via @mnicoletos:

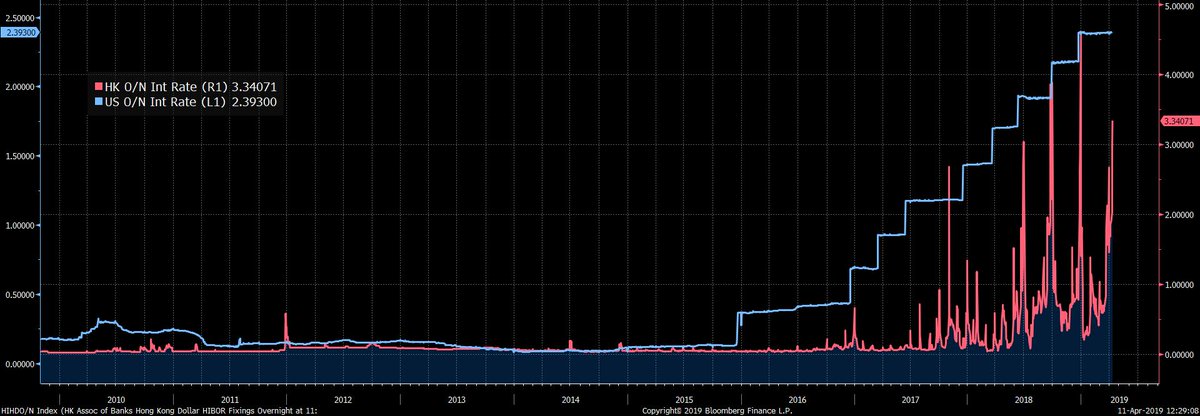

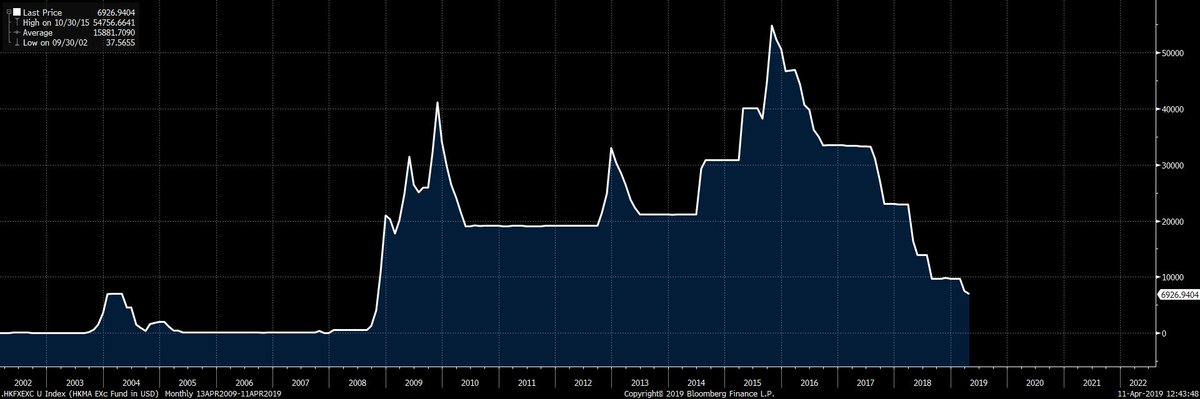

#HongKong: Pressure on the #USD – #HKD peg is mounting. The rising #US interest rates have put enormous pressure on the HKD peg. This has depleted Hong Kong’s excess FX reserves.

#HongKong has FX Reserves of $438bn (March 2019) plus another $6.9bn from the HKMA Exchange Fund which is there to stabilize the #HKD peg. Looking at the HKMA Exchange fund it is clear that money has been leaving HK. Since 2016 the fund has gone from $55bn to $7bn.

#HongKong M2 is currently 1,8 trillion USD. However, the total FX Reserves / M2 are only at 24%.

The #HongKong economy is “pegged” to the #Chinese economy while its currency is pegged to the US Dollar. This asymmetry puts pressure on the #USD – #HKD peg. If we look at the FX Reserves / M2 ratio for #China things look more alarming. The ratio is at an alarming level of 11%

For #China, FX reserves seem to have stabilized, however, the deteriorating Current Account will likely weigh on them. During 1997, once the Asian Tigers’ FX reserves / M2 ratios went to 25% the pegs collapsed. FX reserves were no longer sufficient to support capital outflows.

