Authored by Patrick Hill via RealInvestmentAdvice.com,

A recession is emerging with interest rate curves inverted, the end of the business cycle at hand, world trade falling, and consumers and businesses beginning to pull back on spending. The question is: will monetary or fiscal stimulus turn around a recession?

In this post, we find both stimulus alternatives likely to be too weak to have the necessary economic impact to lift the economy out of a recession. Finally, we will identify the key characteristics of a coming recession and the implications for investors.

Our economy is at the nexus of several major economic trends formed over decades that are limiting monetary and fiscal options. The monetary policy of central banks has caused world economies to be abundant in liquidity, yet producing limited growth. Central bankers in Japan and Europe have been trying to revive growth with $17 trillion injections using negative interest rates. Japan can barely keep its economy growing with an estimate of GDP at .5 % through 2019. The Japanese central bank holds 200 % of GDP in government debt. The European Central Bank holds 85 % of GDP in debt and uses negative interest rates as well. Germany is in a manufacturing recession with the most recent PMI in manufacturing activity at 47.3 and other European economies contracting toward near-zero GDP growth.

Lance Roberts notes that the world economy is not running on a solid economic foundation if there is $17 trillion in negative-yielding debt in his blog, Powell Fails, Trump Rails, The Failure of Negative Rates. He questions the ability of negative interest policies to stabilize world economies,

“You don’t have $17 Trillion in negative-yielding sovereign debt if there is economic and fiscal stability.”

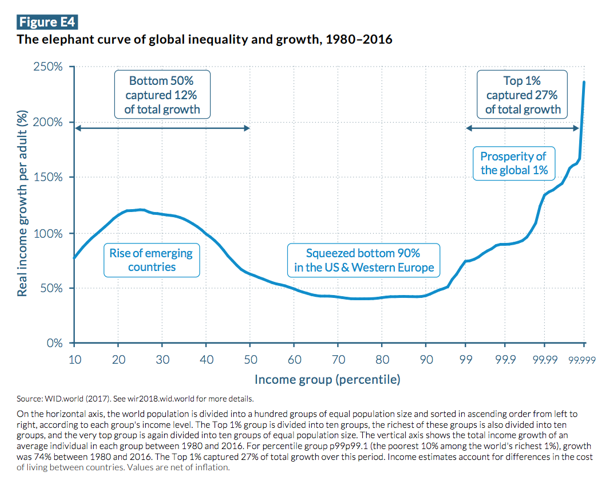

Negative interest rates and extreme monetary stimulus policies have distorted financial relationships between debt and risk assets. This financial distortion has created a significantly wider gap between the 90 % and the top 1 % in wealth.

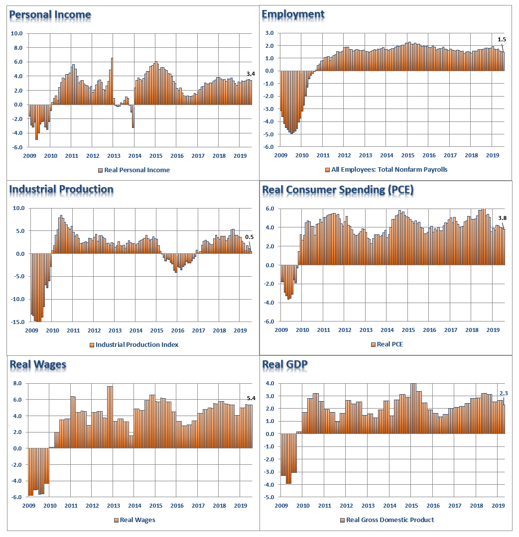

Roberts outlines in the six panel chart below how personal income, employment, industrial production, real consumer spending, real wages, and real GDP are all weakening in the U.S.:

