China’s unprecedented economic development and the massive increase in energy imports have made it an important destination for some of the world’s largest energy exporters. The growing role of EVs in the industrialized West and the fracking revolution in the U.S. have further strengthened Asia’s importance as a major buyer of fossil fuels. China’s modest energy reserves make it dependent on foreign producers to meet its domestic demand. While the Asian country was able to meet its energy requirements by producing 4 million barrels per day (mb/d) from domestic oil fields twenty-five years ago, last year the ratio of foreign oil dependency reached 70 percent.

This high level of reliance is a reason for concern for the Central Government in Beijing as potential supply disruptions create a security risk. Therefore, the Chinese government has been pushing its state-controlled energy companies to increase production from domestic oil fields to reduce dependence. China’s ‘big three’ Sinopec, Cnooc, and PetroChina have responded to the government’s requests and significantly increased spending with mixed results until now.

China’s advantage

The Central Government in Beijing has a controlling stake in the country’s three biggest energy companies. PetroChina is the largest company of the three by volume of oil and gas production. The organization’s partial IPO in 2007 for a moment made it the world’s most valued company based on the hypothetical sale of all shares. It even surpassed the psychological boundary of $1 trillion. However, after the global financial crisis in 2008, the value of the energy giant shrunk significantly towards more realistic levels.

Sinopec is China’s second-largest producer of oil and gas, and Asia’s largest refiner. Of the three energy giants, Cnooc is the smallest but the most efficient. The company enjoys higher profitability as it’s not bogged down to refinery activities in mainland China where the government exerts pressure to reduce prices for political reasons. Also, Cnooc has a relatively large portfolio of offshore activities.

The financial burden

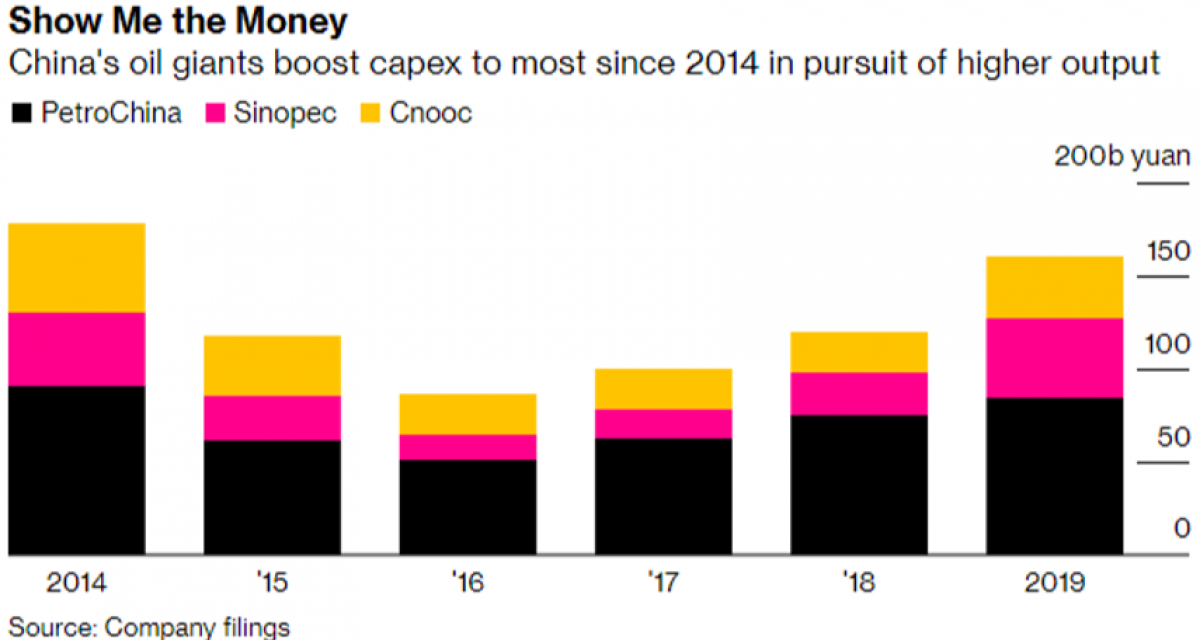

After the implicit request from the Central Government, the three energy giants showed their intention to invest a cumulative $77 billion or 517 billion yuan in domestic upstream activities. The economic rationale behind these investments is weak given the maturity of the oil fields in question and their relative depletion. However, Beijing’s intention is not to improve the companies’ competitive position, but to strengthen China, as the country faces structural and external challenges.

Although upstream spending tends to be concentrated in the second half of the year, already a substantial difference from last year’s investment pattern can be seen.

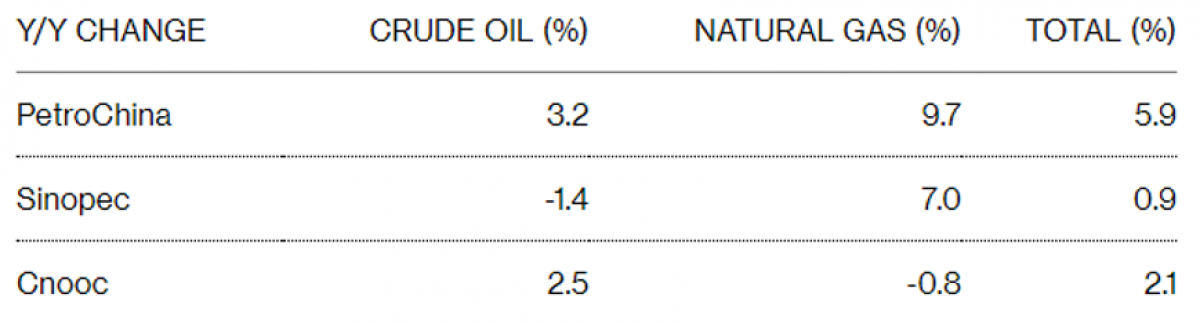

Larger CAPEX targets are having mixed results for Chinese energy companies. While PetroChina and Cnooc have managed to increase oil production by 3.2 and 2.5 percent respectively, Sinopec is falling behind with a modest decline of 1.4 percent. The overall production of fossil fuels including natural gas, however, shows a more convincing picture.

Beijing’s coal-to-gas policy has significantly increased the Asian country’s natural gas consumption. During last winter’s heating season, the Chinese government was confronted with a possible shortage of natural gas. Therefore, local governments were instructed to give households a preferential treatment and to reduce the flow of energy to the industry. This year certain measures have been taken to prevent a similar crunch including increasing domestic natural gas production capacity.

PetroChina and Sinopec have expanded their natural gas production by a remarkable 5.9 and 7 percent respectively. This means that the average production of hydrocarbons for the three companies, despite a modest decline in the case of Cnooc for gas and Sinopec for oil, is still positive.

The companies’ mixed advantage

China’s energy giants have historically profited from their government’s closed-door policy meaning that international energy companies have restricted access to the Chinese market. This is a significant advantage for the three energy giants.

However, Beijing does not give preferential treatment for free and expects the companies to respond to the Central Government’s calls and take responsibility when required. Beijing, for example, sets the prices for gasoline and other fuels, which means that the companies are making a significant loss in certain cases.

Despite the limitations, the lack of competition from foreign companies in the world’s second-largest market is significant enough to maintain the relative obedience of Chinese energy companies. Therefore, both sides are inclined to continue their relationship and provide their counterpart with the necessary advantage.

By Vanand Meliksetian for Oilprice.com