by Frank Holmes, CEO, U.S. Global Investors

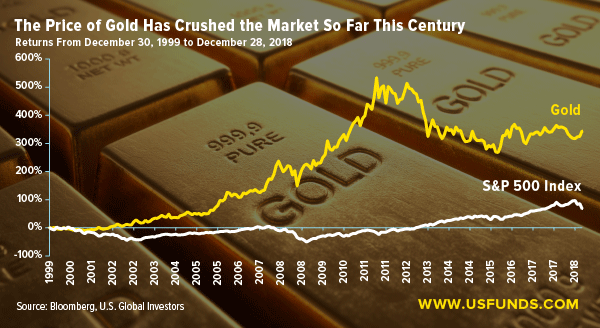

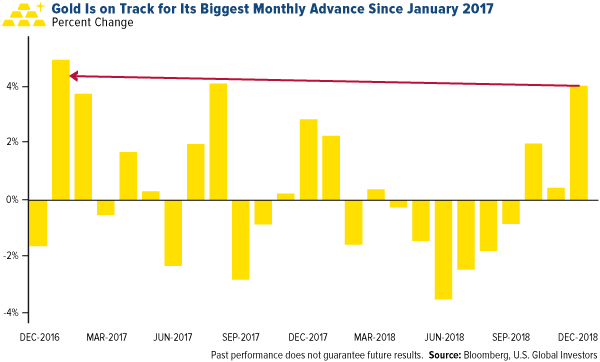

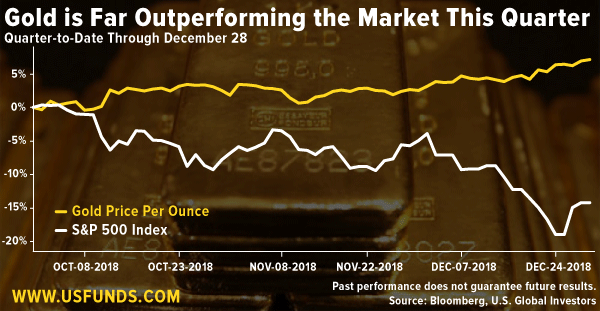

With only one trading day remaining in 2018, I’m pleased to report that the price of gold has so far beaten the S&P 500 Index for the month of December (4.4 percent versus minus 10 percent), the fourth quarter (7.4 percent versus minus 15 percent) and the year (minus 2 percent versus minus 7 percent). Since stocks have stumbled recently, this might not come as such a shock.

What might surprise some of you is that gold has also outperformed the market for the century (344 percent versus 67 percent).

What this means is that, even though the yellow metal is still down from its 2011 peak, it has proven itself as a valuable diversifier in most any investor’s portfolio. And if stocks are headed for another big pullback next year, it could become even more valuable.

Looking back over the past 12 months, I’m not surprised to see that my five most popular and widely shared posts of 2018 involve gold (with one exception). Below I count them down, beginning with a story about Texas, the home state of U.S. Global Investors.

5. Texas Gold Investors Just Got Their Own Fort Knox

The Texas Bullion Depository, the first of its kind in the U.S., officially opened to the public in Austin in early June, capping three years of planning and construction. At the time, Texans were able to deposit their gold and other precious metals at an already-existing facility. Earlier this month, though, officials broke ground on a new, state-of-the-art, 40,000-square-foot facility in Leander, Texas, just north of Austin.

This is wonderful news. Because Texas is such a trend-setting state, it might encourage other states to look into creating their own depositories. It also has the potential to attract even more investors to precious metals, which I believe are crucial components of any well-diversified portfolio.

4. It’s Time for Contrarians to Get Bullish on Gold

For most of 2018, the gold bears were large and in charge, with hedge funds shorting the yellow metal in record numbers this past summer. A major contributor to this is gold’s negative correlation to the U.S. dollar, which was strong relative to other major world currencies throughout the year.

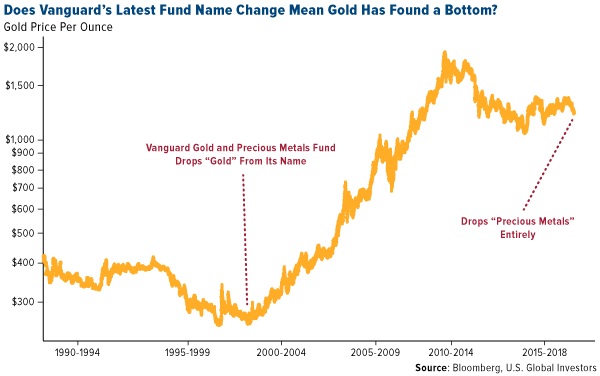

A bottom in gold prices looked especially likely after Vanguard, the world’s largest mutual fund company, announced it was closing its precious metals and mining fund. Back in 2001, when gold had similarly found a bottom, Vanguard dropped the word “gold” from what was then the Gold and Precious Metals Fund, and the change coincided with a decade-long precious metals bull run.

