by JDTAS

I keep hearing that these are just overnight operations and only involve treasuries.

They are not all overnight loans. Looking at the Federal Reserves website there is numerous longer repo loans “term repos”. https://apps.newyorkfed.org/markets/autorates/tomo-results-display?SHOWMORE=TRUE&startDate=01/01/2000&enddate=01/01/2000

In fact, looking at the last 25 Repo operations 25% has been longer than 1 day (not counting the Friday ones that are not paid back until Monday).

October 10 – 2 weeks (42.6 Billion), October 11 – 6 days (21.150 Billion), October 15 – 2 weeks (20.1 Billion), October 17 – 15 days (30.650 Billion), October 22 – 2 weeks (35 Billion)

Less than 2 weeks the Federal reserve has injected more than 100 Billion (not counting the overnight repos) and I didn’t go back further to add more. In addition, they released a statement today that they are increasing the “term repos” (next one tomorrow, and then Oct 29th) to “at least $45 billion.” So this number will be increasing.https://www.newyorkfed.org/markets/opolicy/operating_policy_191023

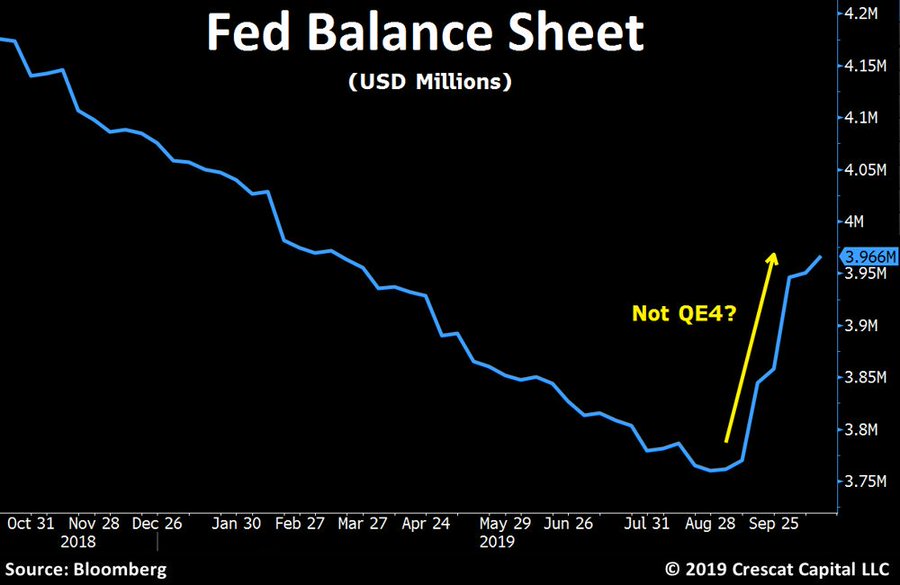

This probably explains the recent uptick in the Federal Reserve Balance Sheet:

https://www.federalreserve.gov/monetarypolicy/bst_recenttrends.htm

This looks very similar to past QE based on the chart. Where do you draw the line? 1 day lending? 1 week? 1 month? 1 year?

I am worried because according to the fed the overnight Repos are not just treasuries. It includes “Treasury, agency debt, or agency mortgage-backed securities (MBS).” https://www.newyorkfed.org/markets/domestic-market-operations/monetary-policy-implementation/repo-reverse-repo-agreements

I would wager that the trading being attempted is not treasuries and either agency debt or MBS that banks are not willing to take on because of some risk involved and the low interest rate. And, of course we cannot trust the Federal Reserve they are not going to come out screaming about a problem and send the market into a panic.