via Zerohedge:

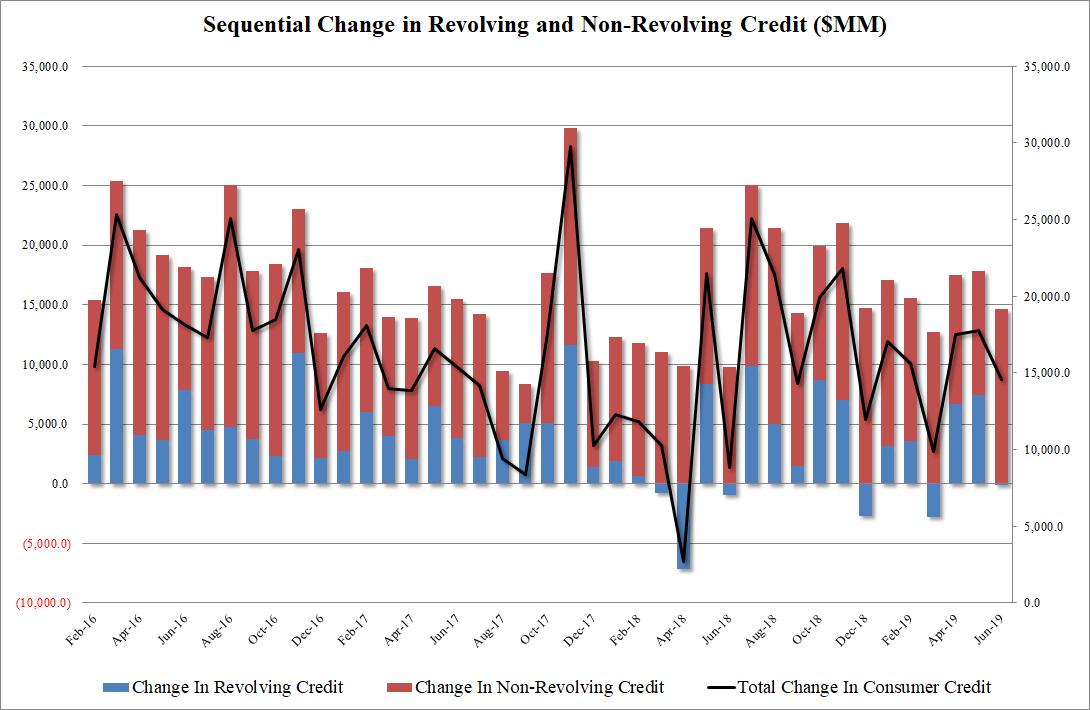

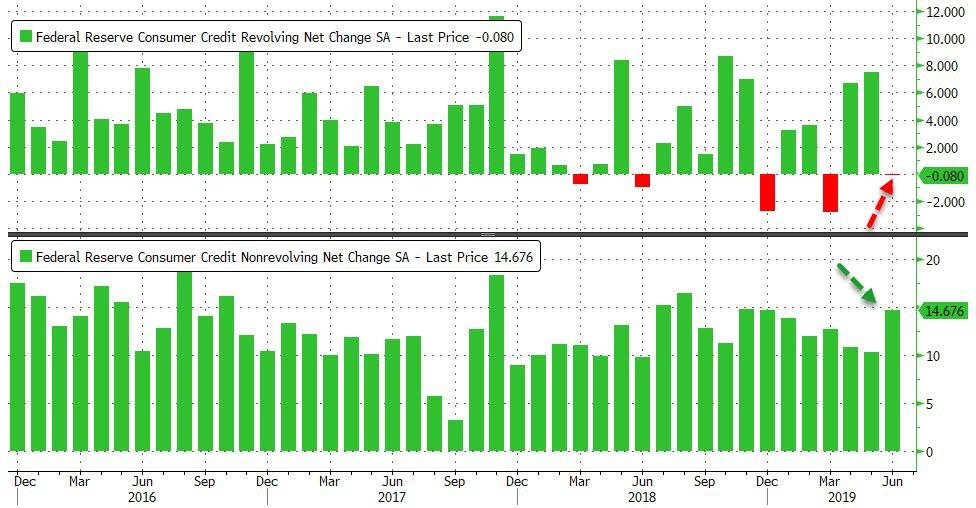

After two months of torrid gains for revolving, or credit card debt, moments ago the Fed reported in its monthly consumer credit report that in June US consumer hit the breaks hard on new credit-fueled spending.

In June, revolving credit declined by $80.5 million, the first such drop since March, and only the sixth decline since 2015. However, this was more than offset by a $14.7 billion increase in non-revolving, or student and auto loan, credit as total consumer credit in June rose by $14.6 billion, modestly below the $16.1 billion expected. Meanwhile, the May data was revised upward, from $17.1 billion to $17.8 billion.

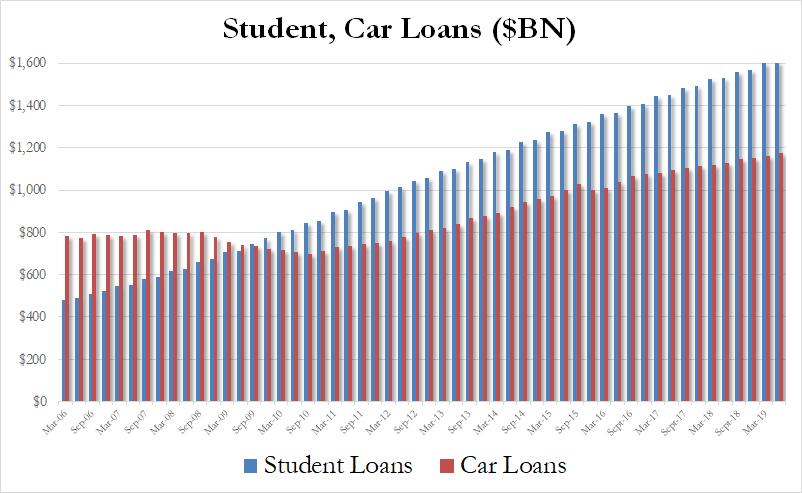

And while the reversal in June credit card use may prompt fresh questions about the strength of the US consumer despite the latest upward revision in the personal saving rates, one place where there were no surprises, was in the total amount of student and auto loans: here as expected, both numbers hit fresh all time highs, with a record $1.605 trillion in student loans outstanding, an increase of $6.8 billion in the quarter, while auto debt also hit a new all time high of $1.174 trillion, an increase of $8.4 billion in the quarter.

In short, whether they want to or not, Americans continue to drown even deeper in debt, and enjoying every minute of it.