So could this mean another bull run is in the works? No one can say for sure, of course, but the timing of Vanguard’s announcement was certainly interesting. Now that gold is trading above $1,280 again for the first time since June, my confidence that the metal is set for a huge breakout has only grown stronger.

3. Here’s How We Discovered This Disruptive Gold Stock Before It Went Public

|

| Photo courtesy of Menë |

In November I shared with you one of my favorite new precious metal jewelry companies—Menë. You might not be familiar with the name yet, but you could be soon enough. In its first 10 months of operation, Menë did as much as $7 million in sales, and in more than 53 countries, as of October.

Founded in 2017, the company’s mission is to disrupt the gold jewelry market. It aims to do this by making its pieces strictly from 24-karat gold or platinum, selling directly to the consumer and pricing its merchandise fairly and transparently. Unlike traditional sellers, Menë prices its jewelry based on the changing value of gold, then charges a 15 percent to 20 percent design and production fee on top of that.

Here at U.S. Global Investors, we believe gold is money and a timeless investment. Menë , which takes its name from the Aramaic word for “money,” has clearly run with that idea, going so far as to trademark the phrase “investment jewelry.” We see the company as an attractive way to invest in gold’s Love Trade.

2. Which Has the Biggest Economy: Texas or Russia?

With Russia in the news almost daily this year, thanks mostly to the investigation into the 2016 U.S. presidential election, I wanted to know which had the larger economy—Russia or Texas. (Spoiler alert: It’s Texas, by about $400 billion.)

At the time of my writing this, Russia was ranked as the number one oil producer in the world. In September, however, the U.S. regained the title after pumping out nearly 11 million barrels per day late in the summer, a feat the American industry has never before achieved. Today, the U.S. produces between 11.60 and 11.70 million barrels per day, whereas Russia averages around 11.37 million barrels.

On a similar note, the International Energy Agency (IEA) just issued its prediction that, by 2025, the total amount of U.S. oil production would equal that of Russia and Saudi Arabia combined.

1. It’s Time for the Fear Trade to Move Gold Prices

My post popular post of 2018 was, coincidentally, also the very first thing I wrote this year. The yellow metal had ended 2017 up more than 13 percent, its best year since 2010, while senior gold miners gained more than 11 percent. All of this occurred even as the stock market closed regularly at all-time highs and the price of bitcoin was rising by leaps and bounds.

I attributed gold’s strong 2017 performance mainly to the Fear Trade, specifically to concerns over inflation. Interestingly, inflation never really materialized this year—the year-over-year percent change in the consumer price index (CPI) didn’t even breach 3 percent. Most forecasts for 2019 are just as mild.

However, there are other things to keep an eye on in the new year—namely, the ballooning U.S. deficit; growing debt at the consumer, corporate and government levels; rising interest rates; and signs of a global economic slowdown. What’s more, Democrats take control of the U.S. House of Representatives next month. We can probably expect to see multiple investigations into the Trump administration, which could possibly slow the progress of additional pro-growth, pro-business policies.

Taken together, these risks burnish the investment case of gold’s Fear Trade. I remain bullish on the metal for 2019 and recommend a 10 percent portfolio weighting: 5 percent in bullion and jewelry and the other 5 percent in well-managed gold mining stocks, mutual funds and ETFs.

Gold Market

This week spot gold closed at $1,280.75, up $24.70 per ounce, or 1.97 percent. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week higher by 1.43 percent. The S&P/TSX Venture Index came in up 4.13 percent. The U.S. Trade-Weighted Dollar fell 0.60 percent.

| Date | Event | Survey | Actual | Prior |

|---|---|---|---|---|

| Dec-27 | Hong Kong Exports YoY | 7.7% | -0.8% | 14.6% |

| Dec-27 | Initial Jobless Claims | 216k | 216k | 214k |

| Dec-27 | Conf. Board Consumer Confidence | 133.5 | 128.1 | 136.4 |

| Dec-28 | Germany CPI YoY | 1.9% | 1.7% | 2.3% |

| Jan-1 | Caixin China PMI Mfg | 50.2 | — | 50.2 |

| Jan-2 | New Home Sales | 568k | — | 544k |

| Jan-3 | ADP Employment Change | 180k | — | 179k |

| Jan-3 | Initial Jobless Claims | 223k | — | 216k |

| Jan-3 | ISM Manufacturing | 58.0 | — | 59.3 |

| Jan-4 | Eurozone CPI Core YoY | 1.0% | — | 1.0% |

| Jan-4 | Change in Nonfarm Payrolls | 180k | — | 155k |

Strengths

- The best performing metal this week was silver, up 5.15 percent, finally getting some respect as it approaches its 200-day moving average. Hitting six-month highs this week, money managers are the most bullish they’ve been on gold in months. Gold has been a beneficiary of the volatility experienced in global equities this week. Bloomberg reports that gold priced in the British pound has jumped back above 1,000 pounds an ounce and is trading at its highest level since September 2017. The move in gold could be further supported by international markets, which have seen the greenback fall to nearly a five-year low of just 61.9 percent of allocated reserves, reports Bloomberg.