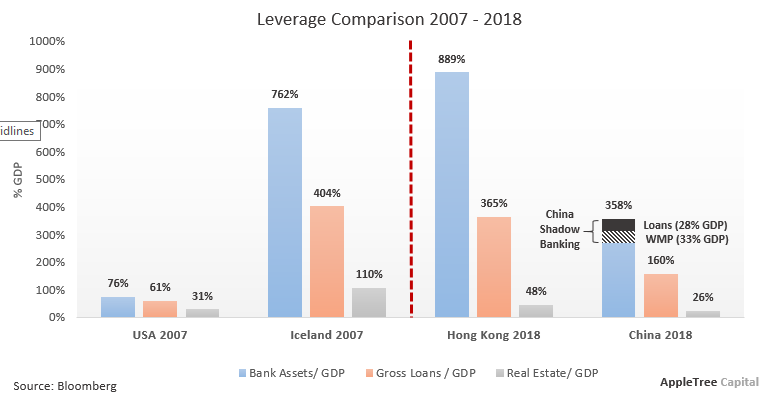

Finally, #China‘s & #HongKong‘s banking systems are so levered that they have reached unprecedented levels. China’s banking assets are now approx. 400% of China’s GDP while Hong Kong’s banks are 900% of GDP. Chinese banking assets are now approx. 50% of Global GDP

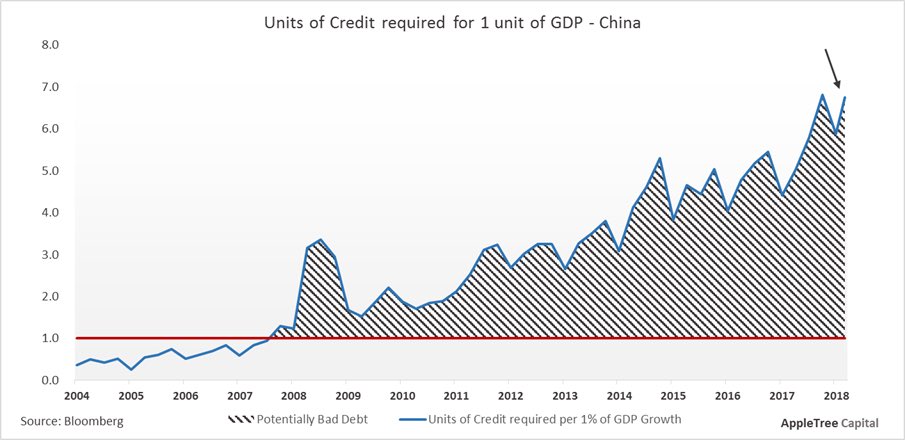

#China posted “decent” GDP numbers. To achieve that it used debt. China needs more and more debt to reach the same GDP growth. China needs 6.75 units of credit to produce 1 unit of GDP (Mar 2019), that’s the 2nd highest reading ever with highest being 6.82 units on Sep 2018

#China’s vulnerabilities continue to rise… In a sharp reversal from just a few years ago, the combined dollar liabilities at China’s big four #banks exceeded their #dollar assets at the end of 2018 https://www.wsj.com/articles/chinas-banks-are-running-out-of-dollars-11556012442… via @WSJ #usd #cnh #cny

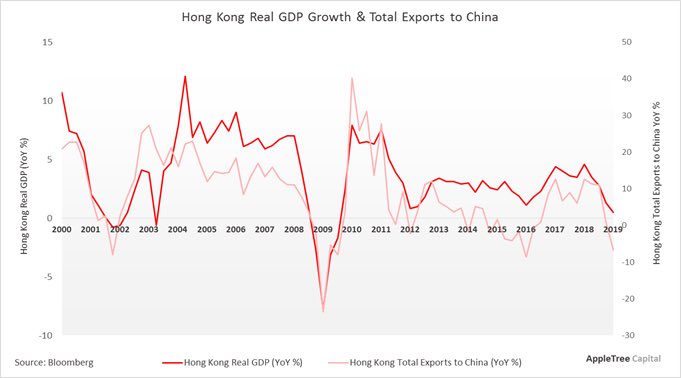

#HongKong’s economy grew at its slowest rate in a decade during the first quarter, Real GDP eased to 0.5% in Q1 2019 on a YoY basis. Initial estimates had the economy growing by 2-3% this year (annual budget in February). https://www.scmp.com/news/hong-kong/hong-kong-economy/article/3008578/hong-kongs-gdp-slows-05-cent-first-quarter-2019 … #HK #HKPEG #HKD #China

