Are investors suffering from Fed FOMO? The fear of missing out on The Federal Reserve’s epic low-interest rates and prodigious money printing?

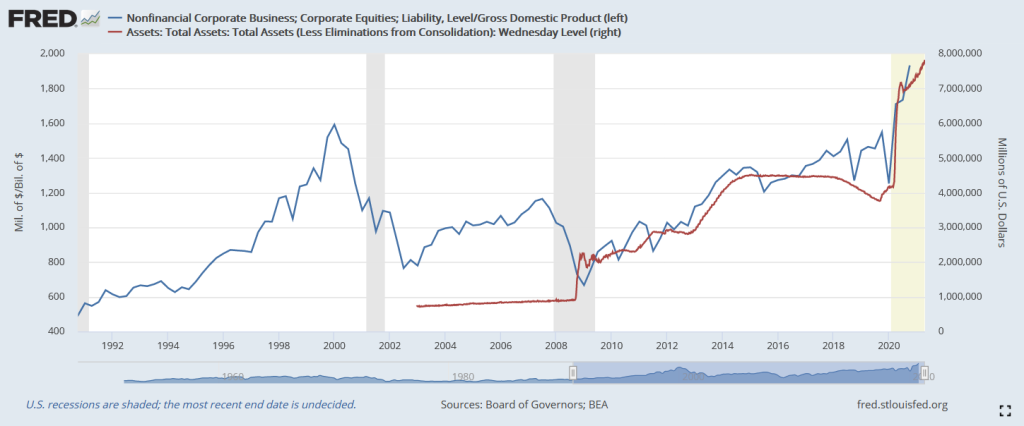

The Buffett Indicator, a measure of the equity market adjusted by GDP, is higher than the notorious dot.com bubble of the late 1990s, fueled by The Fed’s growth of their balance sheet since late 2008.

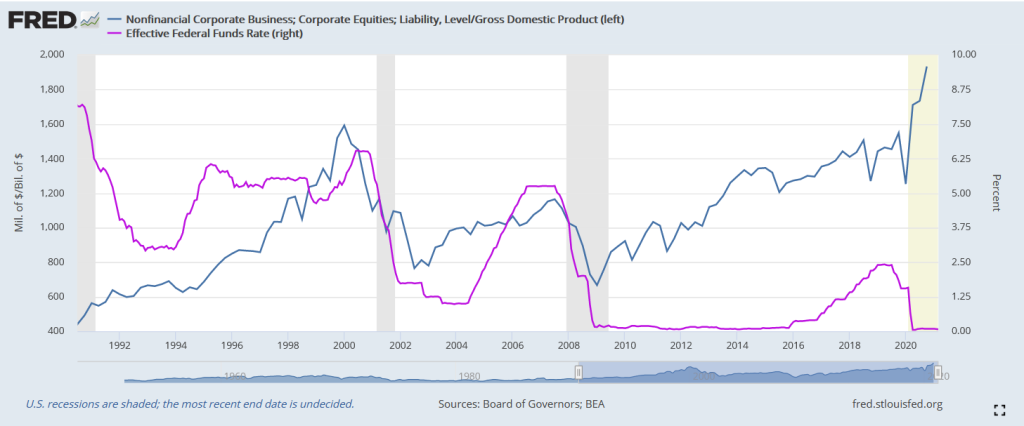

If we look at the Buffett Indicator against The Fed Funds Effective rate, we see the same thing: a massive equity bubble.

Then we have Redfin’s home price index growing at 16.7% year-over-year.

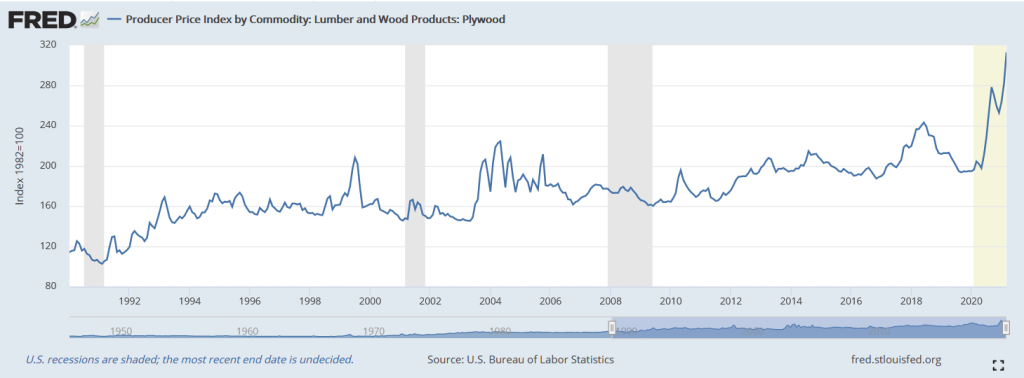

Then we have the meteoric rise in lumber prices. As in plywood.