- Gold bulls added substantial positions to ETFs backed by bullion as the yellow metal is heading for its best month in two years on the heels of the partial U.S. government shutdown and shaky equities. Gold-backed ETF holdings have surged by more than 100 tons since October and the rapid inflow has helped to boost prices, reports Bloomberg. On Thursday’s trading session, ETFs bought 662,080 troy ounces of gold, which is the biggest one-day increase in at least 12 months. Also on Thursday, the SPDR Gold Shares fund saw inflows of more than $643 million, the most since July 2016.

- Turkey continues to add to its gold reserves. Holdings rose $191 million from the previous week. The country spent most of 2018 selling off about 15 percent of its bullion in an effort to prop up the local currency, but its reversal to add to reserves is a positive trend. According to official figures from the central bank in Ankara, Turkey’s reserves are worth $19.8 billion as of the end of last week.

Weaknesses

- The worst performing metal this week was platinum, up just 0.23 percent. The Federal Reserve of Richmond said on Wednesday that its measure of factory activity across the eastern U.S. fell unexpectedly to minus 8, while economists were predicting an increase to 15. In another unexpected drop that could demonstrate weakness in the economy, the contract signings to purchasing previously owned U.S. homes fell for a second month in November, reports Bloomberg.

- U.S. leveraged loan funds have been seeing big outflows since November. In the week ended December 26, investors pulled out $3.5 billion for a third straight week of record setting withdrawals, according to Lipper data. It was also the sixth consecutive week of outflows of more than $1 billion. Bloomberg’s Lisa Lee writes that swooning prices are scaring other institutional investors away from the market.

- This December has been particularly volatile for the U.S. stock market and traders and investors have agreed that these are not usual times. Stephen Innes, head of trading for Asia Pacific at Oanda Corp., said that this month is “completely bizarre” and that “it’s incredible just how harmful markets veer when sentiment slides.” First Majestic Silver, a Canadian gold mining company, is set to offer $50 million in shares via BMO Capital Markets through “at-the-market distributions,” reports Bloomberg. Shares have climbed 27 percent in the past money and the proceeds of the sale will be used for developing existing mines and adding to working capital.

Opportunities

- Morgan Stanley strategists wrote in a note this week that 2018 has been a historically bad year, with the top five worst asset classes all being equity-related. Analysts write that such down performance across the board for the year has not occurred in recent history. Morgan Stanley does, however, remain bullish on gold, as forecasts for a weak U.S. dollar and lower yields could push the metal higher in 2019.

- Global chaos has made gold a holiday winner on safe-haven demand. Quincy Krosby, chief market strategy at Prudential Financial, said that “the market is questioning whether the Fed is making a policy mistake, and that could not only lead to slower growth, but perhaps to a recession.” She continued to say that when you see this heavy selling in equities, “it’s indicative of fear, and gold becomes a safe-haven allocation.” Gold has actually crushed the S&P 500 so far this quarter, returning close to 5 percent while the stock market is down close to 15 percent.

- Another precious metal having a great run is silver, which rose to its highest since August and is approaching its 200-day moving average. On Wednesday, silver futures were nearing their highest in more than four months. Tai Wong at BMO Capital Markets says that silver, although down 12 percent for the year, is rallying now on the back of bullishness in gold as a safe-haven asset.

Threats

- This week the People’s Bank of China emphasized that its monetary policy would remain prudent, pushing back against interpretations of its recent moves as signaling looser policy, reports Bloomberg News. Sun Guofeng, director of the monetary policy department, told reports that “the stance on prudent monetary policy hasn’t changed” and that policymakers won’t “flood” the economy with excessive liquidity. China continues to face challenges of slow investment, weak consumption and the effects of the trade war with the U.S.

- Russia and Turkey have been maneuvering to position themselves for a new order in Syria after President Donald Trump announced the withdrawal of American troops in the region, reports Bloomberg. It is likely not a coincidence that Turkey has turned down the media heat on the Saudi state murder of Jamal Khashoggi with President Trump trading off our Kurdish allies to President Erdogan. This could result in further geopolitical instability.

- Russia is considering constitution changes that might allow President Vladimir Putin to remain in power beyond the end of his current term in 2024, in which the current law would require him to step down, according to comments from the speaker of Russia’s parliament. On Wednesday President Putin said he witnessed a final test of a hypersonic glide vehicle, which is one of a series of new weapons that would be able to overcome existing defenses, reports Bloomberg.

