via valuewalk:

One can’t help but walk away from Europe worried and concerned. The Continent is long on bickering and skepticism and short on unity and solidarity – all of which is threatening the EU’s fragile cyclical economic expansion and the global earnings of U.S. multinationals. As Europe’s woes accumulate and reach a tipping point, the aftershocks will be felt far and wide.

A new report by Bank of America, U.S. Trust explores this issue and the impact on global economy and markets.

Nearing A Tipping Point In Europe

Rarely has Europe seemed so dysfunctional and discombobulated — with significant implications for corporate America. After three trips to the Continent in the past two months, one can’t help but walk away worried that the European Union (EU) is at a tipping point. The Continent is long on bickering and skepticism and short on unity and solidarity, all of which is threatening the EU’s fragile cyclical economic expansion and the fundamental underpins of the Union.

Q3 hedge fund letters, conference, scoops etc

The woes are multiplying: The United Kingdom’s departure from the EU; the bitter divide between Brussels and Italy over the latter’s budget deficit; rising political populism along the periphery (Poland and Hungary); the currency crisis in Turkey; the refugee crisis emanating from the Middle East and Africa; the divide between the wealthy north and the stagnant south; the political departure of Angela Merkel—all of these variables have converged to leave Europe confused and confounded, and confronting multiple crises.

And 2019 doesn’t look any better — at least in the near term. The United Kingdom is scheduled to depart the EU on March 29, 2019 without any clear road map or exit ramp at this juncture. Meanwhile, with populism gaining strength across the region, the European Parliamentary elections are scheduled for May. At stake are numerous key positions that drive Europe, including new presidents of the European Commission, the European Council and the European Central Bank. The fundamental unity of Europe will be at risk if nationalist candidates/parties fare well in the Parliamentary elections, a prospect that is expected to weigh heavily on investor confidence over the near term. Risks around Brexit and the Parliamentary elections are expected to weigh on both the pound and the euro over the near term, contributing to U.S. dollar strength.

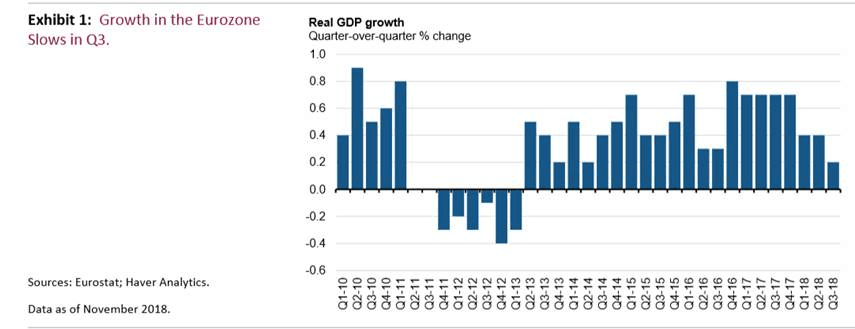

Compounding matters, amid all the political strife, economic growth across Europe has decelerated. Eurozone GDP growth in Q3 came in lower than expected by analysts, slowing to 0.2% over the quarter (Exhibit 1). Manufacturing PMIs in Europe have also witnessed a sharp slowdown since peaking at the end of last year. This pullback is in stark contrast to the economic environment in 2017, when annual GDP growth in the Eurozone eclipsed that of the U.S. (2.4% vs. 2.2%).

Additionally, data released last week showed the German economy (the largest in the EU) contracted in Q3 for the first time since 2015 amid weakness in the auto industry and a slowdown in China.1 While much of the weakness in the auto sector was cited as temporary, owing to manufacturers’ delays in meeting the EU’s new emissions standards, a more protracted U.S.-China trade war could have more lasting effects on capital goods producers in the export-dependent region. EU exports of goods and services make up 45% of GDP, while exports from China and the U.S. are a much smaller share (20% of GDP and 12% of GDP, respectively).

All of the above wouldn’t be of consequence if Europe didn’t matter to the health of the global economy. The fact is, however, it does. Only the U.S. economy, for instance, is larger than the EU: $20.5 trillion nominal U.S. dollars vs. $18.8 trillion, according to International Monetary Fund estimates for 2018. In the same year, the EU economy was some 39% larger than China’s. Not only is the EU large, its 500 million consumers rank among the wealthiest in the world, with the EU home to nine of the top 20 nations ranked by per-capita income. Wealth is correlated with highly skilled labor, innovation, a world-class R&D infrastructure and importantly, strong levels of private consumption. In 2016, the EU accounted for 21% of global personal consumption, a slightly lower share than that of the U.S. (29%) but well above that of China (10%) and India (3%).

