Wolf Richter wolfstreet.com, http://www.amazon.com/author/wolfrichter

Bitter irony: Government told first-time buyers 5 months before bust began to “get into the Sydney housing market”; once in, “you’re pretty well set for life.”

“Nothing goes to heck in a straight line” because there is always a bounce, sooner or later – that’s my story and I’m sticking to it, but it does get tested from time to time, including in Australia’s housing bust.

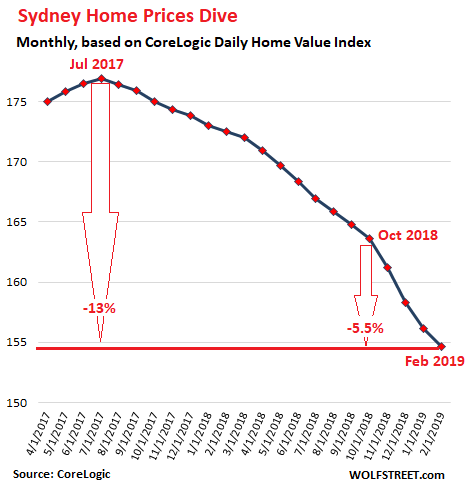

Across the metro area of Sydney, prices of all types of homes combined, according to CoreLogic’s Home Value Index, fell 1.0% in February from January, 10.4% from a year ago, and nearly 13% from its peak in July 2017. Just over the past four months, the index has dropped 5.5%:

The volume of closed sales recorded in Sydney in February plunged 20.6% from the already weak sales in February last year, according to CoreLogic’s report.

Condos, generally the lower end of the market, is where first-time buyers are thought to have a chance, and they were considered the saving grace in this market. But prices continue to drop, and the industry’s hope that first time buyers would bail out this market is now fading.

- House prices dropped 1.1% in February and 11.5% year-over-year.

- Condo prices dropped 0.8% in February and 8.8% year-over-year.

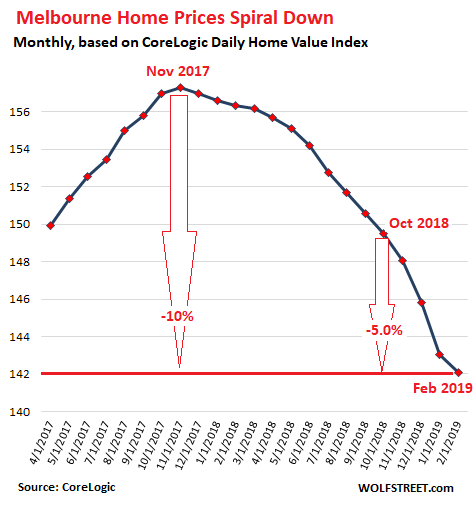

In the Melbourne metro, the second largest market in Australia, prices of all types of homes fell 1% for the month and 9.1% year-over-year, according to the CoreLogic Home Value Index. The index is now down nearly 10% from the peak in November 2017. Over just the past four months, the index for Melbourne dropped 5.0%:

House prices in Melbourne dropped 1.2% for the month and 11.5% year-over-year. Condo prices dropped 0.6% for the months and 3.7% year-over year. CoreLogic estimates that closed sales in Melbourne plunged 22.1% in February from the already weak sales a year ago.

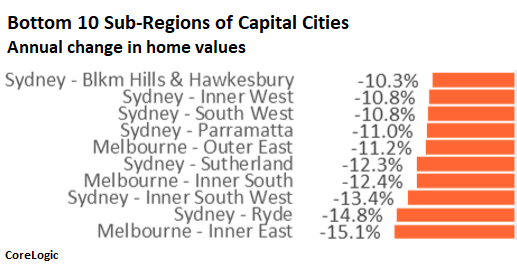

Of the bottom 10 sub-regions of Australia’s capital cities seven were in the Sydney metro and three were in Melbourne (chart via CoreLogic):

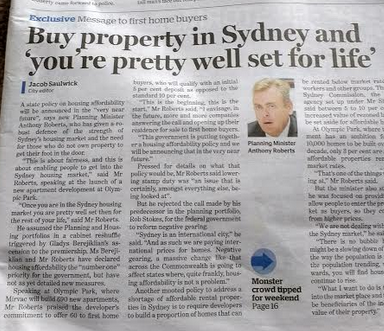

There is a bitter irony to all this. In February 2017, just months before the market in Sydney peaked, Anthony Roberts, New South Wales Minister for Planning and Housing, was promoting the launch of a 690-unit apartment development at Olympic Park, a suburb of Sydney, heaping praise on the developer for having reserved 60 units for first-time buyers.

Roberts was hyping new incentives for first-time buyers, including a reduction of the down-payment to 5%, to lure them into the Sydney housing market:

“This is about fairness, and this is about enabling people to get into the Sydney housing market. Once you are in the Sydney housing market, you’re pretty well set then for the rest of your life.”

It induced me to write an article with this headline, obviously: Housing Bubble in Sydney Soars to New High, Politicians Promote Scheme to Bitter End, with this image of the Sydney Morning Herald’s eternally glorious headline:

The metros of Sydney and Melbourne, due to their enormous size and high prices, dominate the national home values, but weakness is now spreading to other capital cities, with only Hobart and Canberra still showing year-over-year gains (in parenthesis, CoreLogic’s measure of “median value”):

- Sydney: -10.4% (A$789K)

- Melbourne: -9.1% (A$629K)

- Brisbane: -0.5% (A$491K)

- Adelaide: -1.0% ($433K)

- Perth: -6.9% (A$439K)

- Hobart +7.2% (A$457K)

- Darwin: -5.3% (A$398K)

- Canberra +3.4% (A$594K)

On a national basis, the CoreLogic Home Value Index dropped 6.3% year-over-year and 6.8% from its peak in October 2017. It’s now back where it had been in September 2016. CoreLogic’s report points out that, despite the decline, the index remains 18% higher than it had been five years ago, “highlighting that most home owners remain in a strong equity position.” Only recent buyers are underwater.

That’s a calming thought, even for the Reserve Bank of Australia, according to the minutes for its Monetary Policy Meeting on February 5, 2019, when it decided to maintain its policy rate at the record low level of 1.5%:

From a longer-run perspective, members assessed that, following such large increases in housing prices, the effect of the recent price falls on overall economic activity was expected to be relatively small.

From a financial stability perspective, tighter lending standards, an improving labor market and low interest rates were all likely to support households’ capacity to service their debt.

Few households were in negative equity positions despite the falls in housing prices, implying that banks’ losses would be limited even if household financial stress were to become more widespread.

The IMF was less sanguine in its assessment of Australia. It found that “the financial sector faces continued vulnerabilities from high household debt, still-stretched real estate valuations, and banks’ ongoing dependence on funding from global markets.”

The assessment “recommended further steps to bolster financial supervision as well as to reinforce financial crisis management,” which might be a good idea.