Index Summary

- The major market indices finished mixed this week. The Dow Jones Industrial Average gained 2.75 percent. The S&P 500 Stock Index rose 2.74 percent, while the Nasdaq Composite climbed 3.97 percent. The Russell 2000 small capitalization index gained 3.61 percent this week.

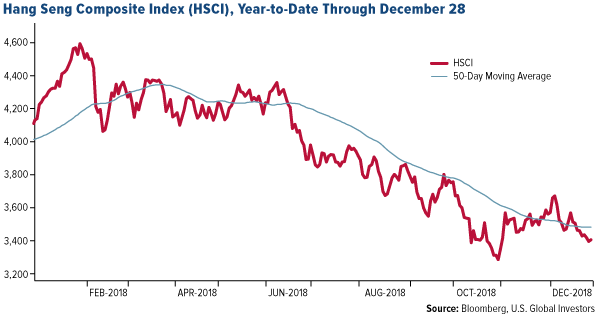

- The Hang Seng Composite lost 0.86 percent this week; while Taiwan was up 0.52 percent and the KOSPI fell 0.99 percent.

- The 10-year Treasury bond yield rose 8 basis points to 2.714 percent.

Domestic Equity Market

Strengths

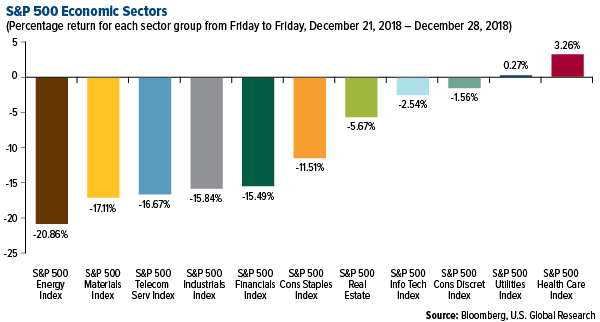

- Healthcare was the best performing sector of the year, increasing 3.26 percent compared to an overall decrease of 7.08 percent for the S&P 500.

- Advanced Micro Devices was the best performing stock for the year, increasing 73.15 percent.

- Blue-chip consumer staple names such as Procter & Gamble, Hormel Foods and Coca-Cola have weathered the stock market correction much better than many other parts of the market, posting sizable gains during a volatile year.

Weaknesses

- Energy was the worst performing sector for the year, decreasing by 20.86 percent compared to an overall decrease of 7.08 percent for the S&P 500.

- Coty Inc was the worst performing stock for the year, falling 67.42 percent.

- Volatility started to spike early in 2018, when the S&P 500 suffered a 10 percent correction between February and April. That first plunge came in early February after inflation fears surfaced on stronger than expected U.S. wage growth. October saw the beginning of the market’s second plunge into correction caused by weak overseas growth, rising rates, weakening oil and disappointing news relating to technology and internet stocks.

Opportunities

- There’s been a change of sentiment in the markets. People are getting more selective about buying higher quality blue-chip stocks that might be better over the long-term, whereas before investors kept on piling into momentum stocks.

- There seems to be bipartisan agreement in Washington about getting something done to lower health costs, and President Donald Trump has made verbal overtures about being ready to work with Democrats on policy. Furthermore, both sides seem committed to infrastructure spending. Action on those fronts would help materials, energy and select health care stocks.

- Equities are the place to be in 2019, according to Goldman Sachs Asset Management (GSAM). The company is betting that global growth will extend into next year, giving support to stock fundamentals. GSAM favors emerging-market assets over the developed market, although it said U.S. stocks look appealing after the sell-off has driven price-to-earnings multiples down considerably.

Threats

- The “FAANG” stocks (Apple, Amazon, Facebook, Netflix and Alphabet) contributed in an outsized way to the overall market’s climb to record highs throughout 2017, and then again in the summer of 2018, but began unraveling in the second half of 2018, leading the market decline. As early as July, Netflix and Facebook failed to impress investors with their earnings. Amazon had a similar earnings disappointment in October, followed by Apple falling short in its earnings outlook in early November. By early December, all five of these closely followed names had descended more than 20 percent from their all-time highs, helping to put what had been one of the biggest sources of upward momentum into a bear market and helping spread negative sentiment to the rest of the market. The total hit to the market cap of just these five stocks reached $1 trillion by late November.

- The recent strength of the dollar may reflect faith in the U.S. economy, but it can also hurt foreign economies by making the cost of U.S. goods higher. That’s also a potential headwind for U.S. multinational companies, especially considering about 40 percent of S&P 500 revenue comes from abroad.

