Yesterday I pointed out how inflation has become deeply embedded in our financial system.

As a quick recap, inflation arrives in stages. It’s not as though it appears overnight and suddenly the cost of everything rises.

Instead, inflation slowly works its way into the financial system in price hikes in the following prices.

- Phase 1: The price of raw materials (what producers/ manufactures pay for supplies)

- Phase 2: Factory gate prices (what producers charge distributors/retailers).

- Phase 3: Retail prices (what consumers pay).

As I noted yesterday, we now have all three of these in place. This tells us that inflation is now deeply embedded in our financial system.

Historically, the only thing that has stopped inflation is for the Fed to tighten monetary policy by either hiking interest rates or tapering its Quantitative Easing (QE) programs.

During the last inflationary scare in 2010-2011, the Fed allowed its QE 2 program to end. It then waited several months before introducing any new monetary programs. And when it did introduce one, it didn’t involve money printing (instead the Fed used the proceeds from Treasury sales to buy long-date Treasuries through a process called Operation Twist). This was a kind of stealth tightening.

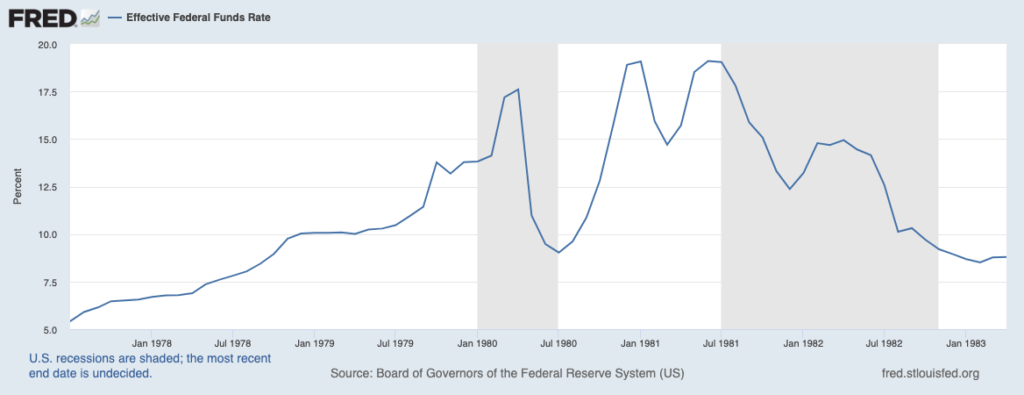

Bear in mind, that was a relatively minor inflationary scare. During the last legitimate inflationary storm in the 1970s-1980s, the Fed was forced to be MUCH more aggressive with its tightening, raising interest rates from 4.5% to over 19%! It’s worth noting that this triggered two SEVERE recessions (shaded areas).

So, which will it be this time? A kind of stealth tapering like we saw in 2011… or aggressive tightening like we saw in the late 1970s?

The answer may surprise you… it’s NEITHER.

That’s correct. The Fed doesn’t believe the U.S. is experiencing real inflation yet. According to Fed Chair Jerome Powell the inflation we’re experiencing is “transitory” meaning it won’t last so the Fed doesn’t have to do anything.

Powell is not alone. Fed officials across the board have referred to inflation as “transitory” stating that even if inflation rises above the Fed’s target of 2% (say to 2.75% or even 3%), it’s not a big deal.

Bear in mind, inflation is already well over 3% now.

So, what does this mean?

The Fed will continue to keep interest rates at zero, while printing $125 billion per month all while ignoring the countless signals that inflation is already spiraling out of control. Yes, the Fed will eventually be forced to act once inflation becomes a political issue, but until then the Fed will have its “blinders” on.

Which means… inflation is going to rage and rage.

On that note, we just published a Special Investment Report concerning FIVE secret investments you can use to make inflation pay you as it rips through the financial system in the months ahead.

The report is titled Survive the Inflationary Storm. And it explains in very simply terms how to make inflation PAY YOU.

We are making just 100 copies available to the public.

To pick up yours, swing by:

https://phoenixcapitalmarketing.com/inflationstorm.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research