via Zerohedge:

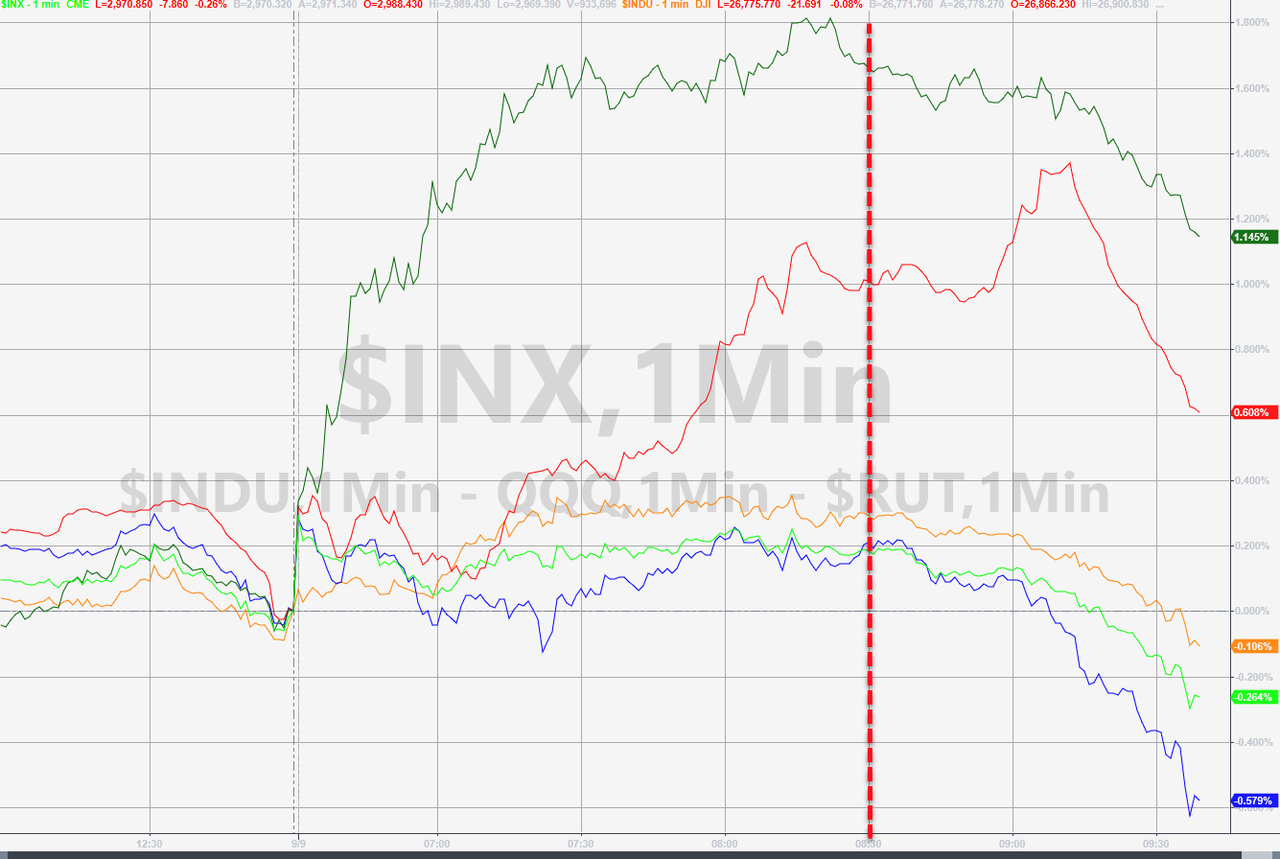

Having squeezed higher overnight and accelerated after the US open, it appears the catalyst for the sudden dump in US equity markets is the European market close…

Nasdaq futures illustrate the technical nature of the move best as the drop erases the sudden spike at the US open on Friday (after payrolls missed)…

As it appears momentum-tilted quants and CTAs are suddenly collapsing after a stellar start to the year as we discussed last week in “The Best And Worst Hedge Funds Of 2019: Momos On Rampage”

Source: Bloomberg

This is the biggest collapse in momo since the extremes in 2009…

Source: Bloomberg

… as Michael Krause noted:

Chatter is that this is forced derisking from momo-tilted funds that have suffered the equity equivalent of a “VaR shock” as momentum has outperformed so dramatically that they need to be rescaled to risk exposure limits.

Indeed, none other than Charlie McElligott commented on this possibility of a violent momo reversal earlier today, when he noted that a potential selloff in duration/rates would also be felt in the US Equities complex, “because as we’ve outlined here for months, the current consensus / “Momentum” positioning construct is a pure reflection of the “Duration Trade”: “long” Secular Growth and Min-Vol Defensives against “short” / underweight Cyclicals.”

Following up on his prediction just after the violent momentum/value reversal, Charlie notes that “practically everything I’ve been discussing YTD—which is that the Equities “Momentum” trade is a pure expression of “long duration (secular growth and defensive / min vol), short cyclicals”—is clearly seeing “stop-out” / deleveraging flows today, and has clearly now taken-on a life of its own despite the underlying macro catalyst behind it (Rates selloff / Bear-Steepening ) now moderating off worst levels.”

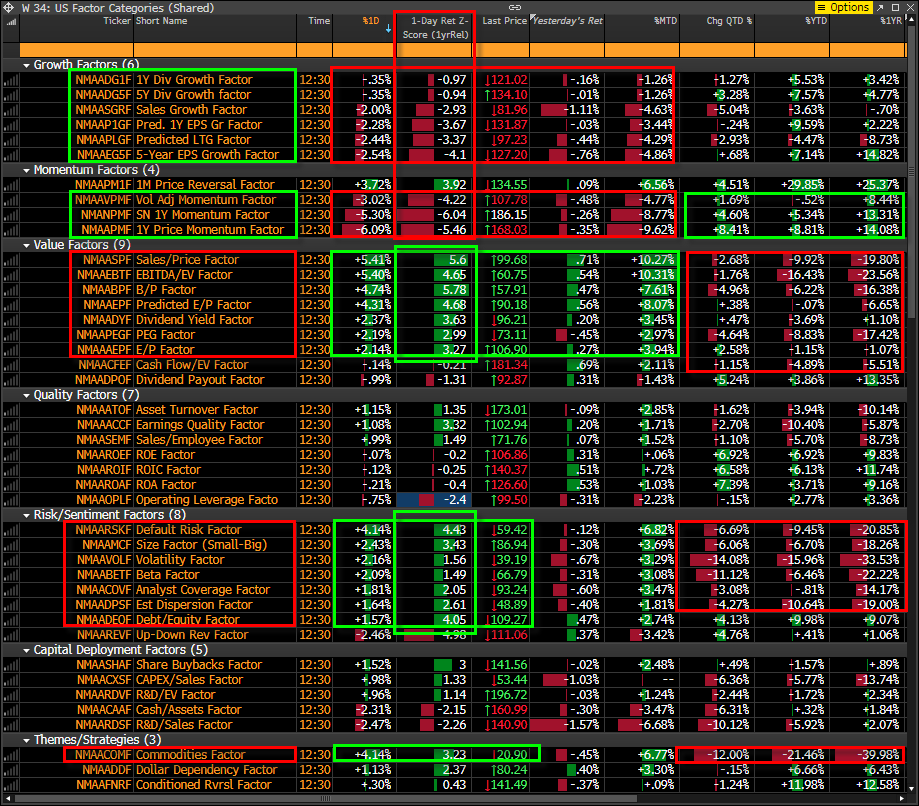

Specifically, McElligott urges traders to look at the factor moves and corroborating z-scores today: “these are > 4 / 5 standard deviation unwind explosions, as various iterations of “Price Momentum” come unglued due to the complete reversal of everybody’s consensual positioning—Long Growth (nuked), Short Value (exploding higher)”, to wit:

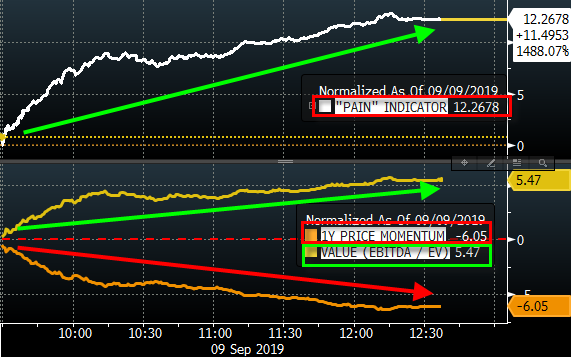

McElligott adds that his “max-pain” indicator (long EBITDA / EV factor vs short Momentum factor—which is de facto “backwards” to consensual factor exposure) is seeing a +12.3% move on the session—a 7 z-score move (since 2010), as everybody’s Value (Cyclical / High Beta) “shorts” RIP (Energy Most Shorted +4.8%, Leveraged Balance Sheet +4.3%, Value Most Shorted +2.7%) and their “longs” PUKE (Secular Growth i.e. Software 8 x’s EV /Sales -8.6% today, -12.7% 2d—or Tech Momentum Longs -5.9% on session, -11.4% 2d):

Putting the violent momentum/value reversal in a chart, this represents the largest one-day move higher in McElligott’s equity “pain indicator” since at least 2010, as funds were “wrong-footed” by being heavy “momentum” and short “value”…

… with the market action today showing what happens when countless momentum chasers suddenly hit reverse.

Bottom line, according to the Nomura quant, today’s action is “the worst single-day of performance in my model Equities HF L/S portfolio since February 5th / February 8th 2018’s Leveraged VIX ETN “Extinction Event“: