by AlexPitti

The US Is In Secular Economic Decline

One major issue preventing dynamism is the cost of education. College costs have increased significantly as a function of government backed student loans despite the fact that information is cheaper and more ubiquitous than ever. High college costs mean 20 year olds don’t have the freedom to work at a start-up for little or no pay to start their career. Some may apply for an internship which pays little, but the goal is always economic security because student debt is a source of so much economic insecurity. There’s also a societal shift among young people where they rely on their parents until an older age than previous generations. That shift doesn’t encourage risk taking, moving across state lines, and shifting jobs often which as we detailed previously is the source of being paid competitive wages.

In fact, youth employment is lowest in 20 years as we detailed previously. To make matters worse, the percentage of 20 year olds who switch jobs has been in a secular decline for decades, with millennial’s currently switching jobs the least on a percentage basis compared to previous generations since the 1990s. The older someone is, generally the less risk they take. If parents have more influence and financial responsibilities to bear as a result of young adults being more reliant on them, they’ll take less risk. The need for economic security, parents pressuring young adults into safer jobs, and less entrepreneurial teens all combine for a less entrepreneurial generation despite entrepreneurship being a popular dream for many.

Student Loans – A Generational Disaster

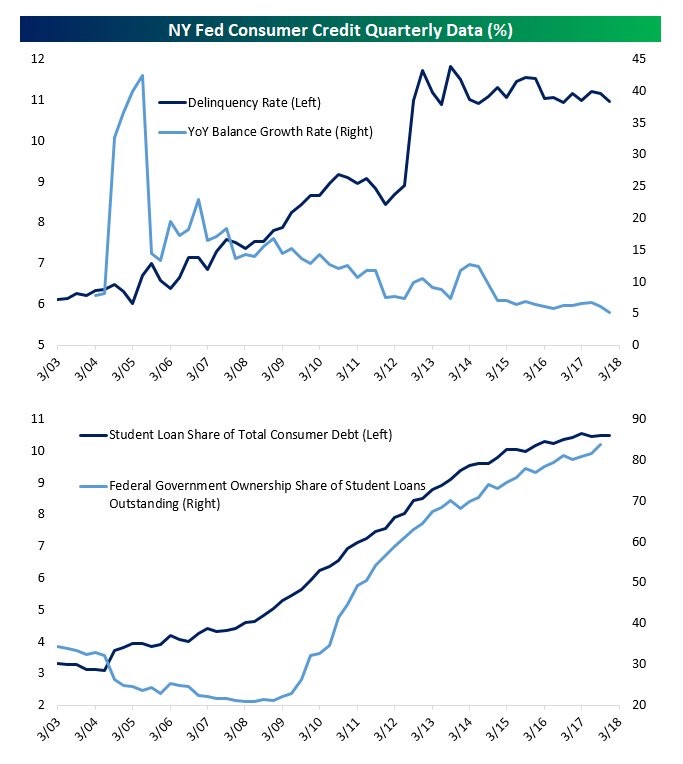

The millennial generation appears to be the most affected by student loans because it looks like by the time the next generation gets to college, the costs will be so prohibitive that some will avoid loans. As you can see from the top chart below, the delinquency rate is inversely related to the year over year growth in student loans taken out.