via Zerohedge:

Cooling rents in formerly hot real estate markets like New York City and Boston might give the Federal Reserve the excuse it needs to keep rates low and allow formerly frothy real-estate markets across the US to recover from a recent dip.

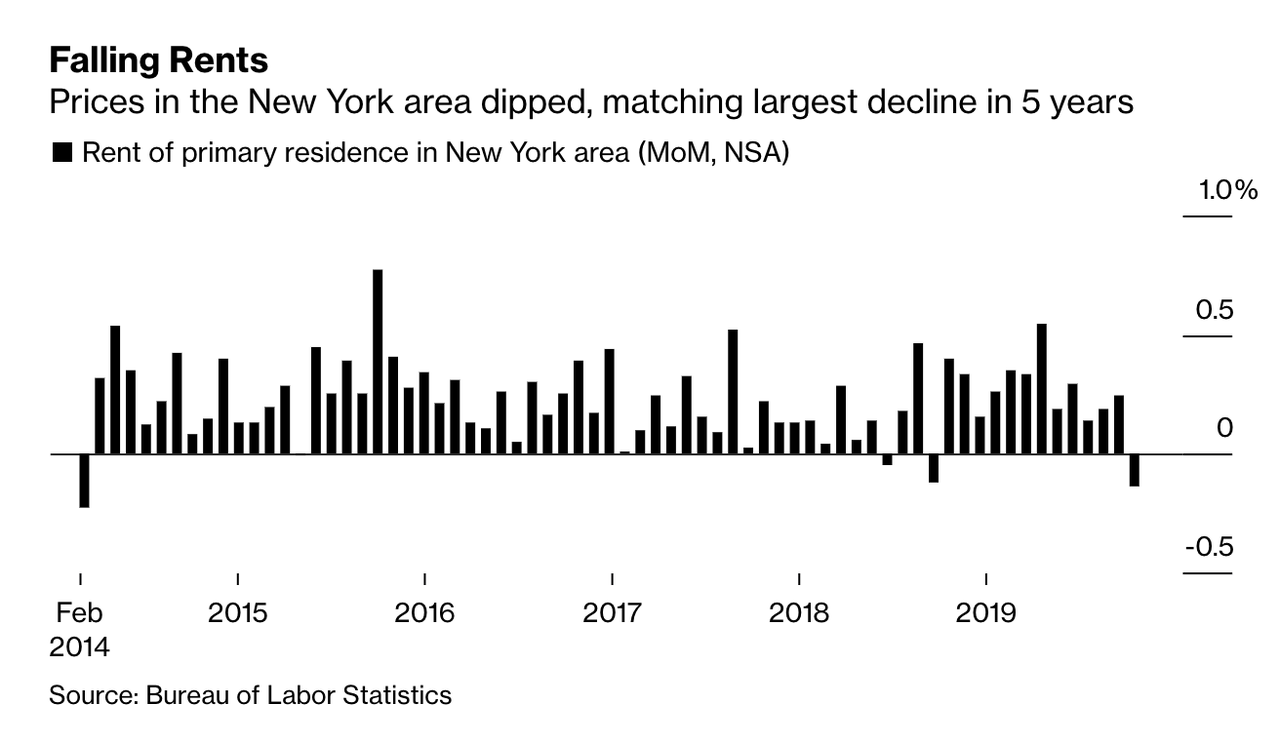

The Greater New York area saw rents for primary residences fall 0.1% MoM in October, while rents paid in Boston fell 0.2%. This weighed on the national rent number, leaving growth almost flat for the first time in eight years – an obvious warning sign about the housing market. According to Bloomberg, national rents account for around 40% of core CPI, meaning rents have an important impact on inflation.

We’ve discussed the unraveling of the housing market in the past. Prices and rents finally peaked in New York a few years ago, which we said was an omen that broader declines were in store.

Squeezed renters and an influx of new high-end housing has caused Manhattan rents to continue to fall. In a real threat to markets, inventory is backing up and for the first time in a long time, Manhattan is almost starting to look like a buyer’s market.