- Small-cap stocks, which had forged new all-time highs earlier in the year based on the perception that small-caps might be less vulnerable to international trade tensions, fell to new lows for the year in December as investors started worrying about the highly-leveraged nature of many small-cap stocks in a rising rate environment.

The Economy and Bond Market

Strengths

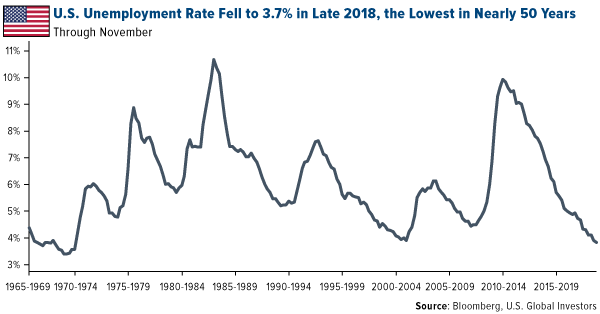

- Overall, job gains remained robust throughout 2018. The U.S. unemployment rate fell to 3.7 percent by late 2018, the lowest in nearly 50 years.

- The December 2017 Tax Cuts and Jobs Act helped strengthen the nation’s GDP in 2018, rising from 2.3 percent in the fourth quarter of 2017 to 3.4 percent in the third quarter of 2018.

- Contained inflation and a tight job market brought some relief to workers in 2018. Price-adjusted average hourly earnings rose 0.8 percent last month from November 2017, the biggest increase in more than a year, according to Labor Department Data.

Weaknesses

- Goldman Sachs believes growth is likely to slow significantly next year, from a recent pace of 3.4 percent to roughly 1.75 percent by the end of 2019. The bank expects tighter financial conditions and a fading fiscal stimulus to be the key drivers of the deceleration.

- Looking back at 2018, the trade war between the U.S. and China was the biggest story of the year. The impact of rising tariffs between the world’s two biggest economies boomeranged around almost every sector, and possibly helped lead to some of the slower overseas growth seen during much of the year. Now at the end of the year, China has been reporting slower export and import growth, which is perhaps a sign that the tariffs are beginning to hurt.

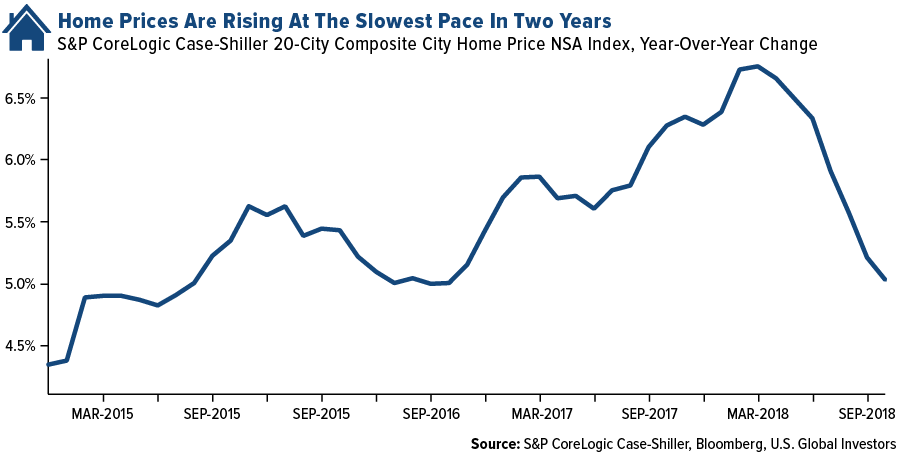

- Rising interest rates proved to be a headwind for housing in 2018, as the S&P CoreLogic Case-Shiller U.S. National Home Price Index dropped to 5 percent in December 2018, down from 6.26 percent in December 2017.

Opportunities

- According to Goldman Sachs, neither overheating nor financial imbalances — the classic causes of recessions— appear worrisome, raising the likelihood that the economic expansion remains on track to become the longest in U.S. history in 2019.

- Longer-term Treasury yields, like the 10-year and 30-year, never climbed as much in 2018 as short-term ones, which are more sensitive to Fed rate hikes. By late in the year, when it appeared the Fed might take a more dovish stance in 2019, investors started coming back to the bond market. Another factor favoring longer-term U.S. bonds has likely been the premium of U.S. Treasury yields to those in foreign bond markets, which can make U.S. Treasuries appear more attractive. “Fixed income is in vogue again, for the first time in a decade,” said Craig Laffman, director of fixed income and syndicate at TD Ameritrade.

- China’s top policymakers have signaled more support for the economy next year through tax cuts and other policy measures in order to counteract the effects of the trade war, which have weighed on growth. A lift in China’s economy would propel world markets.

Threats

- Almost half of chief financial officers believe a recession will strike the U.S. economy by the end of 2019, according to the latest Duke University/CFO Global Business Outlook survey.

