via Zerohedge:

Of all the major US multinationals that do business in China, Apple is in a particularly precarious position: iPhones sold in the US will be subject to the new tariffs, since Apple builds most of them in China, while Chinese consumers – whom the company has come to depend on for sales growth – could shun the brand as the trade war intensifies.

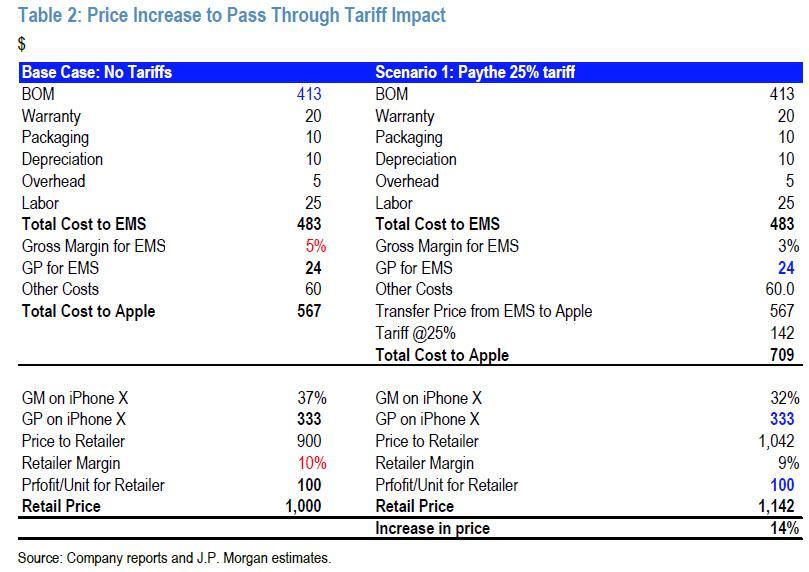

Analysts at JP Morgan recently calculated that Apple would need to raise prices on iPhones sold in the US by 14% to offset the new tariffs.

But with the market focused on the ‘next billion users’, falling victim to a consumer boycott inspired by the Trump administration’s ‘blacklisting’ of Huawei would likely be more painful for Apple shareholders – the hit to Apple’s market cap this week could be just the beginning.

Most who have held the stock since at least the end of last year probably remember how Apple single-handedly tanked the market when it cut its quarterly revenue guidance for the first time in 16 years, citing weaker than expected iPhone sales in China.

Offering an assessment that he might soon regret, Apple CEO Tim Cook told analysts late last month during the company’s quarterly earnings call that sales in China were picking up. Apple shares rallied after-hours that day after Cook assured investors that the trade dialogue between Washington and Beijing had “improved” and that this had bolstered “consumer confidence on the ground there.”

Cook couldn’t have been more wrong, though, and barely a week later, a rupture in negotiations that Wall Street had failed to anticipate became a reality.

But the potential for a consumer boycott can no longer be ignored, according to a handful of analysts quoted by Bloomberg.

“There is a potential for a boycott” of Apple products, said Shannon Cross of Cross Research. “There could be a movement in China to support national champions.”

An outright ban of Apple products by the Communist Party would have a devastating impact on Apple’s results, with Goldman analysts estimating that the company would forego nearly one-third of its profits. An even more dire scenario: China implementing production restrictions that would force Apple to reengineer its entire global supply chain.

But even with no further action, some analysts believe iPhone sales in China could drop by as much as 5% over the next year, thanks to the Huawei ban.

Apple could lose nearly a third of its profit if China retaliated by banning its products, Goldman Sachs analysts estimated this week. Dan Ives, an analyst at Wedbush Securities, said 3% to 5% of iPhone sales in China may disappear over the next 12 to 18 months because of the U.S. ban on Huawei. Apple shares were down less than 1% at 9:36 a.m. in New York.

Apple would face much more dire consequences if production restrictions were implemented in China, Goldman analysts led by Rod Hall wrote in a research note.

“We do not believe the company would be able to shift much iPhone volume outside of China on short notice, though actions that would push Apple production outside of China could have negative implications for the China tech ecosystem as well as for local employment,” the Goldman analysts said.

As for the near-term impact for Apple, the rising tide of Chinese nationalism could make it more difficult for the tech giant to meet its forecasts for the second quarter of 2019 (the third quarter of Apple’s fiscal year).

Even if China doesn’t retaliate directly, nationalist sentiment will likely hurt Apple’s sales in the country and could cause the company to miss its fiscal third-quarter forecasts, according to Lynx Equity Strategies. Apple didn’t respond to requests for comment on Tuesday.

Fortunately for Apple shareholders (a group that now includes Berkshire Hathaway), the White House’s crackdown on Huawei might have a silver lining. Google’s decision to stop offering Android services on Huawei phones could dampen demand from customers, while Apple might be able to secure better deals in its supplier agreements.

Huawei customers vented on social media on Tuesday, worrying their gadgets might not work as well with less support from the U.S. internet giant. That could mean some customers buy an iPhone instead.

“These issues will reduce demand for Huawei over coming years and could give Apple an incrementally better position in the marketplace,” said Ives.

There aren’t many customers in the U.S. for Apple to win back. But in other parts of the world, Huawei has become a thorn in Apple’s side. The Chinese tech giant had almost a quarter of the smartphone market in Europe in the fourth quarter, just behind Apple and Samsung Electronics Co., according to research firm Canalys. Globally, Huawei is the second-largest smartphone maker behind Samsung.

Beside Google, Huawei is also losing access to key components from U.S. chip makers including Qualcomm Inc. and Intel Corp. The loss of such a big customer may make these suppliers more willing to negotiate on price with Apple.

“It could give Apple a little bit more leverage in supplier agreement negotiations, but Apple won’t want to pressure them too much,” said Cross.

But the unfortunate reality remains: Regardless of what happens with Huawei, if the Trump tariffs remain in place (or, if the White House expands them to include virtually all Chinese goods entering the US), Apple is going to need to make a difficult decision: Either raise prices on its iPhones, or absorb the tariffs, which would put a serious dent in its gross margin.

Whatever the company decides, Wall Street probably won’t be thrilled.