BONDS FLASH RECESSION WARNING…

Stocks fell on Wednesday as bond yields declined again, triggering concerns about the economic outlook. Increasing trade tensions in the China-U.S. trade fight also weighed on markets.

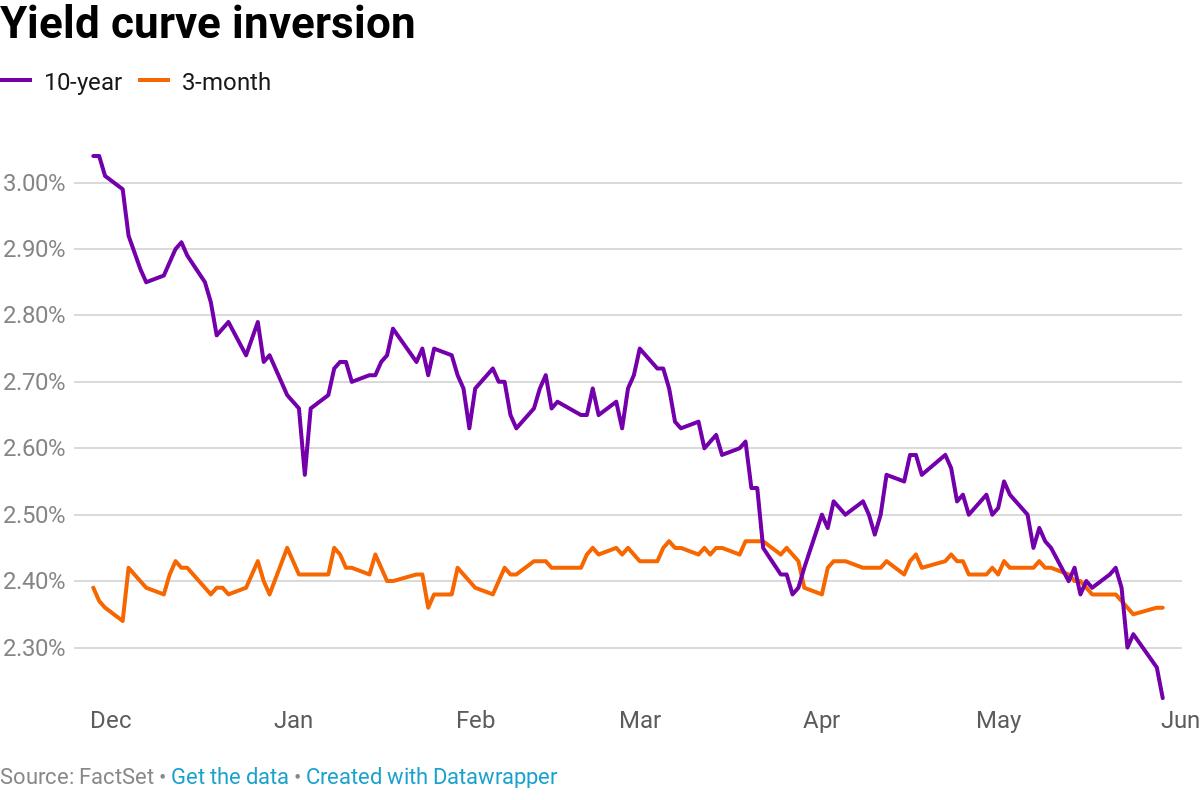

WIDEST CURVE INVERSION SINCE FINANCIAL CRISIS…

.1559146165005.png)

Long-term government debt yields fell further below rates on short-term notes and bills during Wednesday’s session, an unusual bond market phenomenon often heralded on Wall Street as a recession prognosticator.

The yield curve inversion between the 3-month Treasury bill and the 10-year note widened to its deepest level since the financial crisis, with investors now expecting a 10 basis point premium for holding 3-month bills over 10-year notes. The 3-month bill yield rose to 2.362% while the 10-year note yield dropped to 2.26%, off its lowest since September 2017 notched earlier in the session.

The yield curve is sending a warning about economic growth in the United States and the world, many investors and economists believe. Under normal market conditions, those that buy debt from the U.S. government for years are compensated with better interest rates than those who loan money for a matter of months.

The fall in government-bond yields has been a global phenomenon

Rivals Building Workarounds to Dollar’s Dominance…

Iran sanctions spur Europe and India to devise systems to trade with Tehran without using the U.S. currency