Of immediate concern is how much cash Boeing is burning due to the 737 MAX fiasco and now the coronavirus, and how much cash it can pile up to avoid a liquidity crisis.

By Wolf Richter for WOLF STREET.

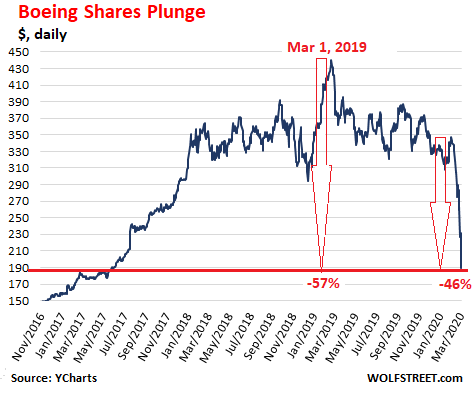

Boeing’s shares [BA] came unglued, plunging 18.1% today, after having already plunged over the past four weeks. Since February 12, shares have crashed 46%, and since the peak on March 1, 2019, 57%:

Today’s plunge came after a flurry of disclosures and leaks in the morning about Boeing, including:

- Sources said that Boeing is planning to draw down entirely and much quicker than expected its new credit facility of $13.825 billion as early as Friday, apparently worried that banks might freeze the credit facility later, and banks did during the Financial Crisis.

- Boeing disclosed that it had negative net orders of -28 aircraft for the first two months of 2020, with cancellations of the 737 MAX exceeding orders for all models;

- It imposed a hiring freeze to “preserve cash”

Trying to forestall a liquidity crisis.

Of immediate concern is how much cash Boeing is burning to deal with the 737 MAX fiasco, and how much cash it can pile up to avoid a liquidity crisis.

Back in October 2019, Boeing obtained a new credit line of $9.5 billion, which about doubled the size of its existing credit line. Credit lines serve as liquidity backup that a company can draw down when it needs cash. Then in February, it obtained another loan facility, this time a two-year “delayed-draw term loan” for $13.825 billion from a consortium of banks, led by Citibank. This type of loan allows Boeing to wait drawing the money until it needs it.

Boeing initially drew $7.5 billion on this new credit line and was expected to draw any other amounts way down the road, as needed to deal with the 737 MAX fiasco. But the disruptions from the coronavirus have been thrown on top of its existing 737 MAX fiasco.

Now Boeing is expected to draw the remainder of the line as early as Friday, sources told Bloomberg. According to one of the sources, Boeing is drawing down the rest of the loan as a precaution due to market turmoil.

This means that Boeing is worried the banks might freeze the unused portion of the credit facility and make the cash unavailable, as banks had done during the Financial Crisis, when companies found that access to their credit lines was suddenly blocked just when they needed the cash most urgently.

The cash pressures on Boeing are enormous.

There is the plunge in revenues from stalled sales and deliveries of the grounded 737 MAX, and the cash drain from working with its suppliers for the 737 MAX program to keep them afloat.

Then there are the settlements with airlines, such as Southwest and American Airlines, over the grounded 737 MAX in their fleets, where Boeing pays the airlines. The amounts of the individual settlements have remained confidential, but in its annual report, released on January 31, Boeing spelled out its estimates for the combined amounts: $8.2 billion.

This came in two lumps. In Q2 2019, it “estimated potential concessions and other considerations to customers for disruptions and associated delivery delays related to the 737 MAX grounding, net of insurance recoveries,” at $5.61 billion. Then in Q4 2019, it estimated an additional $2.62 billion, for a total of $8.2 billion.

Negative new orders in 2020 so far.

Boeing also disclosed today just how awful its new orders look: During January and February, Boeing received net new orders of negative -43 orders for the 737 MAX, driven by a flood cancellations. It received only one order (from FedEx) for its 767, and 17 orders for its 787. This includes the conversion by Air Lease Corp of nine 737 MAX orders into three 787 orders; and the conversion by Oman Air of ten 737 MAX orders into four 787 orders.

This brought Boeings net total new orders for the first two months, net of cancellations and conversions, to a negative -28.

And Boeing delivered only 30 planes during those two months, down from 95 in the same period last year.

The hiring freeze to “preserve cash”

And now there’s a hiring freeze, pending a “review of priorities and critical needs,” the company announced in a letter to employees, reported by the Washington Post. This hiring freeze is likely related to the 737 MAX fiasco, and not the coronavirus, or at least not yet.

“We’re also taking steps to address the pressures on our business that result from the pain our customers and suppliers are feeling,” wrote CEO Dave Calhoun and CFO Greg Smith in the letter to employees. “It’s critical for any company to preserve cash in challenging periods. That’s why we’re implementing steps similar to what many companies are doing right now.”

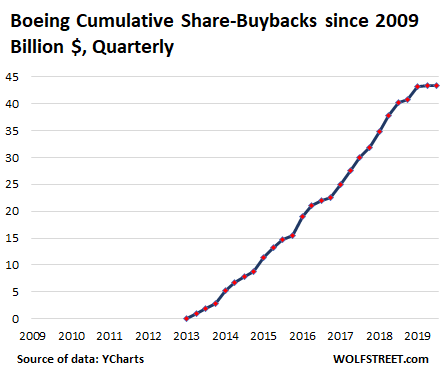

If it hadn’t wasted $43 billion on share buybacks…

This mad scramble for cash and the existential urge to “preserve cash in challenging periods” comes after this master of financial engineering – instead of aircraft engineering – blew, wasted, and incinerated $43.4 billion on buying back its own shares, from June 2013 until the financial consequences of the two 737 MAX crashes finally forced the company to end the practice. That $43.3 billion would come in really handy right now:

The sole purpose of share buybacks is to inflate the stock price because they make the company itself the biggest buyer of its own shares. But those $43 billion of share buybacks cost the company $43 billion in cash. Now those buybacks have stopped because Boeing needs every dime of cash to stay liquid and alive, and shareholders, who’d been so fond of those share buybacks, are now getting crushed by the damage those share buybacks have done to Boeing’s financial position.