- One possible reason the Fed might be re-thinking its hawkish strategy heading into 2019 is continued stagnation of many economies overseas. Much of the world economy saw relatively flat economic growth in 2018, while China’s growth pulled back from recent strength. Fears continue to mount that a prolonged trade war could further slow economies around the world.

- Looking to next year, there are many unanswered questions stemming from the trade war. Can the two countries make progress during the time that President Trump has said he’s willing to wait before raising tariffs to 25 percent from 10 percent? Will China be willing to cut tariffs on U.S. automobiles and buy more U.S. grain? Is there going to be some progress on long-term tangles between the countries, especially in the technology and intellectual property areas? Those questions didn’t get answered in 2018, but there’s always hope for more clarity in 2019.

Energy and Natural Resources Market

Strengths

- Silver was the best performing commodity this week, rising 5.03 percent.

- The best performing sector this week was the NYSE Arca Gold Miners Index. The index rose 1.49 percent, tracking rising gold prices.

- The best performing stock for the week was South32. The Australian mining and metals company rose 6.60 percent.

Weaknesses

- Natural gas was the worst performing commodity this week, dropping 13.10 percent after weekly inventory data showed a smaller than expected stockpile drop.

- The worst performing sector this week was gas utilities. The group collectively dropped 4.4 percent.

- The worst performing stock for the week was OCI. The Dutch fertilizer company dropped 3.10 percent.

Opportunities

- Beijing said it will lower or remove import tariffs on more than 700 types of goods and cut some export levies starting January 1. Legislators are also reviewing draft law that prohibits forced technology transfers, protects intellectual property (IP) rights and puts foreign investors on the same playing field as domestic ones as long as it doesn’t involve sensitive areas.

- Gold powered to six-month highs as market turmoil fired up safe haven demand. Gold is rallying into the end of 2018 as turmoil in global equities, the partial U.S. government shutdown and concerns about the outlook for next year stoke demand, lifting prices to the highest in six months, reports Bloomberg.

- OPEC is doubling down on its commitment to cut supply and support crude oil prices. Iraq, Kuwait, and the United Arab Emirates (U.A.E.) joined Saudi Arabia in saying the group and its allies will extend curbs beyond the first half of 2019. OPEC President Suhail AL Mazrouei even hinted that deeper output cuts could be discussed if needed.

Threats

- Home prices in 20 U.S. cities slowed in October for a seventh consecutive month, extending the longest streak since 2014, a sign of waning demand amid higher mortgage rates and elevated property values. The 20-city index of property values increased 5 percent from a year earlier, after rising 5.2 percent in the prior month, S&P CoreLogic Case-Shiller data showed Wednesday.

- The China’s economy slowed for a seventh straight month in December, as the trade war, subdued domestic demand and decelerating factory inflation combined to undercut growth. That’s the signal from a Bloomberg Economics gauge aggregating the earliest-available indicators on business conditions and market sentiment.

- Copper prices slid after profits of Chinese industrial companies declined for the first time in almost three years. Industrial profits slipped 1.8 percent in November from a year earlier, China’s National Bureau of Statistics said Thursday, highlighting the effects of slowing economic growth and calling into question the outlook for copper demand.

Emerging Europe

Strengths

- Russia was the best performing country this year, gaining 11.8 percent. Despite additional sanctions imposed by the United States and Western Europe, Russia’s economic activity is stable. Back in November the government approved a three-year budget plan that will bring a $62 billion surplus to the budget. President Vladimir Putin hopes for the nation’s economy to join the world’s top five by 2024.

- The euro was the best relative performing currency this year, losing 4.7 percent against the U.S. dollar. The currency was supported by the European Central Bank’s (ECB) bond buying program. However, the ECB announced the end of monetary easing at the end of this year. Most analysts predict a rate hike in the second half of 2019.

- Real Estate was the best performing sector among eastern European markets this year.

Weaknesses

- Greece was the worst performing country this year, losing 24.7 percent. Despite the successful completion of the third bailout program, equites trading on the Athens exchange did not rebound. Stocks have been volatile as there is still a lack of confidence among investors, especially towards Greek banks, which carry a large amount of non-performing loans on their books.

- The Turkish lira was the worst performing currency this year, losing 28 percent against the dollar. Geopolitical tensions put pressure on the lira, especially in the third quarter when sanctions were imposed on Turkey by the Unites States and then removed later on.

- Energy was the worst performing sector among eastern European markets this year.