Source: RIA – 8/23/19

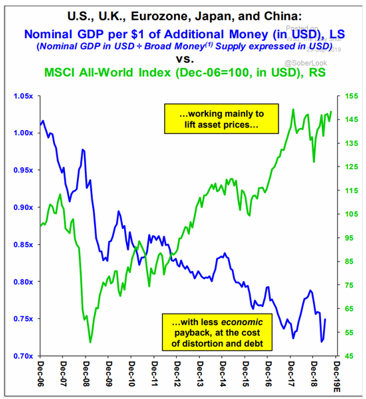

Trillions of dollars of monetary stimulus have not created prosperity for all. The chart below shows how liquidity fueled a dramatic increase in asset prices while the amount of world GDP per money supply declined by about 25 %:

Sources: The Wall Street Journal, The Daily Shot – 9/23/19

Low interest rates have not driven real growth in wages, productivity, innovation, and services development that create real wealth for the working class. Instead, wealth and income are concentrated in the top 1 %. The concentration of wealth in the top one percent is at the highest level since 1929. The World Inequality Report notes inequality has squeezed the middle class between emerging countries and the U.S. and Europe. The top 1 % has received twice the financial growth benefits as the bottom 50 % since 1980:

Source: World Inequality Lab, Thomas Piketty, Gabriel Zucman et al – 2018

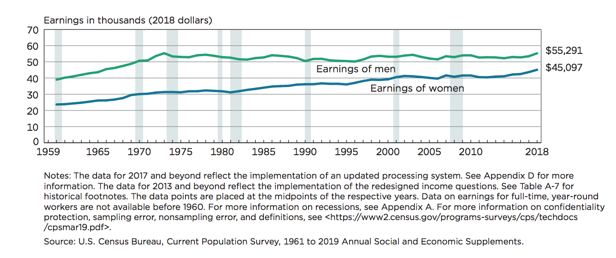

There are several reasons monetary stimulus by itself has not lifted the incomes of the middle class. One of the big causes is that stimulus money has not translated into wage increases for most workers. U.S. real earnings for men have essentially been flat since 1975, while earnings for women have increased though basically flat since 2000:

Source: U.S. Census Bureau – 9/10/19

If monetary policy is not working, then fiscal investment from private and public sectors is necessary to drive an economic reversal. But, will the private and public sector sectors have the necessary tools to bring new life to an economy in decline?

Wealth Creation Has Gone to the Private Sector

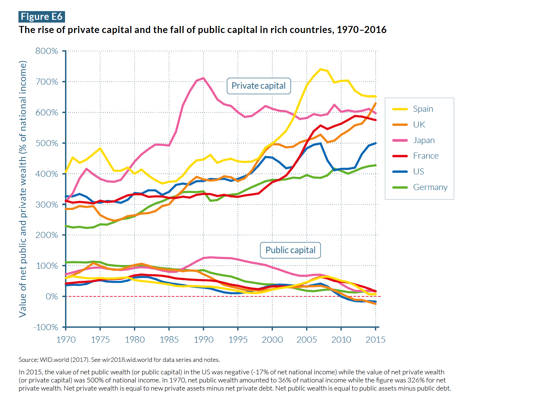

The last 40 years have seen the rise of private capital worldwide while public capital has declined. In 2015, the value of net public wealth (or public capital) in the US was negative -17% of net national income, while the value of net private wealth (or private capital) was 500% of national income. In comparison to 1970, net public wealth amounted to 36% of national income, while net private wealth was at 326 %.

Source: World Inequality Lab, Thomas Piketty, Gabriel Zucman et al – 2018

Essentially, world banks and governments have built monetary and fiscal economic systems that increased private wealth at the expense of public wealth. The lack of public capital makes the creation of public goods and services nearly impossible. The development of public goods and services like basic research and development, education and health services are necessary for an economic rebound. The economy will need a huge stimulus ‘lifting’ program and yet the capital necessary to do the job is in the private sector where private individuals make investment allocation decisions.

Why is building high levels of private capital a problem? Because, as we have discussed, private wealth is now concentrated in the top 1 %, while 70 % of U.S GDP is dependent on consumer spending. The 90 % have been working for stagnant wages for decades, right along with diminishing GDP growth. There is a direct correlation between wealth creation for all the people and GDP growth.

Corporations Are Not In A Position to Invest

Some corporations certainly have invested in their businesses, people, and technology. The issue is the majority of corporations are now financially strapped. Many corporate executives have made profit allocation decisions to pay themselves and their stockholders well at the expense of workers, their communities and the economy.

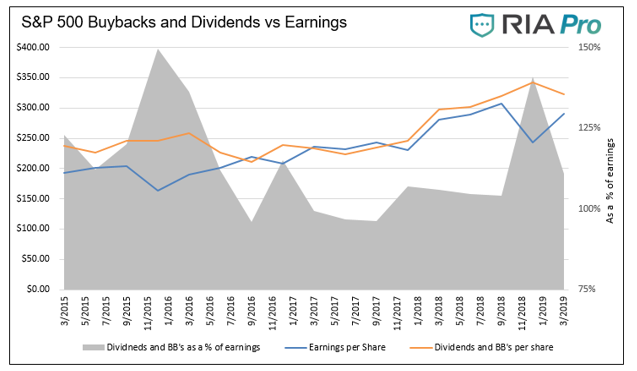

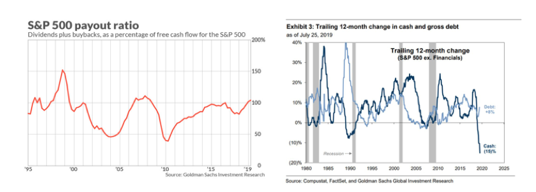

S & P 500 corporations are paying out more cash than they are taking in, creating a cash flow crunch at a – 15 % rate (that’s right they are burning cash) to maintain stock buyback and dividend levels:

Source: Real Investment Advice

Sources: Compustat, Factset, Goldman Sachs – 7/25/19

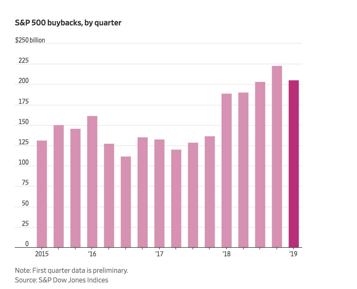

In 2018 stock buybacks at $1.01 trillion were at the highest level they have ever been since buybacks were allowed under the 1982 SEC safe harbor provision decision. It is interesting to consider where our economy would be today if corporations spent the money they were wasting on boosting stock prices and instead invested in long term value creation. One trillion dollars invested in raising wages, research, and development, cutting prices, employee education, and reducing health care premiums would have made a significant impact lifting the financial position of millions. This year stock buybacks have fallen back slightly as debt loads increase and sales fall:

Source: Dow Jones – 7/2019

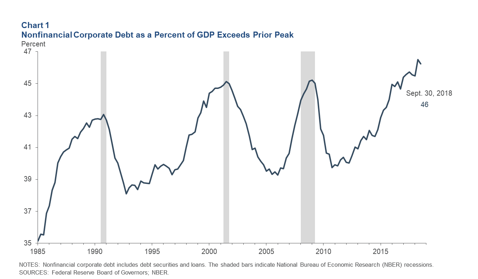

Many corporations with tight cash flows have borrowed to purchase shares, pay dividends and keep their stock price elevated causing corporate debt to hit new highs as a percentage of GDP (note recessions followed three peaks):

Source: Federal Reserve Bank of Dallas – 3/6/2019

Corporate debt has ballooned to 46 % of GDP totaling $5.7 trillion in 2018 versus $2.2 trillion in 2008. While the bulk of these nonfinancial corporate bonds have been investment grade, many bond covenants have become weaker as corporations seek more funding. Some bondholders may find their investment not as secure as they thought resulting in significantly less than 100 % return of principal at maturity.

