Make sure you remember your levels!

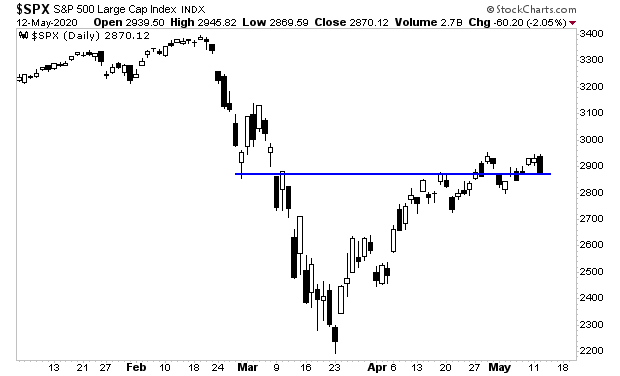

Stocks sold off hard yesterday afternoon. However, they held support at 2,870 on the S&P 500. If you hadn’t identified that support line on your chart and simply reacted to the sudden heavy selling you probably thought “the top was in.”

It wasn’t.

If you want to make money from the markets, forget about calling tops or bottoms. There’s no point. The REAL money is made from riding a trend after it’s been developed.

Until stocks break support in a meaningful way, the trend is UP and dips are to be bought.

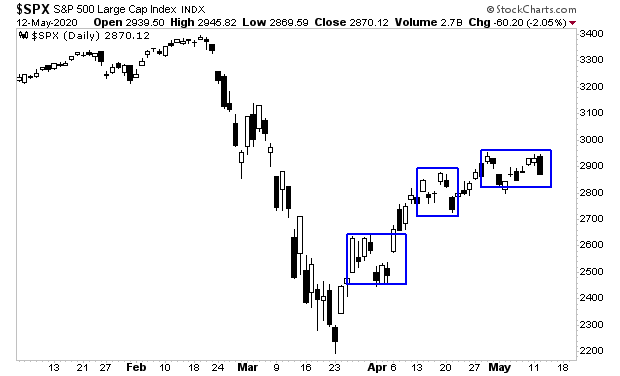

Indeed, I noted recently that stocks have performed two prior periods of consolidation/ small corrections during this rally. They were March 31st-April 6th, and April 20th-April 27th (blue boxes in the chart below). We now have had three of them counting the one begun April 30th.

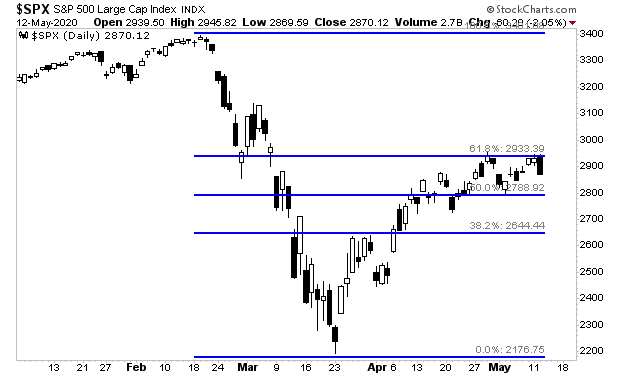

Each one of these consolidations coincided with a particular retracement level of significance (the 38.2%, 50% and now 61.8% retracement). Each one was a buying opportunity.

The current retracement level of 61.8% is the most significant. Typically, when the market retraces more than 61.8% of a drop, it’s indicated that the move is the start of a new bull market, NOT a bear market bounce.

So it’s not too surprising that stocks are struggling with this level more than the previous ones. If they can break above here, it is likely a sign that we are in a new bull market that will take us to new all time highs.

Again, remember your levels, and ignore the financial media. They operate based on emotions and will lose you money.