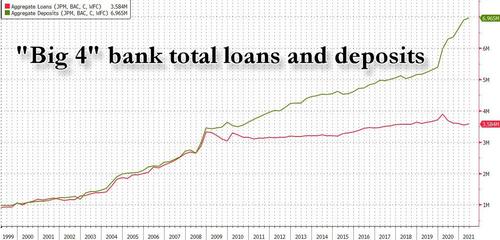

Last month when looking at the latest bank balance sheets, we showed that something was “terminally broken” in the US financial system: specifically, we showed that a “stunning divergence” had emerged between the total deposits at big banks which had just hit a record high courtesy of the Fed’s QE (as the fungible reserves injected by the Fed end up as cash on bank balance sheets and offset the concurrent surge in deposits) and the stagnant loan books, which had barely budged since the Lehman bankruptcy as most US consumers have no pressing need to expand businesses and ventures, a startling confirmation of the woeful state of the US economy when one peels away the fake facade of the record high stock market.

In fact, looking at the chart below, one can see that all the Fed has done since the (first) financial crisis is to force bank balance sheets to grow ever larger not due to loan growth but to accommodate the trillions in reserves which alas earn next to nothing – unless they are invested directly in risk assets as JPMorgan’s CIO “Whale” did back in 2012 with rather unfortunate results – and which screams that something is terminally broken with the entire financial system.