Authored by Mike Shedlock via MishTalk,

Gold blasted through the $1500 level this week. Let’s analyze the message. Here’s a hint: The message isn’t inflation.

The above chart is and end-of-day chart from yesterday. Gold closed at $1484.

At 11:30 AM Central, gold was at $1520, up $36 on the day.

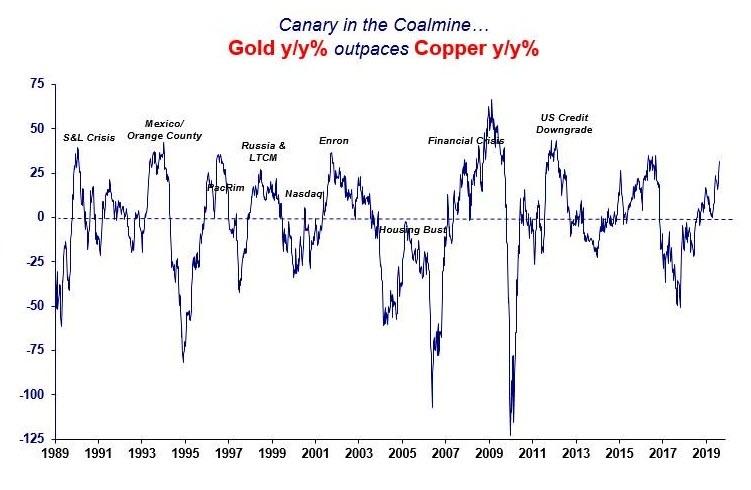

Gold vs Copper

What’s the Message?

Stephanie Pomboy at Macro Mavens nails it.

at the risk of piling-on,the canary in the financial crisis coalmine has been singing loudly. the relationship btw the metallic barometer of financial insecurity (gold) and the metallic barometer of economic activity (copper) has been a reliable predictor of trouble in the past. pic.twitter.com/K6rjNSpRcB

— steph pomboy (@spomboy) August 7, 2019

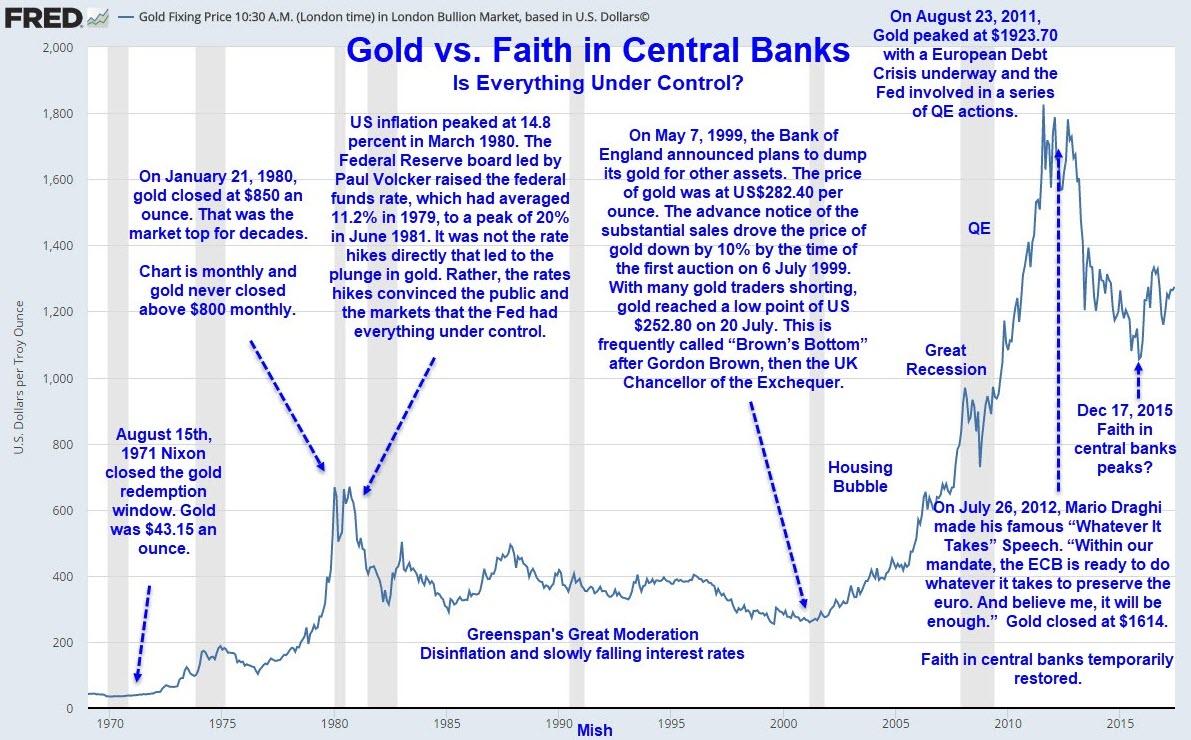

Gold Not an Inflation Hedge

As I have pointed out numerous times, and contrary to popular belief, gold is not an inflation hedge. Gold fell from $800 to $250 with inflation every step of the way.

Rather, gold is a measure of faith in central banks that everything is under control.

Gold vs Faith in Central Banks

Everything Under Control?

Clearly not, and I have easy-to-understand proof.

- Hello Treasury Bears: 10-Year Bond Yield Approaching Record Low Yield

- Negative Yield Debt Hits Record $15 Trillion, Up $1 Trillion in 2 Business Days

- US Treasury Declares China a Currency Manipulator Under Orders From Trump

If you believe gold tracks inflation or is some kind of inflation hedge, you need to think again.

Only in hyperinflation or its mild form, stagflation, is gold an inflation hedge. But even then, both are synonymous with central bank stress.

Hello Treasury Bears

Let me make it simple: It’s the debt, stupid!

The global economy is choking on debt as central banks are determined to have more of it.

Inflation? Forget about it. The bubbles are proof we “had” inflation.

The Bond markets says something else is coming up.