via CNBC:

- Companies, governments and households increased their combined debt load by 50 percent in the 10 years following the financial crisis, S&P Global Ratings said Tuesday.

- The surge represents a 50 percent increase that the ratings firm nonetheless said does not pose the same level of systemic risk.

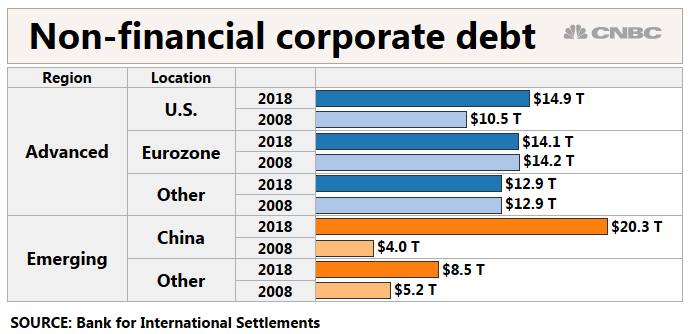

- One area the firm highlighted was corporate debt and the rise of financing given to lower-quality borrowers.

Global debt has jumped since the financial crisis, though one ratings agency thinks that it poses significantly less danger than the last time around.

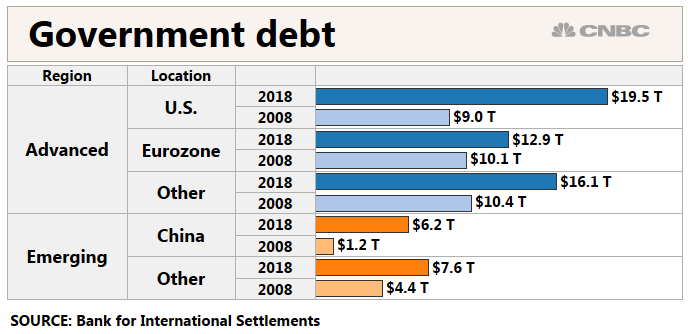

Corporate, government and household indebtedness rose to $178 trillion as of June 2018, a 50 percent increase from a decade ago, according to figures S&P Global Ratings released Tuesday. The expansion was especially acute at the government level, which stood at $62.4 trillion, or 77 percent higher than it did before the public borrowing binge began.

“Global debt is certainly higher and riskier today than it was a decade ago, with households, corporates, and governments all ramping up indebtedness,” S&P Global Ratings credit analyst Terry Chan said in a statement. “Although another credit downturn may be inevitable, we don’t believe it will be as bad as the 2008-2009 global financial crisis.”

The lower danger level is due largely to the nature of the debt — primarily driven by government borrowing in sovereign countries rather than the private sector surge that led to the housing market collapse and the worst economic downturn since the Great Depression.

In addition, much of the gain on the corporate side came from Chinese companies that borrowed from domestic institutions, lowering the probability that defaults would cause global contagion.

“Despite higher leverage, the risk of contagion is mitigated by high investor confidence in major Western governments’ hard currency debt. The high ratio of domestic funding for Chinese corporate debt also reduces contagion risk, because we believe the Chinese government has the means and the motive to prevent widespread defaults,” S&P said.