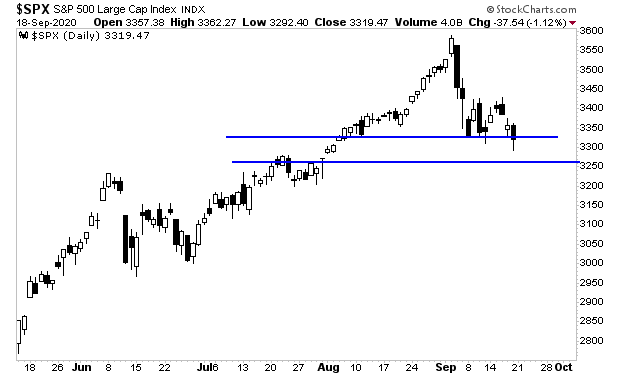

Stocks are down sharply this morning.

This means they’ve taken out their first level of support (top blue line) and will now test secondary support (lower blue line).

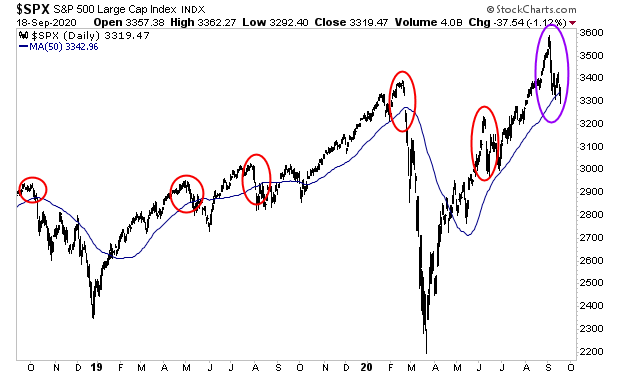

This is not without precedent and honestly, those calling for a crash here are getting carried away. The reality is that stocks were EXTREMELY overbought going into this correction.

Look how stretched the S&P 500 was from its 50-day moving average during this recent rally (purple circle) relative to recent tops (red circles).

It is HIGHLY unusual for the market to be this stretched and NOT stage a significant correction. Again, this was 100% to be expected and if you were watching for this in advance, you likely already locked in a number of solid gains from this move.

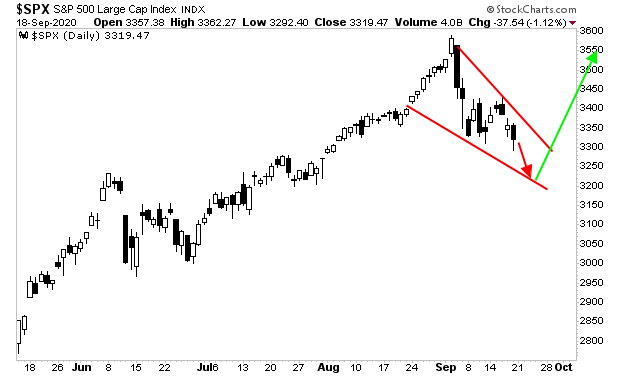

So, what is likely to play out here?

Stocks make a new low this week, before preparing for the next leg up. Something like this:

f you’re looking for this kind of precise guidance on how to trade the markets, I strongly urge you to join our FREE daily e-letter, Gains Pains & Capital. You’ll immediately start receiving our market missives delivered to your inbox every morning.

To do so, go to: https://gainspainscapital.com/

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research