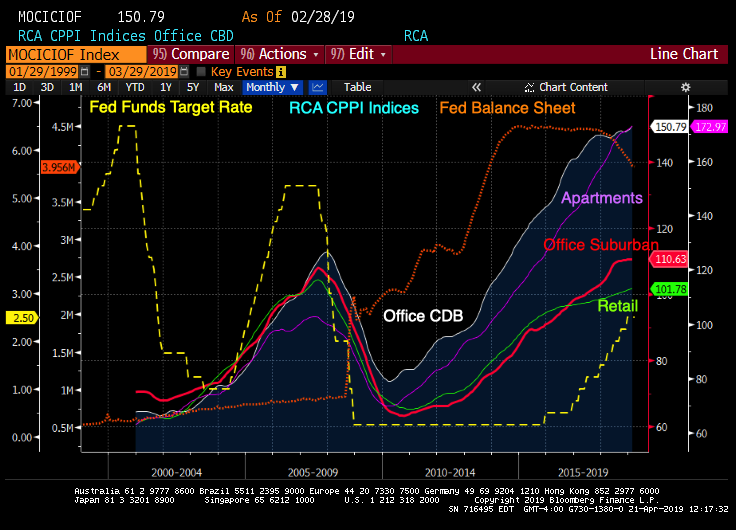

Given the advent of on-line shopping, commercial real estate prices are not quite back to where they were at the height of the asset bubble prior to the financial crisis of 2008-2009. Suburban office space is barely above the pre-crisis peak.

On the other hand, apartment prices are substantially above where they were in 2008-2009, as are CBD (Central Business District) offices.

All with the help of The Federal Reserve’s low interest rate policies. But notice that the growth rate of CRE has slowed (except for apartments).

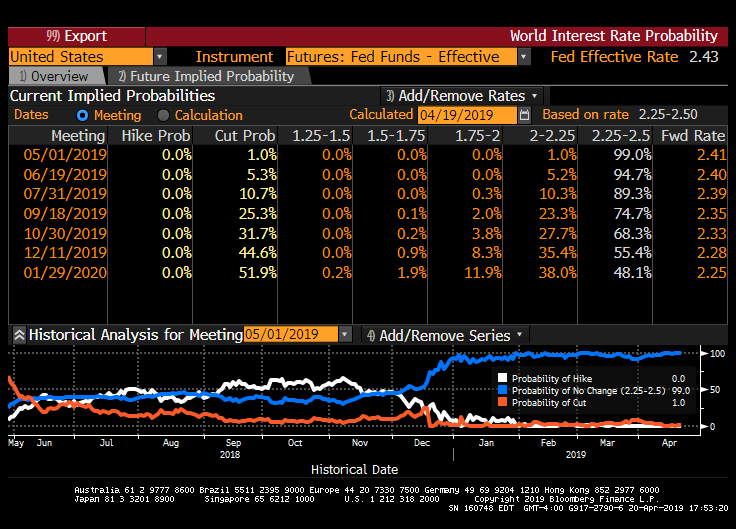

The good news for CRE investors? The Fed isn’t likely to keep raising their target rate or continue to shrink their balance sheet.