Today, the U.S. and Europe remain the bedrock of the global economy. Yes, the economic progress of China, India and others has been impressive over the past decade, but the success of each party is due in part to the global economic architect/framework created, supported and funded by the U.S. and Europe. From this lens, it is clear, and there is no doubt, that the future of the EU remains critical to the long-term health of the global economy.

The Stakes For Corporate America Are Huge

The EU has been a long-time pillar of America’s global economic infrastructure and a key hub for the global competitiveness of U.S. companies. Wealthy consumers, respect for the rule of law, the ease of doing business and credible institutions—all of these factors, and more, have long made the EU a more attractive place to do business for American firms.

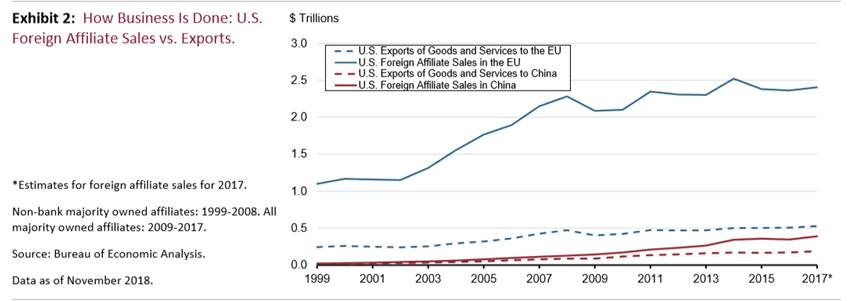

U.S. companies are bound to the European continent primarily through the activities of their foreign affiliates (Exhibit 2). In 2017, we estimate that sales delivered through U.S. affiliates in the EU were roughly $2.4 trillion, compared to U.S. exports of goods and services of $500 billion.

Also evident from the chart below is the fact that Europe remains, by far, the most important market for U.S. multinational companies. While much attention has been given to the rise of the middle class consumer in China and associated market opportunities (represented by the rising red line below), there is still a long way to go before China catches up to the EU in terms of foreign affiliate sales. Currently, the EU accounts for 41% of U.S. foreign affiliate sales, a share larger than that of the entire Asia Pacific region (27%).

Meanwhile, the more profitable U.S. affiliates are in Europe, the more earnings are available to the parent firm to hire and invest at home, dole out higher wages to U.S. workers, and/or increase dividends to U.S. shareholders. In other words, U.S. corporate success in Europe is hugely important to the overall and long-term success of many U.S. multinationals and, by extension, the U.S. economy. The more successful U.S. affiliates are in reaching new consumers in Europe and leveraging the continent’s resources, the better off are the foreign affiliates, U.S. parent companies, U.S. workers, shareholders and local communities.

In other words, America’s transatlantic partnership with Europe yields significant dividends. With nearly 60% of U.S. global foreign affiliate income (a proxy for global earnings) coming courtesy of Europe, no region of the world has as outsized an influence on the economic success or failure of U.S. firms as Europe. And while last year’s positive economic environment led to record profits for U.S. foreign affiliates in Europe, rising investment uncertainty and structural challenges in Europe suggest a more precarious operating environment for U.S. firms doing business in the EU.

Investment Summary

In the end, Europe’s woes are global in nature. What happens in Europe, in other words, doesn’t stay in Europe. Notably in the cross hairs: U.S. multinationals that have long counted on Europe to drive the bulk of their non U.S. earnings growth. Decelerating growth in Europe, along with a stronger U.S. dollar versus the euro, threatens to undermine U.S. global earnings heading into next year. The euro is currently trading near a 17 month low against the dollar, as markets weigh the volatile backdrop in Europe against robust economic growth in the U.S.

With U.S.-China tensions at a hard boil, and with many emerging markets struggling in the face of rising U.S. interest rates and elevated oil prices, the last thing the world economy needs right now is a significant economic downdraft from Europe. That leaves the U.S. economy as the last man standing — which is bullish for U.S. assets on a comparative basis—but as Europe’s woes accumulate and reach a tipping point, the aftershocks will be felt far and wide.