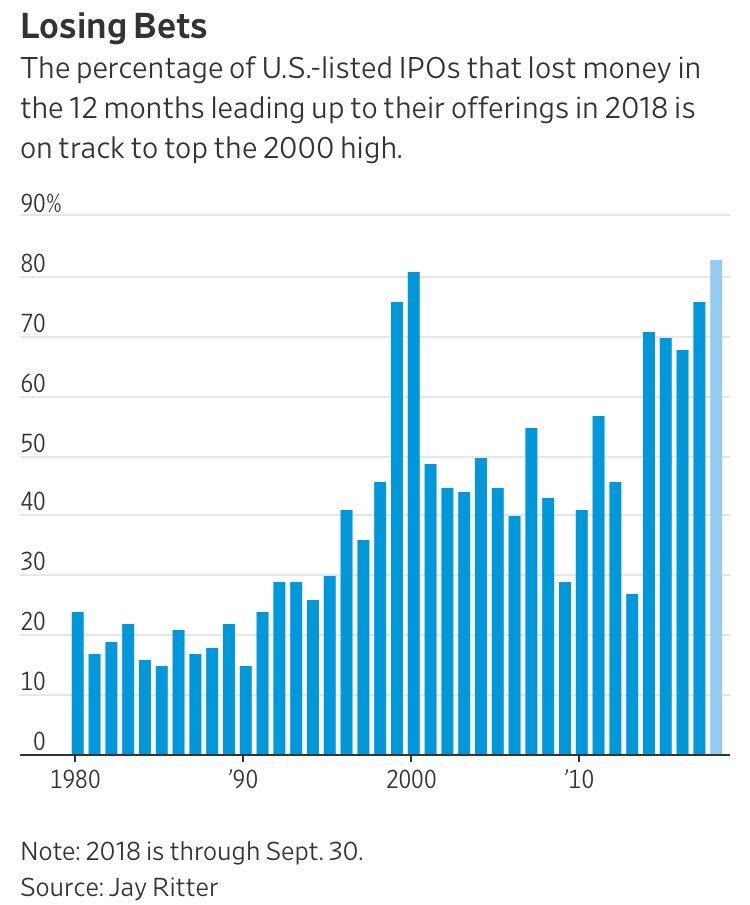

Unprofitability is no obstacle. Jay R. Ritter, the Joe B. Cordell Eminent Scholar Chair at the Warrington College of Business at the University of Florida, finds that the percentage of IPOs with negative earnings per share surpassed 80% in 2018, joining 2000 as the only period in which that dubious threshold has been reached in the last 28 years. That ratio has topped 60% only eight times since 1990, but in each year since 2013.

IPO fever is making its way abroad. Today, Anheuser-Busch InBev S.A./N.V.’s Asian unit began taking orders for an offering on the Hong Kong Stock Exchange that could raise upwards of $9.8 billion, according to The Wall Street Journal. That compares to a projected $7 billion haul per the WSJ in early May and would top the $8.7 billion debut of Kraft Foods, Inc. in 2001 for the world’s largest food and beverage IPO. Also today, Bloomberg reports that the Kingdom of Saudi Arabia “is restarting preparations” for a potential IPO for the Saudi Arabian Oil Company (Aramco). The Saudis are shooting for a $2 trillion mark from Mr. Market.

The latest boom in public offerings is no cause for concern according to Barron’s, which notes in the June 28 edition that the median age of tech companies stood at 12 last year, compared to four in 1999. Barron’s concludes:

The resurgence of IPOs is no flash in the pan, no signal of a bubble re-inflated. Instead, it reflects a shift in the way that investors and entrepreneurs approach company creation, the rich supply of mature companies that have yet to come public, and investors’ insatiable hunger for growth stories.

Comparisons with the Y2K epoch aside, the current IPO frenzy can be traced back to that seemingly all-encompassing modern phenomenon: Radical monetary policy around the globe. The April 5 edition of Grant’s Interest Rate Observer featured an analysis of the forces at work:

A little-known fact about unicorns is that they feed on interest rates. They like low, little rates – the tinier, the better. It’s a preference that they share with the humans of private equity and the bulls of Wall Street.

The risk-incentivizing strategies concocted by central banks have amplified the simple financial calculus of those forecasting future performance:

The lower the interest rate you pick to discount future cash flows to the present, the fatter those cash flows appear. And in the absence of past or present positive cash flow, such projections take center state.

Skipping down to the bottom line, we judge that loss-making unicorns are queuing up to go public for no better reason than it’s now or never.

Indeed, issuers are striking while the iron is hot. Kathleen Smith, co-founder of Renaissance Capital, told CNBC Friday: “Any private company that is not proceeding to go public in this market should have their head examined. The market is wide open, and it’s not always going to be.”

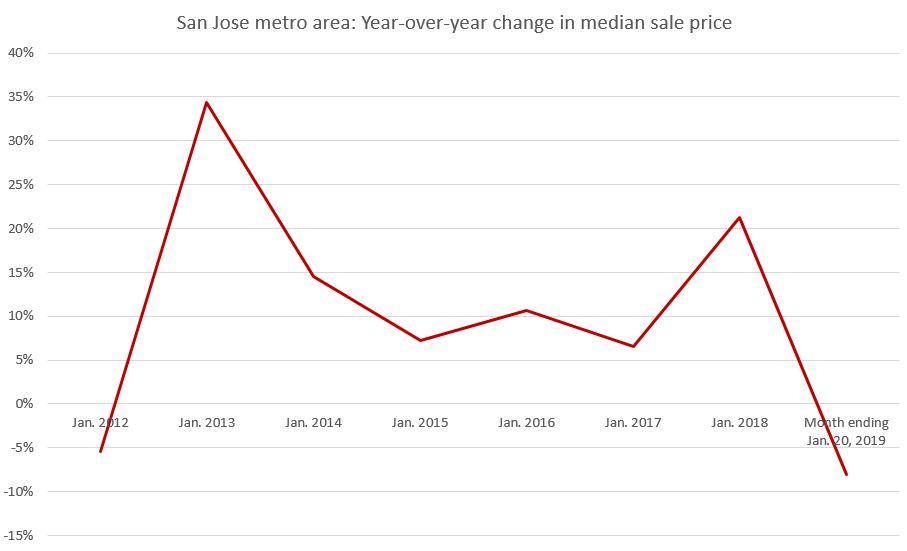

A curious divergence: One might assume that the IPO wave has spurred another leg higher in Silicon Valley housing as tech employees cash out their newfound riches, but that’s not the case. An analysis today from Kate Seabaugh, senior manager at John Burns Real Estate Consulting, finds that a nationwide slowdown in residential housing markets has hit the Northern California tech epicenter particularly hard. San Jose, San Francisco and Seattle saw net resale deceleration (meaning the change in year-over-year price growth this year compared to last) in home prices of 26%, 15% and 13% respectively, in May.

For instance, San Jose went from a 20% percent year-over-year price gain in May 2018 to a 6% drop this year. That’s the worst three showings out of the 33 metro areas tracked by the firm.