Its been another wild week and the fastest ever correction has turned into the fastest ever bear market. The Fed tried to unleash a liquidity bazooka but market players we’re largely uninterested indicating the Fed is not able to alleviate the emerging stresses. There was some interesting action this week. Liquidity is becoming a real problem, even in treasuries.

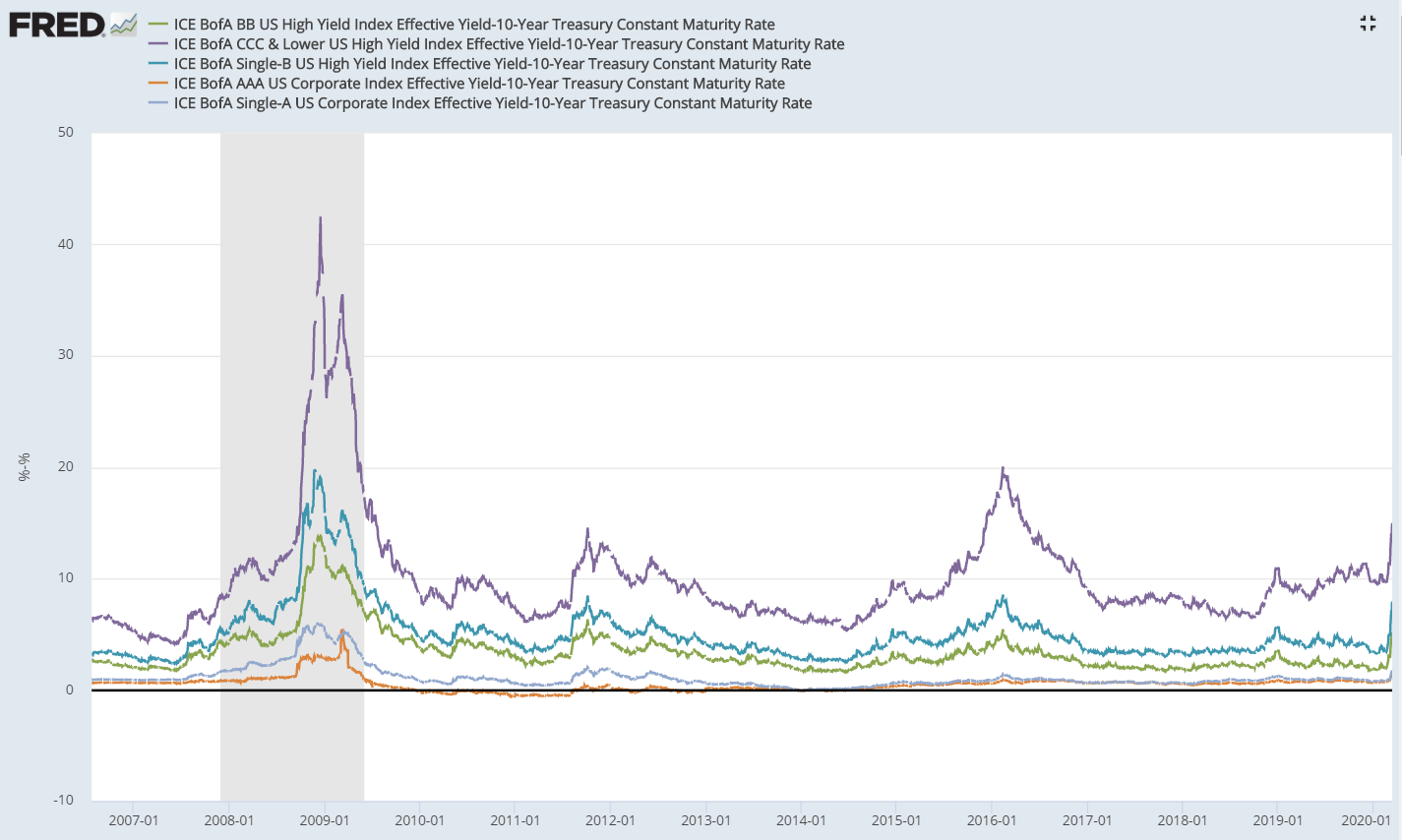

As I showed last week, corporate yield spreads over treasuries continue to increase. Its not just the level but the rate of increase that’s astonishing. We see the same whether its stock prices or increases in volatility in financial markets, the rate of increase is historic to say the least. (chart last updated march 12th)

The stock market is very oversold, there’s no point proving this with charts. There’s no such thing as maximum fear or oversold. The market could go either way, crash or rally. The thing is you can’t ignore years of maximum risk on behavior and not expect the reverse. There is no historical precedent for today’s markets.

The US stock market is also very overvalued. It will only reach normal valuations at 1/3 of the peak (Valuation chart posted before here). Last week I also showed stock market breadth (green). This continues to deteriorate badly. Investors are focused on owning large caps within the S&P. So this isn’t a long term bottom.

Many people in the past couple of years have believed bitcoin would be a hedge against collapse. I looked at this in 2017 and concluded Bitcoin is a risk-on asset. Bitcoin crashed this week. This chart shows its correlation with stock market turns has continued.

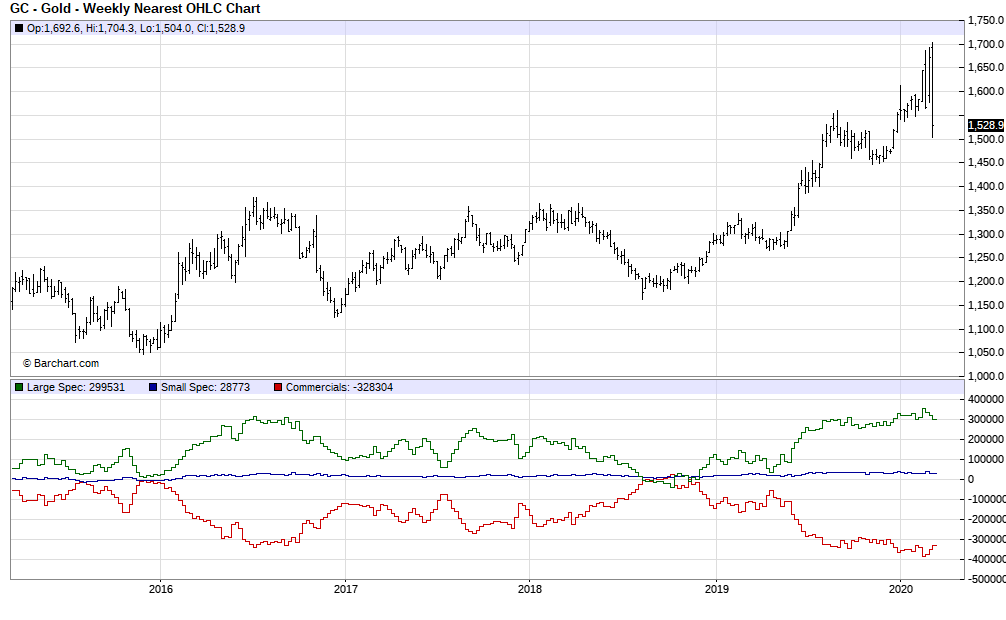

If bitcoin is not a safehaven then you might imagine gold would be. However in the heat of panic this week gold sold off sharply as speculators liquidate anything they can.

Large Speculators have been heavily net long gold (green). They are usually wrong at turns.

