via Zerohedge:

Conventional investing wisdom would have you believe that anybody who has remained bearish on global markets since the financial crisis has not only lost a boatload of money, but has missed out on the opportunity to cash in on one of the most torrid bull markets in recent memory.

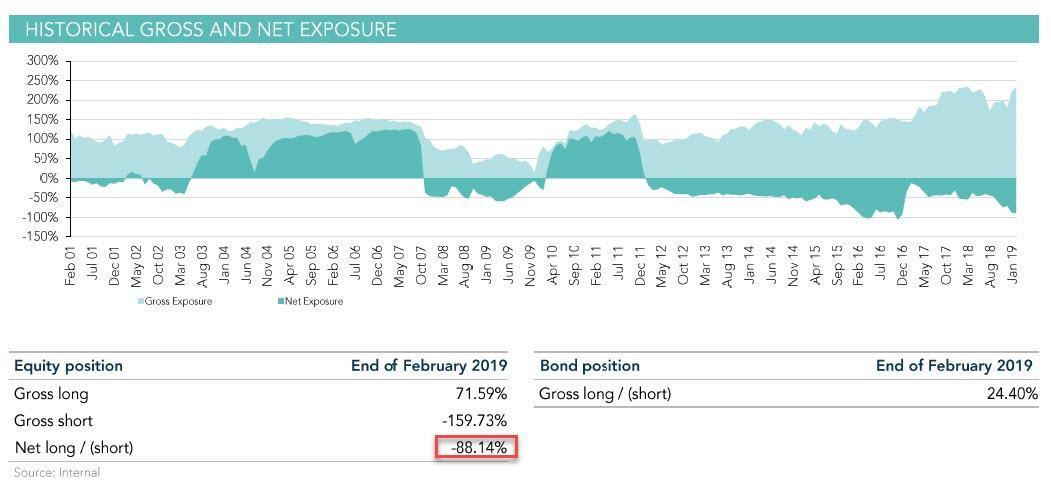

However, as Horseman Global’s Russell Clark has proven over and over again, this simply isn’t true. A few years back, we anointed Horseman with the title “The world’s most bearish hedge fund” for a very simple reason: Of all existing asset managers, Horseman may be the one with the biggest and longest net short position in history. Just look at the chart below, which shows not only that Clark’s net exposure was (as of March) a staggering -88.14%, with a gross short position of 160%, but that he had been effectively net short since 2011!

Yet, to assume that Clark has lost his shirt over the past ten years would be a mistake. Actually, his fund outperformed the S&P 500 for the period between 2011 – when he first went net short – to the end of 2018 (when the Q4 meltdown helped his fund post double-digit returns well above its benchmark).

