Authored by Mark Glennon via WirePoints.org,

The State of Illinois recently reported its biggest annual financial loss ever. Instead of clear reporting on that, we’ve seen perhaps the most glaring example yet of how the state’s finances can be misunderstood, misreported and intentionally distorted.

The loss of $47 billion for the state’s 2018 fiscal year, shown in audited financial statements released late last month, is an astonishing number. For some perspective, that’s about $7 billion more than the entire, current annual budget.

But most of the regular press downplayed or entirely ignored the loss. Many even saw good news. A Reuters headline, for example, read “Illinois budget deficit shrank to $7.8 billion in FY 2018.” You can find similar headlines from across the state.

Why would media coverage differ so drastically from what the audited financial statements really said? Which is right?

Two factors account for the difference, and both should be understood. This is a lesson in how misunderstanding of our financial crisis is created and propagated.

- First, the loss was shrugged off because it stemmed mostly from an accounting change, which we will explain below. But that’s only a partial excuse. In truth, the accounting change exposed a huge liability that has been all but ignored in the past.

- Second, most media reports seem to have blindly repeated a very misleading press release by the Illinois Comptroller that accompanied the financials.

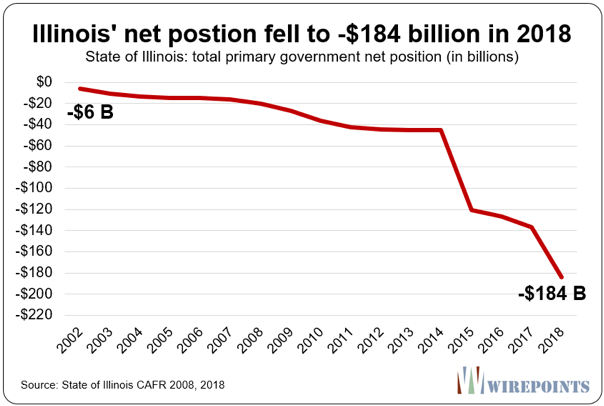

Some background before we elaborate: The new financial statements are in the state’s recently released, long overdue CAFR — the Comprehensive Annual Financial Report for the fiscal year that ended in June 2018. The $47 billion loss is shown in the statements as a drop in “net position,” which is the government’s rough equivalent of net worth that you commonly see in the private sector. Changes in it are comparable to net income. As the CAFR itself says, “Over time, increases and decreases in net position measure whether the State’s financial position is improving or deteriorating.”

The big loss was overwhelmingly due to an accounting change that had a $42 billion impact. That change was for healthcare costs owed in the future to state retirees, called OPEBs (other post-employment benefits). In Illinois, those benefits are constitutionally protected just like pensions. Unlike pensions, however, they are entirely unfunded. New accounting rules now taking effect require full disclosure of that liability, which the CAFR says totals $55 billion.

But should we dismiss the massive loss as a bookkeeping quirk? Hardly.

While the $42 billion loss didn’t occur in one year, it’s a growing monster that has been hidden for many years, unknown to most reporters and the public. Including it now as part of the state’s financial report card is an admission about how deficient previous reporting has been. The Governmental Accounting Standards Board couldn’t keep a straight face any longer as it watched governments like Illinois hide OPEB obligations, so it issued a new standard requiring better disclosure, which is now fully in effect.

The simple is fact is that the state’s true condition is indeed a full $47 billion worse than most Illinoisans were told a year ago. That’s because the regular media, like the accountants, have long ignored OPEB liabilities. If you know about them it’s probably only because you read about them here or in other alternate sources, or have expertise in the area.

The chart below shows the full story properly over time. Since 2002 the state has lost $178 billion. The big jump down in 2015 was also due to an accounting change. There have been other, smaller ones. However, had the proper accounting rules been in place from the start, the line would still end in the same place. Its downward slope would only have been less jagged.

The second reason why the 2018 loss wasn’t reported properly was misleading spin put on by Illinois Comptroller Susana Mendoza when she released the CAFR. Her press release starts as follows:

ILLINOIS CUT ITS DEFICIT IN HALF IN FISCAL YEAR 2018, ANNUAL CAFR SHOWS

The Comprehensive Annual Financial Report (CAFR) released today shows Illinois cut its general funds deficit by $6.849 billion — from a deficit of $14.612 billion in fiscal year 2017 to a deficit of $7.763 billion in fiscal year 2018. That is largely because of a refinancing of state debt from high-interest to low-interest repayment.

Many news stories repeated that or something like it with happy headlines like “Annual report: Illinois cuts deficit in half in fiscal year 2018.” Most of those stories buried the huge loss and the OPEB issue or didn’t mention them at all A notable exception was The Bond Buyer, with a more appropriate headline, “Illinois CAFR arrives, late and covered in red ink.”