Opportunities

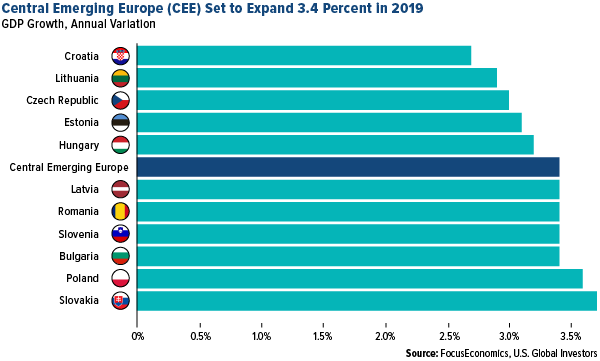

- Central and Eastern European (CEE) economies are expected to grow at 3.4 percent in 2019, which is slower than this year, but stronger than Western Europe and the United States. Professional forecasters see economic growth in the U.S. easing to 2.4 percent in 2019 and to 2.1 percent in the EU. In CEE, the low unemployment, rising wages and still-cheap borrowing costs will support growth. Slovakia and Poland are expected to be the region’s top-performers next year, according to the Focus Economics Consensus Forecast.

- The Cornerstone Macro research team predicts that economic activity in China will rebound next year, which will support economic activity in the Eurozone as EU exports to China are picking up. Manufacturing PMI in China and the Eurozone should move higher, above the 50 level that separates growth from contraction. They also forecast emerging market currency turmoil to be over.

- Poland’s budget deficit next year is expected to be the lowest since 2009, the country’s finance minister said. The government expects the economy to grow at 3.8 percent next year, with inflation targeted at 2.3 percent. The country’s budget deficit is expected to be no more than PLN 28.5 billion (USD 7.6 billion) next year, which is1.8 percent of GDP.

Threats

- The migration crisis in Europe has led to the rise of anti-European, anti-migration populist movements. The next crucial test for the EU will be 2019 elections for the European Parliament on May 23-26. The national parliaments in EU member states have gained power in the past few years and that shift can be reflected in the European Parliament.

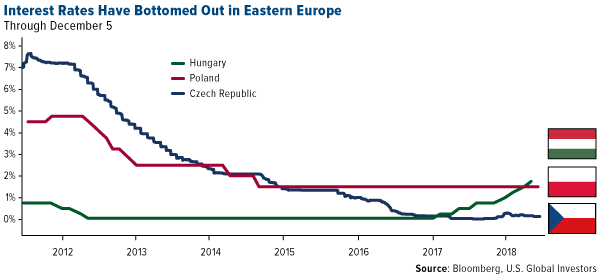

- Poland is in the midst of a record rate pause, while Hungary keeps its borrowing costs near zero. The Czech Republic’s central bank raised rates five times this year and Romania lifted rates too. With the ECB ending its bond-buying program at the end of this year, this may persuade eastern European central banks to soften their dovish tones.

- Theresa May triggered Article 50 of the Lisbon Treaty back in March 29 2017, which gives the UK and EU a window of two years to negotiate the terms on which the UK would exit the EU. The departure is scheduled for 11 pm UK time on Friday, March 29 2019, and if no deal is reached, many analysts predict economic and social chaos.

China Region

Strengths

- Malaysia’s Kuala Lumpur Composite Index climbed 1.30 percent for the week, while India’s NIFTY and SENSEX Indices closed up 1.01 and 0.96 percent, respectively.

- India’s NIFTY and SENSEX Indices look set to close as loners in the green for much of the investable “China Region,” and India—an oil importer—certainly benefits from the decline in crude prices.

- Utilities was the top-performing sector for the Hang Seng Composite in this holiday-shortened trading week, rising 86 basis points.

Weaknesses

- Thailand’s SET Index declined 1.97 percent for the week, while Vietnam’s Ho Chi Minh Stock Index fell by 2.07 percent.

- Almost all regional indices have closed or look very near set to close down on the year, wrapping up a volatile year for emerging markets. Markets like Hong Kong and Shanghai are in bear markets while trade war and slowdown concerns are still looming.

- Information technology was the worst-performing sector in the Hang Seng Composite Index for the week, closing down 2.04 percent and just barely nudging out Energy, which fell 2.03 percent.

Opportunities

- Any positive outcome from the U.S.-China trade spat could remove pressure from China and possibly create a catalyst to the upside amongst global—and particularly China Region—sentiment.

- Vietnam’s GDP clocked in at a hearty 7.30 percent in its latest reading this week.

- Valuations and individual investors’ respective time horizons continue to raise this relevant question for long term and/or contrarian investors: “At what price do you like Hong Kong?”

Threats

- As we enter 2019, the looming outcome of the U.S.-China trade war/truce situation will remain atop investors’ minds, with upcoming talks in January and deadlines subsequently approaching as the winter months roll along and the clock ticks.

- Central banking policies—and real or perceived policy errors—were a strong feature of 2018, and as markets begin to price in the Fed slowing (or halting?) its pace even as we begin to see signs of some slowing in the pace of inflation in spots like the Philippines and Indonesia, perhaps 2019 will be different. But then again, perhaps not. Stay tuned.