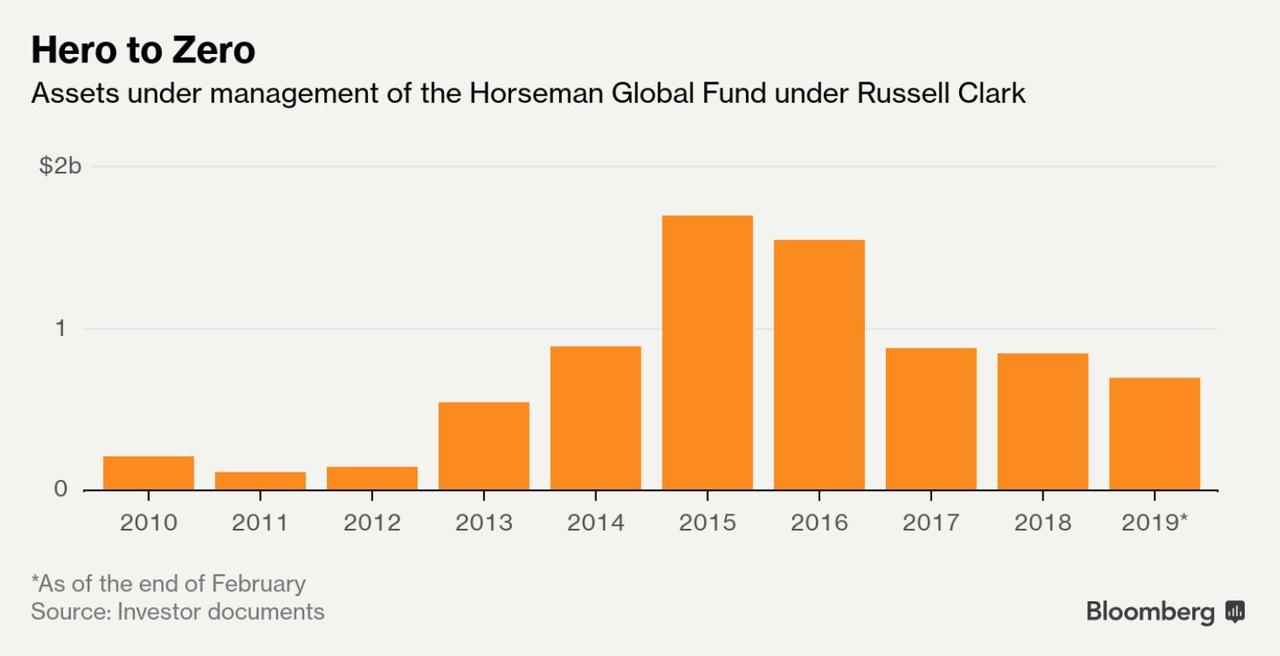

In 2014, Clark posted double-digit returns when oil prices cratered (he was short). In 2013, he made money shorting Brazilian equities. He started with just $111 million when he took over the fund in January 2011, but AUM peaked at $1.5 billion in 2015.

However, the fund’s inconsistent performance (it’s not unusual for Horseman to be up or down 5% in a single month) has alienated some investors who are uncomfortable with the volatility, even as Horseman has bested most other hedge funds in terms of performance, as one former investor told Bloomberg.

Tim Ng, chief investment officer of Princeton, N.J.-based Clearbrook Global Advisors LLC, says his fund pulled its money for similar reasons. “The stretches of negative performance and the high volatility of monthly returns became a consistent drag on our portfolio’s overall return, which prompted us to redeem,” he says.

But after a bruising Q1, when Clark got crushed by the torrid rally in US equities, more LPs have pulled out, and AUM has shrunk to just $690 million. Per the FT, the loss in Horseman’s Global Fund for April was a staggering 12%, which has brought its total loss YTD to more than 25%.

This prompted Clark to joke during an interview with Bloomberg published Friday. Perhaps it was kismet that the interview was timed to coincide with stocks’ worst run since the December rout.

Because if this run doesn’t continue, Clark joked, “this could be my farewell interview.”

During the interview, Clark recounted how his contrarian views were cemented during the early days of his finance career, when he lost several weeks’ worth of pay during the dotcom crash.

Russell Clark’s entry into the high-stakes world of investing could hardly have been less promising. As a graduate trainee at UBS Group AG in Sydney, he was wowed by friends getting rich by day-trading tech stocks in 2000. So he spent his first few paychecks on five dot-com shares. Four crashed to zero, and the fifth lost half its value as the tech bubble burst.

That lesson was so brutal that it helped turn Clark, now 45, into a career contrarian. These days the hedge fund he runs for London-based Horseman Capital Management is prepared for a market crash. It’s an audacious contrast to what’s been the most popular trade in town for years: wagers that stocks will keep rising. What’s more, with a resolve virtually unheard of in the industry, he’s been betting on stock declines for more than seven years.

But as the relative market calm has been increasingly punctuated by bouts of frenzied volatility, Clark believes that the moment where the market finally breaks is nigh at hand.

The vicious December sell-off, crowded trades, low trading volume even during market rebounds – these are signals to Clark that the market is about to crack. Which for him is good news. “The stars are aligning, and the markets are complacent,” he wrote in January. “Get the popcorn ready, it’s showtime.”

Clark’s assiduously dedicated contrarianism has earned him a cult following among professional investors. Though his name isn’t as widely known as an Ackman or a Loeb, his interview with RealVision was one of the company’s most requested videos from 2018 (RV recently released the interview in its entirety for free).

Despite a wave of redemptions in 2016, 2017 and 2018, Clark, who keeps the bulk of his own wealth in Horseman, has retained an unflappable confidence in his investing view.

“When people hate you and write terrible things about you, it tends to be the best time to invest.”

Those who have opted to stick with Clark have probably developed an admiration for his contrarian calls, and accepted the fact tha the fund “lives and dies” with his macro view.

It takes patience and trust to stick with Clark at a time when many investors seem to favor a team-led approach over individual managers. “This fund lives and dies with Russell’s macro call,” says Marcus Storr, head of hedge fund investing at Feri Trust GmbH, based in Bad Homburg, Germany, which manages €34.5 billion ($38.6 billion). “Every investor has to understand that his performance is mainly driven by directional investment ideas.”

And if any investors think Clark might change direction anytime soon, think again. “If you talk to any manager,” he says, “they always want to be bullish, and the classic line will be, ‘There’s always a bull market somewhere.’ My observation is there’s always a bear market somewhere.”