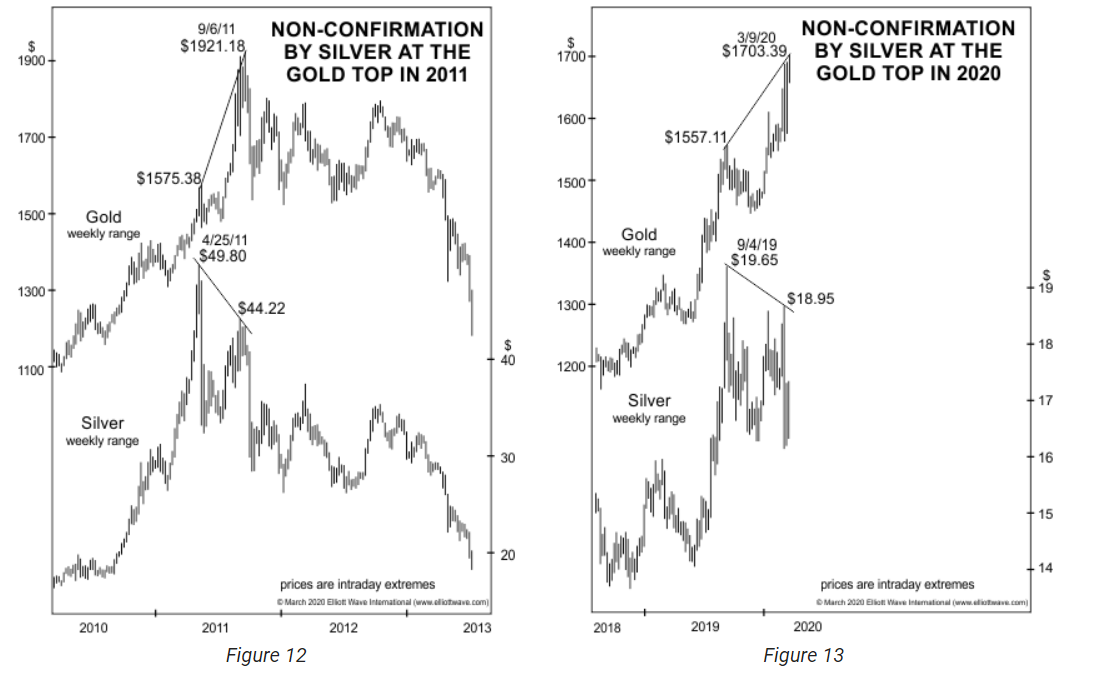

The Elliottwave Theorist put out a chart showing a non confirmation between gold and silver similar to what occurred at the all time high in 2011. Given how much optimism has been directed at gold in recent months I think its making an important top along with other risk assets. Unfortunately now is not a great buying opportunity.

So where are the safe havens? Surely the one asset that does well in any panic has been a great place to hide? Well actually no…

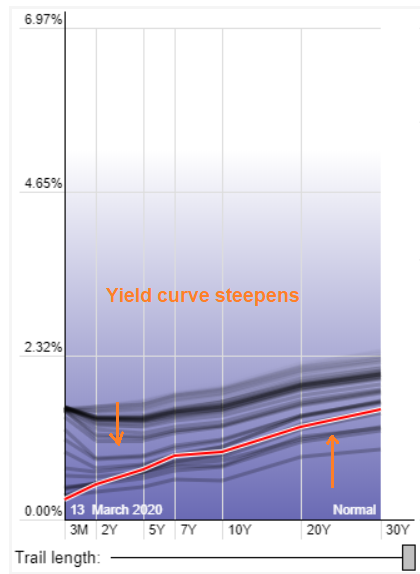

In Lets Review the Market Carnage I showed the yield curve and that long term treasuries were overbought. (98% bulls T-bonds) Well they reversed this week and as a result the yield curve has steepened. This indicates we’re heading for recession (should be obvious at this point).

Is the long term downtrend in yields over? Bond yields have been in a declining trend since the early 80s. If this trend is over after the frenzied bond mania of recent years then we’re entering a new environment where government bonds are not longer a safe haven. This could be disastrous as Treasuries are the bedrock of the financial system.

Treasury liquidity was problematic this week and the fed in their words moved to “ address highly unusual disruptions in Treasury financing markets”.

Cracks in US Treasury market could spell trouble for the system

Investors and analysts are warning about deepening cracks in the world’s largest government bond market.

Strange patterns have started to emerge, such as drops in the price of US Treasuries — a traditional haven — even while riskier assets such as stocks have been squeezed by fears that the coronavirus outbreak will spark a global recession.

Some are warning that the patterns could lead to the unwinding of one of the market’s most popular trading strategies — with potentially serious consequences. Such fears prompted the US Federal Reserve to announce a sweeping package of measures on Thursday to try to ease conditions, including pumping trillions into the financial system.