- China’s Manufacturing PMI is now teetering on the brink of contraction, rather neatly straddling the 50.0 mark that represents growth. We’ll get the next reading over the weekend.

Blockchain and Digital Currencies

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performing for the week ended December 28 was ETERNAL TOKEN, up 483.94 percent.

- In an interview with Bloomberg Daybreak, Henri Arslanian, fintech and crypto leader for Asia at PricewaterhouseCoopers, says he believes there will be many more institutional players entering the digital currency space in 2019, despite the pain felt in 2018. He explains that many players will develop their own solutions, while others will likely partner up with existing names. Arslanian also comments that he sees more “regulatory clarity” in the New Year, which will provide additional “comfort” to the speculative space.

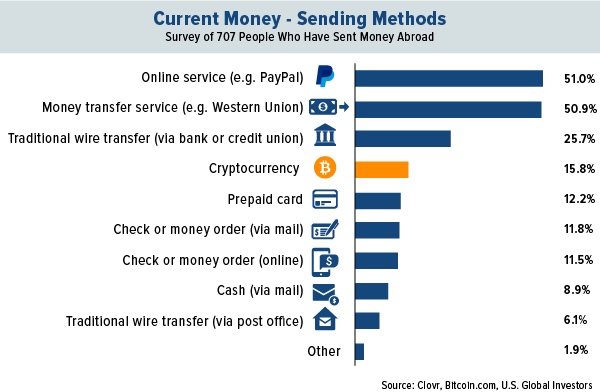

- In a new report by blockchain research company Clovr, there has been a spike in the use of cryptocurrencies to send remittances. As Bitcoin.com reports, this growth is partially due to the high costs incurred when using more traditional methods like Paypal. As seen in the chart below, out of over 700 people surveyed for the “Sending Money Back Home” report, 15.8 percent use cryptocurrency to send funds back home, coming in fourth behind online services, money transfers or a traditional wire transfer.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performing for the week ended December 28 was Leadcoin, down 44.51 percent.

- Months after filing its application to go public on the Hong Kong Stock Exchange, cryptocurrency mining giant Bitmain is undergoing a series of business changes, reports Coindesk. On Tuesday the company confirmed “there has been some adjustment to our staff this year as we continue to build a long-term, sustainable and scalable business.” Bitmain staff has written on Maimai (China’s LinkedIn equivalent) verifying that layoffs will begin next week and that some departments will be let go entirely.

- Research from the Wall Street Journal (WSJ) published on Thursday shows extensive plagiarism and fraud in cryptocurrency offering documents. The WSJ examined 3,291 whitepapers issued by cryptocurrency projects and found that 16 percent of those showed signs of fraudulent activity, improbable returns and plagiarism. It was also discovered that more than 2,000 of the whitepapers contained sentences with luring terms such as “nothing to lose, guaranteed profit, return on investment, highest returns, funds profit”, among others, reports Coin Telegraph.

Opportunities

- An interdisciplinary committee set up by the Indian government to investigate cryptocurrencies is not in favor of an outright ban of the industry, reports Coindesk. According to an anonymous senior official who attended the committee meeting and reported back to the New Indian Express, there have already been two meetings. “There is a general consensus that cryptocurrency cannot be dismissed as completely illegal. It needs to be legalized with strong riders, so deliberations are on.”

- Coindesk reports that the U.S. Department of Defense believes blockchain has big potential in helping to improve disaster relief efforts. The Continuous Process Improvement (CPI) office of the Troop Support division of the Defense Logistics Agency hosted a meeting earlier this month to discussion applications of the technology where CPI management analyst Elijah Londo said “the potential is absolutely enormous.”

- Although 2018 as a whole has been tumultuous for cryptocurrencies, one fact remains that blockchain technology has been proven in many applications, says Carlos Domingo, founder and CEO of Securitize, a platform for issuers seeking to tokenize assets. “Digital securities are not theoretical concepts anymore, but rather a foundation for real applications on the blockchain,” writes Domingo on Coindesk.

Threats

- Electrum wallet network notified users on Thursday of a possible phishing attack that stole around 245 bitcoins, worth around $880,000, reports Coindesk. The firm explained that the attack was conducted by creating multiple fake servers on the network disguised as an update to the wallet.

- Two cryptocurrency exchanges, Kucoin and Huobi, announced this week that a number of tokens will be delisted from the platforms due to chronically low trading value. Among the affected tokens are Bread, WePower, Bitclave and Ethlend.

- One of the largest cryptocurrency hedge funds, BlockTower Capital – which manages more than $130 million in assets – is expected to lose $1 million in options by the end of the week. The fund made a bet late last year that the price of Bitcoin would go above $50,000 by the end of 2018. However, the price of Bitcoin is currently below $4,000, after falling significantly from its peak of close to $20,000.