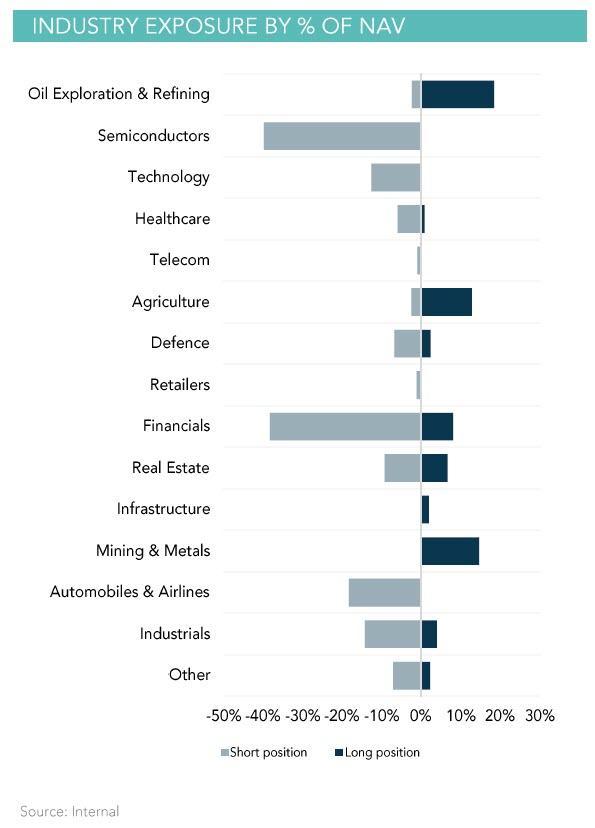

In his March investor letter and during the interview with BBG, Clark detailed the reasoning behind his bets against US shale producers and his bet against auto-callables, equity-linked securities which Clark believes will collapse and trigger a broad resurgence in volatility.

Clark has a front-row seat. He’s shorting the U.S. dollar on a number of bets. He’s trained his skepticism on U.S. shale companies, which he calls “capital destruction machines” that produce oil but no money. Then there’s his wager that autocallables, complex equity-linked securities that aim to generate regular income for their buyers, are going to collapse and volatility will soar. Investors hungry for yields have piled into autocallables, artificially suppressing stock market instability. This, he says, is “unsustainable and will end badly. I’ve seen it twice, three times even. And it feels so close to that inflection point. Everyone’s in the same trade.”

- First, the shale revolution has seen the US go from producing 5m barrels of oil a day to 12m barrels a day. This is hugely positive for growth. This has also had the added benefit of lowering the cost of energy. But data here is starting to weaken, and profitability and share price performance of shale companies is beginning to lag traditional oil drillers. This driver is looking to be coming to an end.

- Secondly, for the global economy, China has become a huge consumer. Its auto market has grown to be the world’s largest, and overseas tourism has grown substantially. This has been a huge tailwind for many industrial and consumer discretionary companies. Recent data is showing that this is beginning to get saturated, with both auto and smartphone markets showing falling volumes.

- Finally, and I would suggest the least understood driver has been the falling cost of equity insurance. For more than 10 years, from 2000 to 2011, equity investors suffered large equity drawdowns in global markets. And it is no coincidence that over this period there was huge growth of the hedge fund industry. When markets continually sell off, and bad things keep happening to your equity portfolio, you are going to want to have some money in a “hedge of some sort. In fact, by 2011, all sorts of tail risk and Black Swan funds had appeared. All these funds bought equity insurance and pushed its price up.

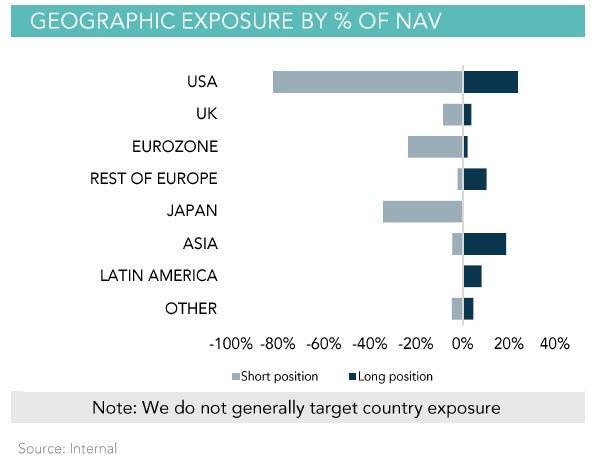

Finally, for those wondering about Clark’s positioning…

…and what the fund is most short…

For anybody looking for more on Horseman…

For those who want to read some of Russell Clark's latest letters, here they are:https://t.co/NoR0dvjOSzhttps://t.co/GWdT2W8oeEhttps://t.co/aVmGy5Ca0m

— zerohedge (@zerohedge) May 10, 2019