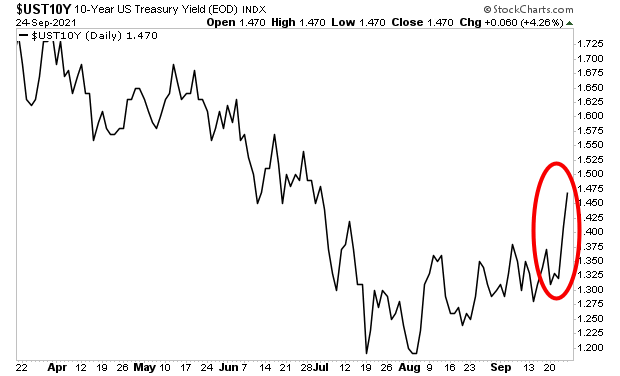

The biggest development last week was the breakout in the 10-year U.S. Treasury.

The 10-year US Treasury is arguably the single most important bond in the world. The yield on this bond represents the risk-free rate of return against which all risk assets (stocks, corporate bonds, mortgages, real estate, etc.) are valued.

Now, this yield moves based on a slew of issues: economic growth, portfolio balancing, Fed monetary policy, what’s happening in international bond markets… and inflation.

I mention all of this, because the yield on the 10-year US Treasury SPIKED sharply higher last week.

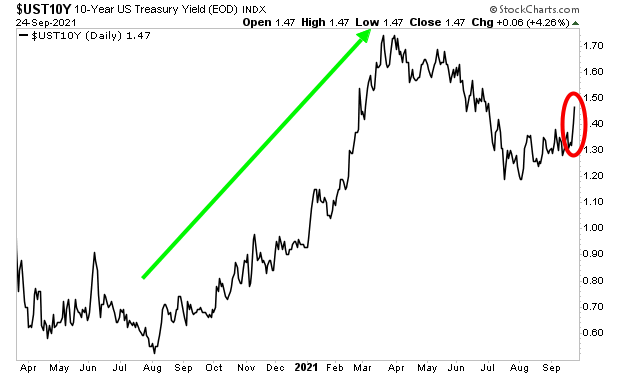

Let’s put this spike in a larger context.

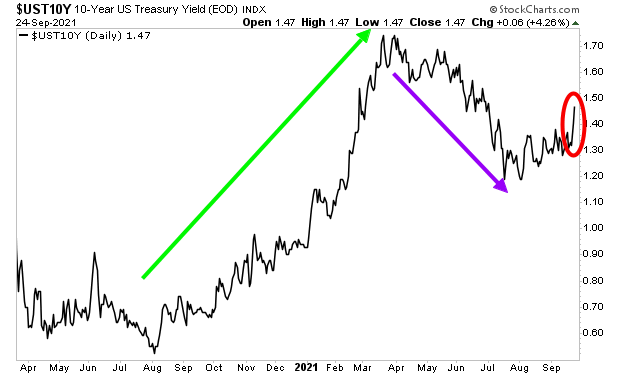

From August of last year (2020) until March of this year (2021), the yield on the 10-Year Treasury spiked rose rapidly as inflation entered the US financial system. I’ve illustrated this spike with a green arrow in the chart below.

Then, in March of 2021, the Fed began to suggest that it was planning to tighten monetary policy. This hurt inflation expectations as the financial system began to believe the Fed would act quickly enough to stop inflation before it became a real problem. As a result of this, the yield on the 10-year Treasury dropped from March of 2021 until July.

I’ve illustrated this with a purple arrow in the chart below. This was, effectively, the bond market giving the Fed the benefit of the doubt when it came to monetary policy.

In this context, last week’s spike in the yield on the 10-year US Treasury represents the first time since March that the bond market began to freak out about inflation again.

This is a MASSIVE deal. It tells us that the market has called the Fed’s bluff: that the Fed won’t act to stop inflation in time and that the economy and financial system are heading towards a crisis in the near future.

If the Fed acts now, by tightening monetary policy aggressively, it will crash stocks. After all, the primary driver of this insane stock market bubble has been the Fed keeping rates at zero and pumping $120 billion per month into the financial system.

And if the Fed DOESN’T act now, inflation will rage, leading to a stag-flationary collapse in the economy… and stocks will still crash as inflation destroys profits in the corporate sector.

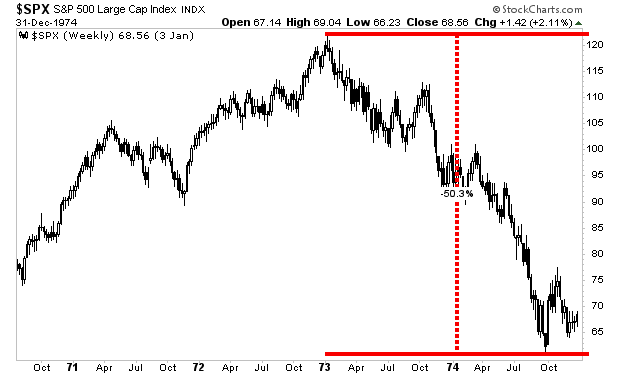

Just like in the mid-1970s, when stocks dropped 50% as inflation crippled the economy.

Put simply: a crisis is coming no matter what the Fed does.

The big question is “WHEN”!?!?

To figure this out, I rely on certain key signals that flash before every market crash.

I detail them, along with what they’re currently saying about the market today in a Special Investment Report How to Predict a Crash.

To pick up a free copy, swing by

https://phoenixcapitalmarketing.com/predictcrash.html

Best Regards