In a recession, corporate sales fall, cash flow goes negative, high debt payments become hard to make, employees are laid off and management tries to hold on. Only a select set of major corporations have cash hoards to ride out a recession, and others may be able obtain loans at steep interest rates, if at all. Other companies may try going to the stock market which will be problematic with low valuations. Plus, investors will be reluctant to buy stock in negative cash flow companies.

Thus, most corporations will be hard pressed to invest the billions of dollars necessary to turnaround a recession. Instead, they will be just trying to keep the doors open, the lights on, and maintain staffing levels to hold on until the day sales stop falling and finally turn up.

Public Sector is Also Tapped Out

In past recessions, federal policy makers have turned to fiscal policy – public spending on infrastructure projects, research development, training, corporate partnerships, and public services to revive the economy. When the 2008 financial crisis was at its peak the Bush administration, followed by the Obama government pumped fiscal stimulus of $983 billion in spending over four years on roads, bridges, airports, and other projects. The Fed funds interest rate before the recession was at 5.25 % at the peak allowing lower rates to have plenty of impact. Today, with rates at 1.75-2.00 %, the impact will be negligible. In 2008, it was the combined massive injection of monetary and fiscal stimulus that created a V-shaped recession with the economy back on a path to recovery in 18 months. It was not monetary policy alone that moved the economy forward. However, the recession caused lasting financial damage to wealth of millions. Many retirement portfolios lost 40 – 60 % of their value, millions of homeowners lost their homes, thousands of workers were laid off late in their careers and unable to find comparable jobs. The Great Recession changed many people’s lives permanently, yet it was relatively short-lived compared to the Great Depression.

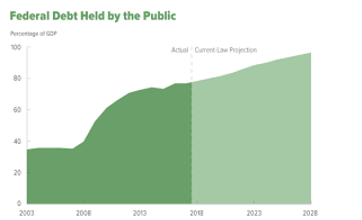

As noted in the chart above, public sector wealth has actually moved to negative levels in the U.S. at – 17 % of national income. Our federal government is running a $1 trillion deficit per year. In 2007, the federal government debt level was at 39 % of GDP. The Congressional Budget Office projects that by 2028 the Federal deficit will be at 100 % of GDP

Source: CBO – 4/9/19

We are at a different time economically than 2008. Today with Federal debt is over 100% of GDP and expected to grow rapidly. The Feds balance sheet is still excessive and they formally stopped reducing the size (QT). In a recession federal policymakers will likely make spending cuts to keep the deficit from going exponential. Policy makers will be limited by the twin deficits of $22.0 trillion national debt and ongoing deficits of $1+ trillion a year, eroding investor confidence in U.S. bonds. The problem is the political consensus for fiscal stimulus in 2008 – 2009 does not exist today, and it will probably be even worse after the 2020 election. Our cultural, social and political fabric is so frayed as a result of decades of divisive politics it is likely to take years to sort out during a recession. Our political leaders will be fixing the politics of our country while searching for intelligent stimulus solutions to be developed, agreed upon and implemented.

What Will the Next Recession Look Like?

We don’t know when the next recession will come. Yet, present trends do tell us what the structure of a recession might look like, as a deep U- shaped, slow recovery measured in years not months:

- Corporations Short of Cash – Corporations already strapped are short on cash, will lay off workers, pull back spending, and are stuck paying off huge debts instead of investing.

- Federal Government Spending Cuts – The federal government caught with falling revenues from corporations and individuals, is forced to make deep cuts first in discretionary spending and then social services and transfer funding programs. The reduction of transfer programs will drive slower consumer spending.

- Consumers Pull Back Spending – Consumers will be forced to tighten budgets, pay off expensive car loans and student debt, and for those laid off seeking work anywhere they can find a job.