Something Weird Is Happening on Wall Street, and Not Just the Stock Sell-Off

there were reports from trading desks that many assets that are normally liquid — easy to buy and sell — were freezing up, with securities not trading widely. This was true of the bonds issued by municipalities and major corporations but, more curiously, also of Treasury bonds, normally the bedrock of the global financial system…..

All this suggests that major financial players are experiencing a cash crunch, and are selling whatever they can as a result. That would help explain the seeming contradiction of assets that should go up in value in a time of economic peril instead falling in value.

Will the dollar be a safe haven? I’m not yet sure on this one. But with a dollar shortage emerging this could be one to keep a track of. There are some correlations that held well until the last couple of years. Those were that the dollar did well in risk-off periods, times of oil weakness and deflation.

For a long time the dollar did well in risk off periods and had a strong inverse correlation with oil prices. For the last couple of years this relationship broke down somewhat (Could that be an early divergence ahead of other markets?) so I’m not sure if it will reappear but with a dollar funding shortage emerging there’s a strong possibility it could. These charts could imply a dollar rally.

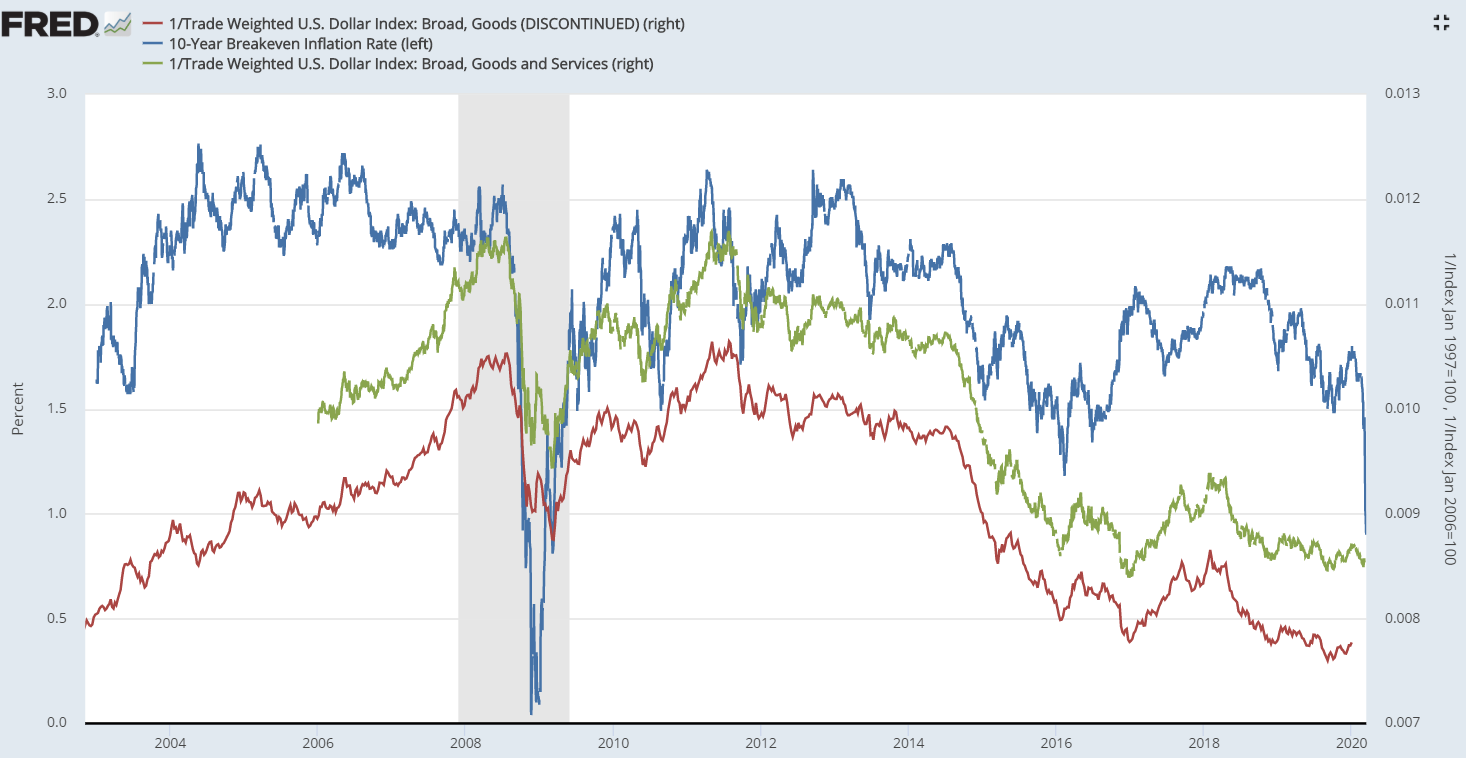

Here is the markets expectation of inflation (blue) and the Dollar (inverted, green/red). The dollar usually performs well when inflation falls. If this continues to be the case the Dollar should rally soon.

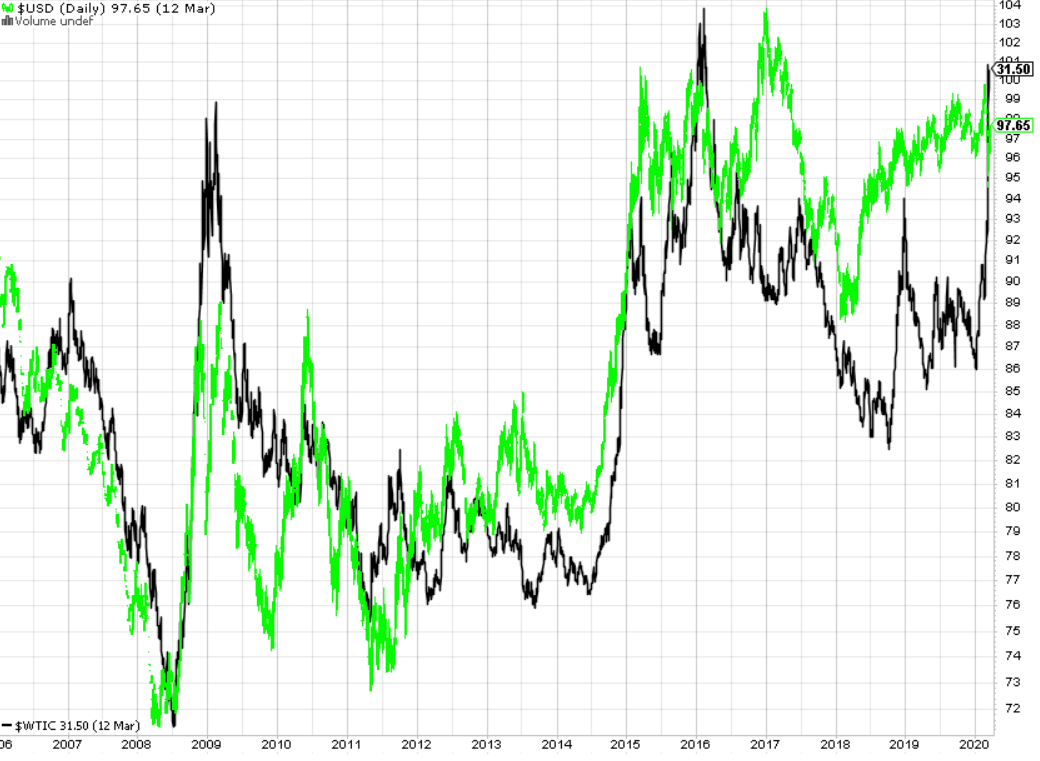

The Dollar long had a good inverse relationship with oil (green — USD, black — Oil – inverted).

So with safe havens being not so safe where do we go now?

The demand effects from an economic recession and COVID-19 are going to lead to a extreme demand shock in certain sectors. Supply chain disruption can bring industries to a standstill. The supply chain shortages are just starting to work their way through.

This combined with the deflationary financial environment could lead to the worst nightmare scenario where nothing thrives but cash.