Comptroller Susana Mendoza

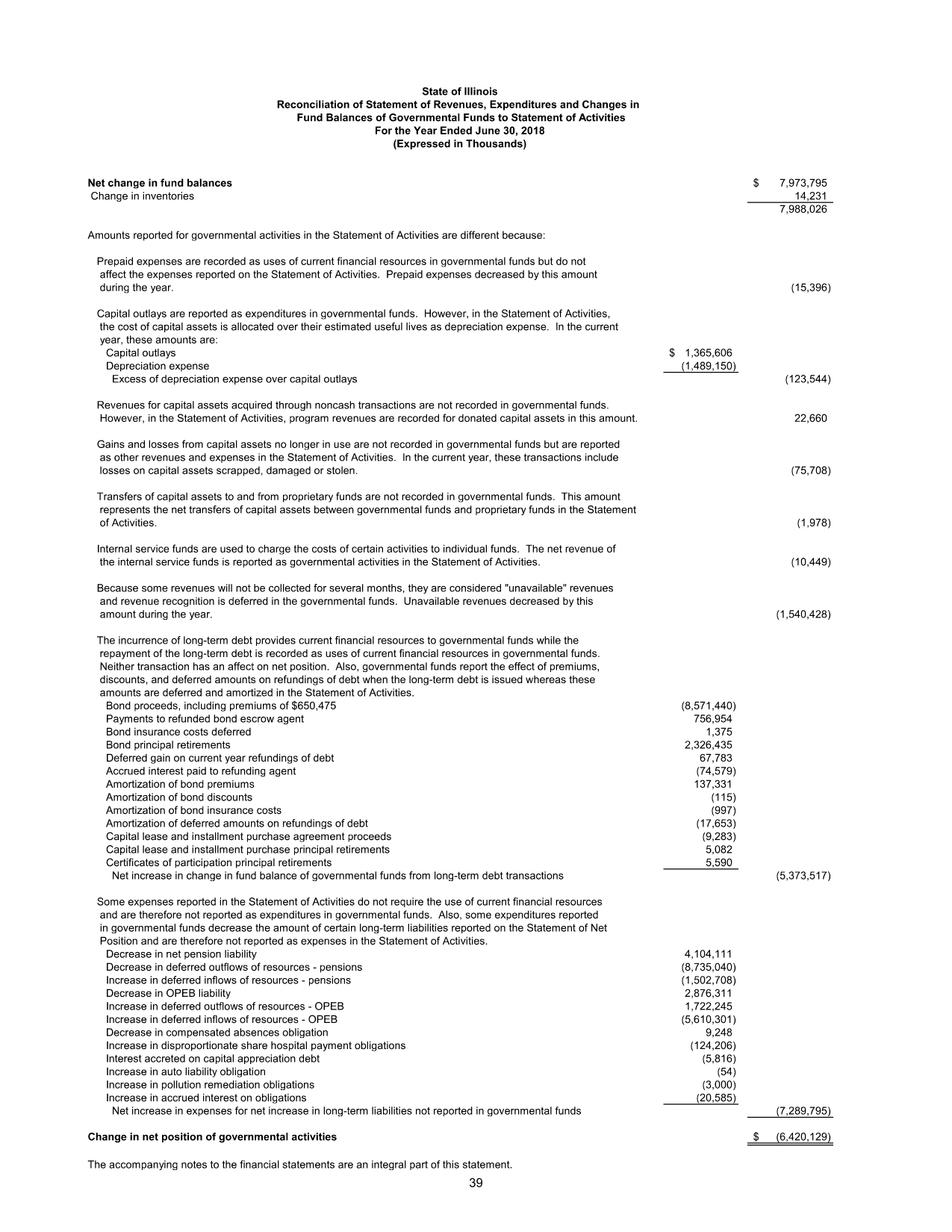

In truth, Mendoza cherry-picked an extremely unrepresentative element of the CAFR. Note that she referred only to the “general funds” to claim the deficit reduction. The general funds are only part of the picture, and they effectively count borrowed money as if it is income!

It’s like claiming you cut your losses in half by putting that half on a credit card. During the year, Illinois sold bonds to pay down $6.5 billion of its huge backlog of unpaid bills. Refinancing from one debt to another in that manner has little genuine impact, aside from some interesting savings that, for 2018, would be a tiny portion of the supposed deficit reduction.

This is a common trick politicians use. I checked in with Sheila Weinberg, CEO of Truth in Accounting, about the Illinois CAFR issue. She repeated what she has long taught: “General fund accounting is incomplete and misleading, for many reasons including the fact that bond proceeds are accounted for as income.” (For those interested in the details, see the page from the CAFR reproduced below listing all the items ignored in the Governmental Funds, which include the general fund, which is why it is so misleading.)

Mendoza certainly had a different lens on CAFR numbers two years ago when we had a governor she didn’t like, Bruce Rauner. Her press release for the 2016 CAFR started as follows, focusing on the entire net position instead of just general funds:

With no relief in sight, Illinois’ finances deteriorated at an alarming rate in fiscal year 2016 as net deficit totals spiked to a staggering $126.7 billion…. The State’s [CAFR] paints a worsening outlook for the State’s financial future on this unsustainable path. Mendoza said the CAFR findings reflect a lawless fiscal climate.

Well, that “staggering” negative $126.7 billion is now negative $184 billion. It had worsened by $5.8 billion under that “lawless fiscal climate,” which is about the same as last year if you ignore the OPEB loss. No moral outrage now from Mendoza, however.

I called Abdon Pallasch, Mendoza’s press director, to comment on why I thought her most recent press release is so misleading. “It’s all in the CAFR” that was published, he said, adding that they selected the parts they did, focused on the general fund, and that those wishing to write about other aspects can look at the other sections.

Yes, literally read, Mendoza’s press release is correct. I say it’s also grossly misleading.

Keep in mind that the 2018 fiscal year was an unusually good year in the markets, which temporarily reduced the state’s deficit. Stocks returned some 14% that year, about twice what the state pensions assume they will return per year. That allowed the pensions to actually improve a bit – the net unfunded pension liability shrank by $4 billion to $134 billion. Had they deteriorated as rapidly as they typically do, the overall report would have been far worse.

Finally, if you’ve been wondering how much the recent state income tax hikes would solve, you now have the answer. Those increases took effect at the start of the fiscal year covered by the new CAFR. They obviously didn’t materially change the state’s direction downward, even if you ignore the OPEB issue.

Page 39 from CAFR, listing matters not recorded in Governmental Funds that do impact change in net position: