One of the most fascinating observations I have made over my career has been that the banks always lend at the top and contract lending at the bottom in every market. Going into 1980, banks were calling me to ask if I wanted to borrow money. Recently, I got a phone call from my bank asking, once again, if I would be interested in a loan. This to me is merely a confirmation that we are approaching a major turning point.

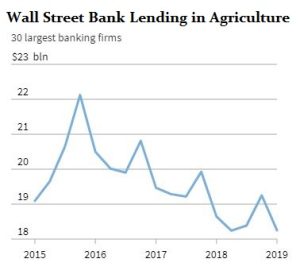

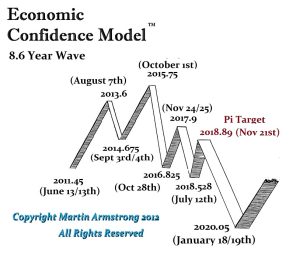

When I look at lending into the agricultural sector, the big Wall Street banks are once again perfectly in line with the cycle. They peaked in loans to farmers back in 2015, and have been declining ever since going into 2020. Bank lending to the agricultural sector peaked with the ECM and we will see it bottom in 2020. Our model will be correct in forecasting the next wave, which will be a cost-push inflationary wave. As the agricultural sectors come back to life, thanks to shortages, then the bankers will be willing to lend once again. The banks are the PERFECT indicator of how not to run a business. They make decisions emotionally and always get the economy dead wrong (i.e mortgage-backed securities peaked in 2007).