#HongKong’s economy is “pegged” to the Chinese economy. Hong Kong’s GDP is clearly correlated to Hong Kong’s exports to #China. If China’s economy deteriorates further Hong Kong will be hit hard. The HK banking system is 900% HK GDP. #HK #HKpeg #HKD #USD

#HongKong: What is more interesting to see though is the correlation between Hong Kong’s GDP and Hong Kong’s real exports to #China (i.e. HK exports to China excluding imports from China that were re-exported back to China)

In the mean time… #China Defaults hit a record high in 2018. 2019 appears to be worse. During the first 4 months defaults are 3.4x more than the same period of 2018. This is more than triple that of 2016, when defaults were more concentrated in H1. https://www.bloomberg.com/amp/news/articles/2019-05-07/china-defaults-hit-record-in-2018-the-2019-pace-is-triple-that …

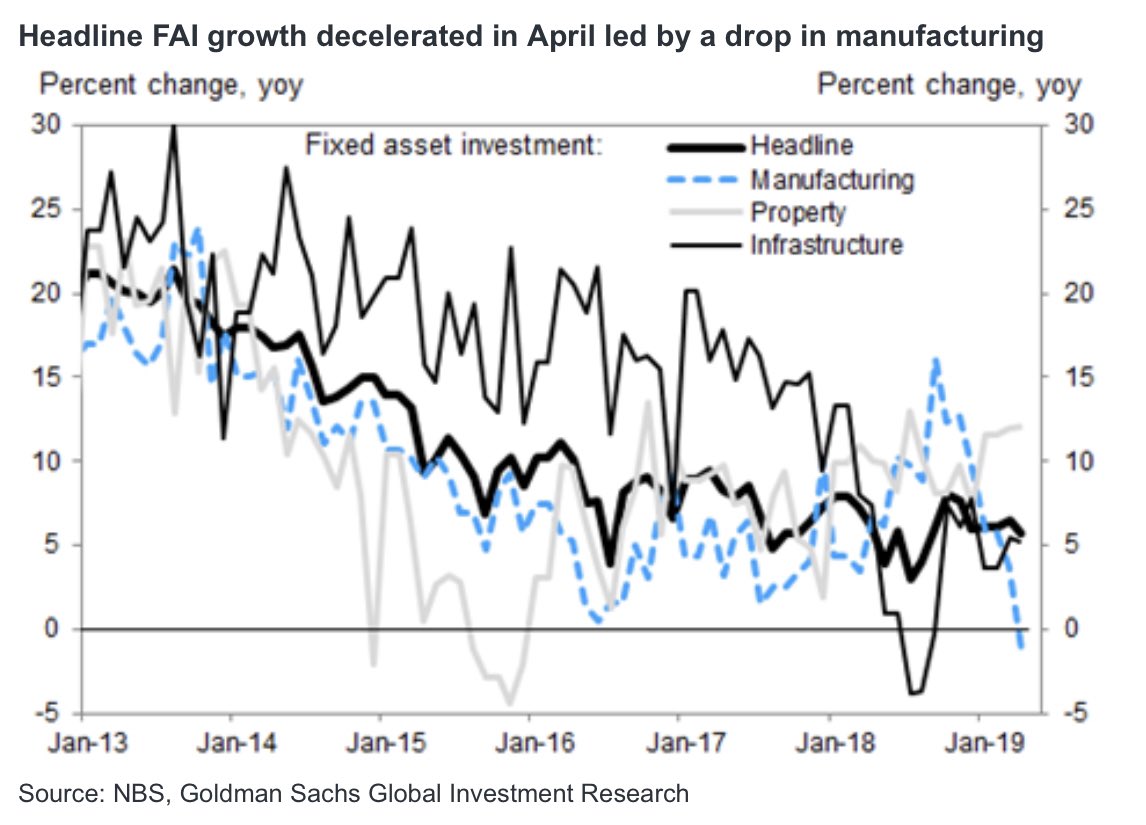

#China’s manufacturing is falling off a cliff! Guess what happens to defaults? Guess what happens to NPLs? China’s banks are only 450% of GDP and #HongKong’s banks are only 900% of HK GDP Guess who wants to take their money out of China? Do you think HK is safe? #Thinkagain