Just like the legend of a bow-and-arrow toting, Sherwood Forest-dwelling vigilante, Menlo Park, Calif.-based Robinhood set out to bring that sentiment to the retail investing set with a brokerage app.

The company was founded in April 2013 by Vladimir Tenev and Baiju Bhatt, who had previously built high-frequency trading platforms for financial institutions. Their goal was to provide everyone with access to the financial markets, not just the wealthy… just like the Merry Men would do with unsuspecting victims traveling through Sherwood Forest.

The idea was a hit. No one had ever offered stock trades with zero commissions. This made investing affordable for people of any age and income. Today, the app has over 13 million users with an average age of 31.

The company has no storefront branches and operates entirely online without fees… and, as customers found out last week, no customer service.

And just like the fairytale…

There’s a Nemesis in This Story, Too

This past Friday, customers logged in to find that their shares had been liquidated and that withdrawals were pending… and not to their linked bank accounts.

When they reached out to Robinhood, they also found that it could take up to three weeks for the company’s fraud department to get back to them. A Robinhood spokesperson said this was no fault of theirs and that “a limited number of customers” were affected.

I’m not here to criticize Robinhood—I’ve been a customer since its earliest days. But I am here to point out trends. And there are two big ones that we must take note of in the markets.

Trend 1: Free Trades Are Here to Stay

Robinhood set the stage for zero-commission trading, which attracted more people to investing.

When commissions were $9.99 (remember paying to enter a position and again when you exited, along with any applicable broker fees?), investors had to take that into consideration.

The added cash costs served as a good deterrent against trading with smaller amounts of money. Those fees could put a dent in your wins or amplify your losses in a big hurry.

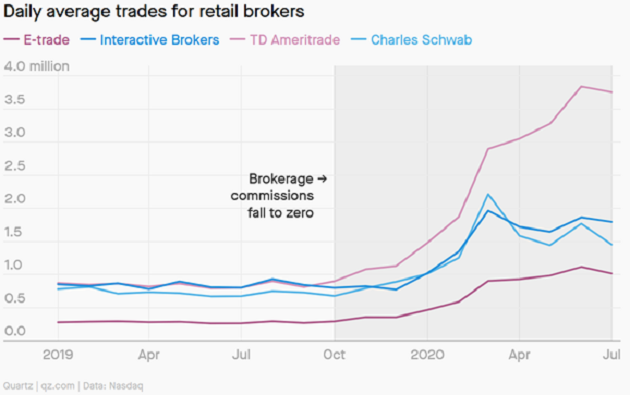

Source: Quartz

The coronavirus was the next prong in this change of brokerage culture. People found themselves with more time on their hands, $1,200 in relief money, and the need to make more cash.

So they turned to the markets.

About half of investors on the Robinhood app say they are brand-new to investing. We can assume at least some are making impulse bets… rather than using proven systems like the kinds our Mauldin Economics editors use to deliver consistent, market-beating results.

With no commissions, there’s no downside to buying and selling without a system… for the individual. But now, there are reports that some billionaires are complaining about Robinhood amateurs moving the market.

Shares of Hertz (HTZ) bounced 800% after declaring bankruptcy. The fact that the company does not have enough assets to meet its debt obligations somehow didn’t raise a red flag.

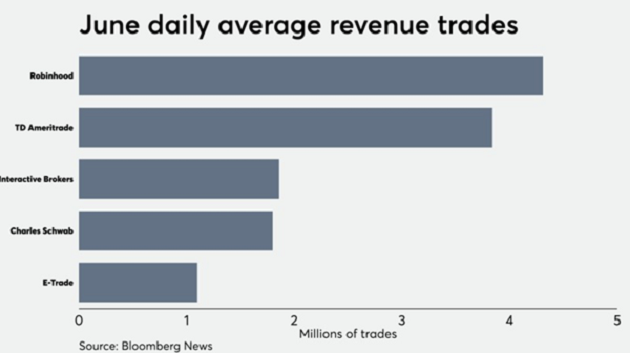

And the momentum of investors continued into the summer. In June, 4.3 million shares traded each day, on average. That was about four times the numbers of trades at E*Trade (ETFC) for the same period.

Source: FinancialPlanning

Investors don’t seem to be growing tired of Robinhood… even though it’s not perfect.

But the competition it distanced itself from has caught on. Will it catch up?

Trend 2: The Sheriff of Nottingham’s Troops Are Joining Forces

Other online brokers cut their fees in rapid succession to compete with Robinhood. Of course, there are some exceptions to this rule. For example, trading on other exchanges or the over-the-counter markets (which Robinhood doesn’t offer).

Fewer commissions did, in fact, mean more trades. But at the same time, it made making money more complex for the companies involved.

So, for their next act, the bigger brokers want to put their arrows into fewer quivers.

- Late last year, Charles Schwab (SCHW) announced its plans to merge with TD Ameritrade. Shockingly, regulators and shareholders approved it. The $26 billion deal closed just last week.

- Morgan Stanley’s (MS) solution is to spend $13 billion to buy E*Trade and, in turn, gain access to a younger audience as well as more active traders and options traders.

This means that Robinhood is the one setting the new standard for investing… not the giants from the past.

The Future Is Fintech

If the coronavirus taught us anything, it’s that we will be less and less dependent on brick-and-mortar locations… even for handling our financials.

It’s clear that financial technology—fintech—is the future of banking and investing. But at what cost?

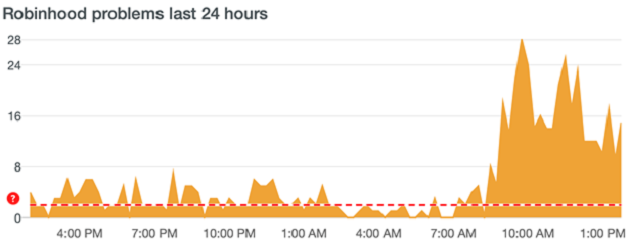

Most people still want to be able to reach a customer service representative when it has something to do with their money. Plus, you might want someone to call if you’re unable to place a trade due to an outage… which seems to still be an issue on Robinhood.

Source: Downdetector

According to Downdetector, Robinhood has experienced outages every month so far in 2020. And the company is currently facing lawsuits due to outages in March.

And don’t forget the tragic story of the 20-year-old “options investor” who took his own life after he believed he was assigned almost a million dollars’ worth of leverage.

Could this have been prevented with a simple, answered customer service call? Sadly, we will never know.

What we do know is that trading and investing are far riskier without expert guidance—and getting help on demand (and potentially for a small fee) could go a long way.

Perhaps that might be the opportunity for platforms like E*Trade and Ameritrade to “rob” Robinhood of some of its thunder.