I’ve received a number of emails asking me why stocks rallied from mid-March until this week despite the clear and obvious warning signals I’ve flagged: the economy rolling over, supply chain disruptions, inflation, and a hawkish Fed.

A significant part of this rally has been fueled by investors moving money out of bonds and into stocks. The reason for this is that bond prices fall/ bond yields rise during periods of higher inflation. This means bonds are less attractive as an asset class… which, according to modern portfolio theory, means it’s time to move capital into stocks. And not just a little.

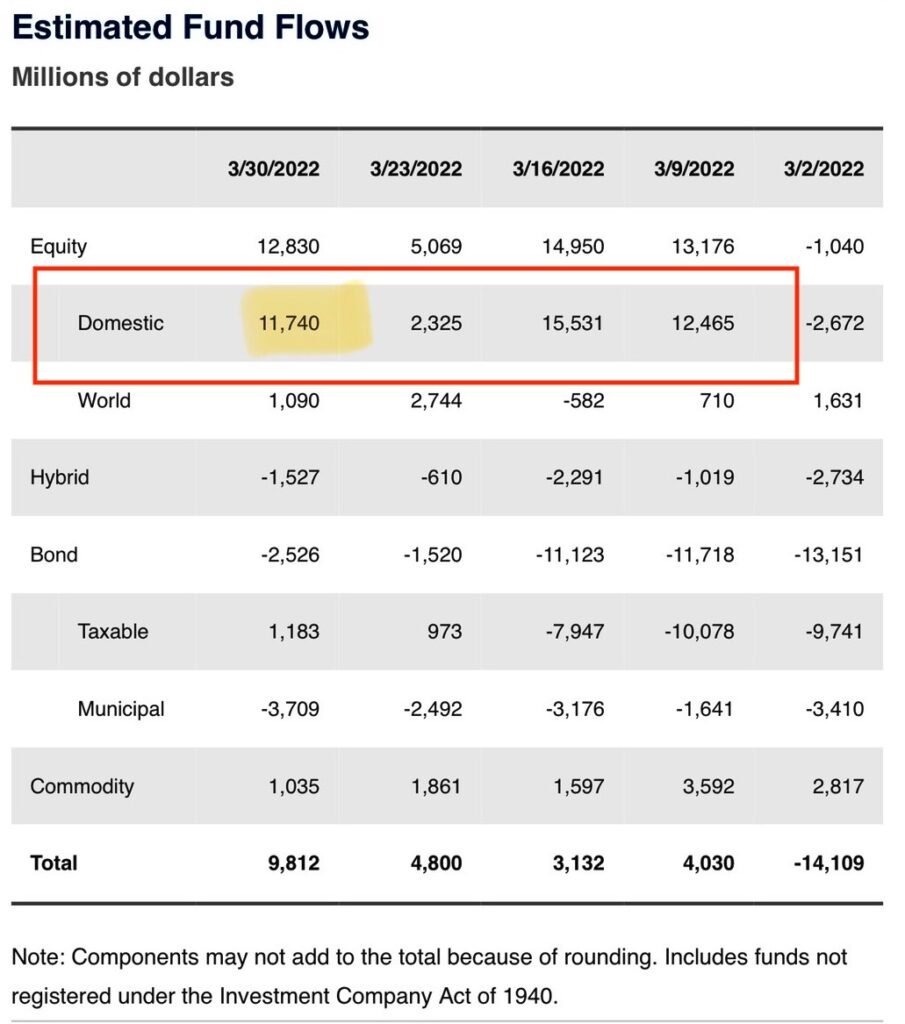

Throughout March, investors have pulled $40 BILLION from bond funds while putting $45 billion into stocks. Because the U.S. is the “cleanest dirty shirt” as far as developed markets go, some $41 billion of the $45 billion in stock fund inflows has gone to U.S.-based funds

This is why stocks rallied in March, despite the OBVIOUS red flags. It’s not that stocks are a great investment at current prices… it’s that bonds are so much worse.

However, this looks ready to change.

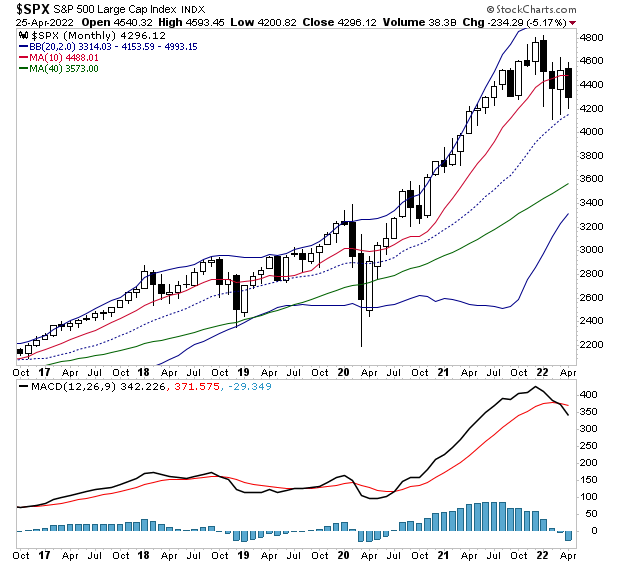

The technical damage of the last few weeks has been severe. As I write this, the S&P 500 is hovering around its 50-week/ 10 month moving average. If it breaks lower here… it’s going to at least 4,200 if not 3,600.

I would also point out that the Monthly MACD (a momentum gauge) is now on a “sell signal.” This has preceded declines of 20+% every time it registered in the last four years.

Put simply, another bloodbath is coming… and smart investors are already taking steps to profit from it.