- World Trade Declines – World trade will not be a source of rebuilding sales growth as a result of the China – US trade war, and tariffs with Europe and Japan. We expect no trade deal or a small deal with the majority of tariffs to stay in place. In other words, just reversing some tariffs will not be enough to restart sales. New buyer – seller relationships are already set, closing sales channels to US companies. New country alliances are already in place, leaving the US closed out of emerging high growth markets. A successor Trans Pacific Partnership (TPP) agreement with Japan and eleven other countries was signed in March, 2018 without the US. China is negotiating a new agreement with the EU. EU and China trade totals 365 billion euros per year. China is working with a federation of African countries to gain favorable trade access to their markets.

- Pension Payments in Jeopardy – Workers dependent on corporate and public pensions may see their benefits cut from pensions, which are poorly funded today with markets at all-time highs. GE just announced freezing pensions for 20,000 employees, the harbinger of a possible trend that will reduce consumer spending

- Investment Environment Uncertain – Uncertainty in investments will be extremely high, ‘get rich quick’ schemes will flourish as they did in 2008 – 2009 and 2000.

- Fed Implements Low Rates & QE – The Fed is likely to implement very low interest rates (though not negative rates), and QE with liquidity in abundance but the economy will have low inflation, and declining GDP feeling like the Japanese economic stasis – ‘locked in irons’.

Implications for Investors

The following recommendations are intended for consideration just prior or during a recession with a sharp decline in the markets, not necessarily for today’s markets.

Cash – It is crucial to maintain a significant cash hoard so you can purchase corporate stocks when they cheapen. The SPX could decline by 40 – 50 % or more when the economy is in recession. Yet, good values in some stocks will be available. At the 1500 level, there is an excellent opportunity to make good long term growth and value investments based on sound research.

CDs – as Will Rogers noted during the Depression, “I’m more interested in Return of my Capital than Return on my Capital”, a prudent investor should be too. CDs are FDIC insured while offering lower interest rates than other investments. Importantly, they provide return of capital and allow you to sleep at night.

Bonds – U.S. Treasuries certainly provide safety, return of principal, and during a recession will provide better overall returns than high-risk equity investments. Corporate bonds may come under greater scrutiny by investors even for so-called ‘blue chips’ like General Electric. The firm is falling on hard times with $156 billion in debt. GE is seeking business direction and selling off assets. The major conglomerate’s bonds have declined in value by 2.5 % last year with their rating dropped to BBB. Now with new management the price of GE bonds is climbing up slightly.

Utilities – are regulated to have a profit. While they may see declining revenues due to less energy use by corporations and individuals, they still will pay dividends to shareholders as they did in 2008. Consumer staple companies are likely to be cash flow strained; most did not pay dividends to investors during the 2008 – 2009 recession. REITs need to be evaluated on a company by company basis to determine how secure their cash streams are from leases. During the 2008 – 2009 downturn, some REITs stopped paying dividends due to declining revenues from lease defaults.

Growth & Value Equities– invest in new sectors that have government support or emerging demand based on social trends like climate change: renewables, water, carbon emission recovery, environmental cleanup. From our Navigating A Two Block Trade World – US and China post, we noted possible investments in bridge companies between the two trade blocks; services, and countries that act as bridges like Australia. Look for firms with good cash positions to ride out the recession, companies in new markets with sales generated by innovations, or problem solving products that require spending by customers. For example, seniors will have to spend money on health services. Companies serving an increasingly aging population with innovative low cost health solutions are likely to see good demand and sales growth.

The intelligent investor will do well to ‘hope for the best, but plan for the worst’ in terms of portfolio management in a coming recession. Asking hard questions of financial product executives and doing your own research will likely be keys to survival.

In the end, Americans have always pulled together, solved problems, and moved ahead toward an even better future. After a reversion to the mean in the capital markets and an economic recession things will improve. A reversion in social and culture values is likely to happen in parallel to the financial reversion. The complacency, greed, and selfishness that drove the present economic extremes will give way to a new appreciation of values like self-sacrifice, service, fairness, fair wages and benefits for workers, and creation of a renewed economy that creates financial opportunities for all, not just the few.