via Eric Basmajian

Summary:

- Breakeven rates have come down significantly from the peak several weeks ago.

- We have forecast the reduction in break-even rates for the past couple of months.

- As inflation expectations fade, nominal rates will continue to fall.

BREAKEVEN RATES

On March 13, 2018, I penned a research note to members of EPB Macro Research titled, “[Weekly Macro Theme] Inflation In Focus‘. The [Weekly Macro Theme] report is one of three reports sent out to subscribers on a weekly basis.

In that research note, I argued that the market’s expectations for inflation over the next 10 years, via the breakeven rate, were far too high at a rate of 2.10% and would likely converge to the true 10-year annualized rate of inflation, near 1.6%. I also argued that a 50-basis point reduction in inflation expectations would translate to roughly a 50-basis point decline in the 10-year treasury yield all else equal. Both growth and inflation impact long-term interest rates, and a reduction in inflation expectations would translate to lower nominal yields.

Before updating the current rates of inflation expectations, here is a look at what I wrote to subscribers in the [Weekly Macro Theme]report roughly three weeks ago.

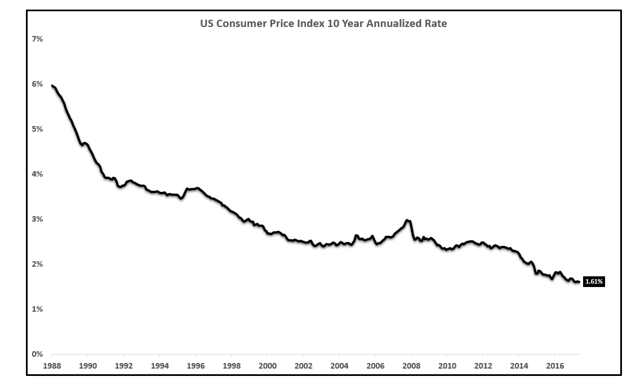

The rate of inflation over the past 10 years has been 1.61% on average and has been in decline over the past several decades given the factors of debt, demographics, and productivity discussed above.

10 Year Annualized Inflation Rate:

Source: BLS, EPB Macro Research

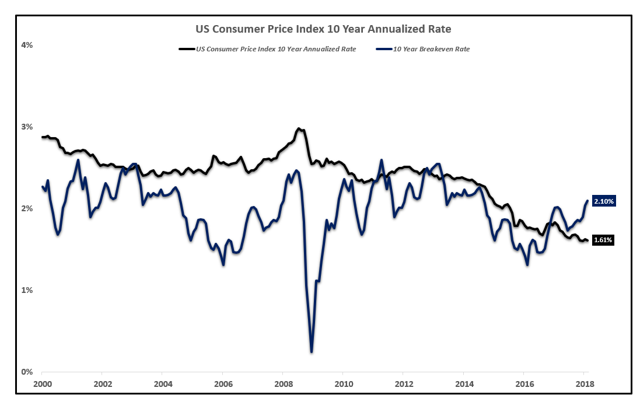

Inflation expectations are way too high. I have highlighted this point in past articles but it is worth reiterating. Inflation over the past 10 years has been 1.61% on average and the market is currently anticipating, through 10-year breakeven rates, that there will be 2.10% inflation on average over the next 10 years.

Inflation Expectations Are WAY Too High:

Source: BLS, EPB Macro Research

It is important to note that long-term interest rates have bottomed. On February 21, (TLT) bottomed. The economic data has slowed materially since then, along with the inflation data as noted above. This was well forecast in previous notes and will start to get priced in more significantly in the coming weeks.

I expected the market to begin repricing inflation expectations as stated in the last line of that statement above.

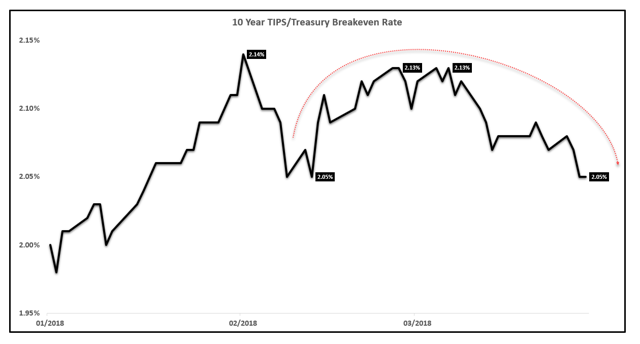

Since that research note, inflation expectations have fallen from 2.10% to 2.05%. Inflation expectations were 2.13% at the peak.

Since that note on March 13th, the 10-year Treasury rate (IEF) has fallen from 2.87% to 2.77% today. The 10-year yield has dropped 10 basis points, with a 5 basis point reduction in inflation expectations since March 13th.

10-Year Breakeven Inflation Rate:

Source: FRED, EPB Macro Research

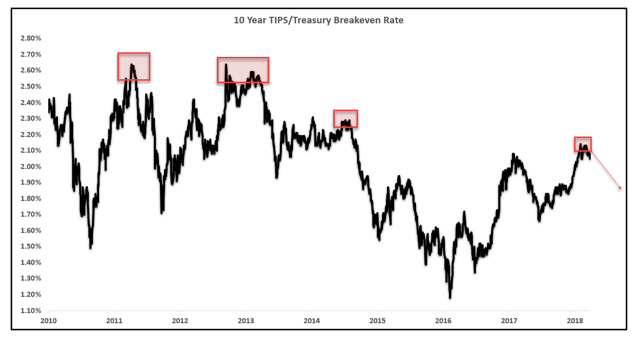

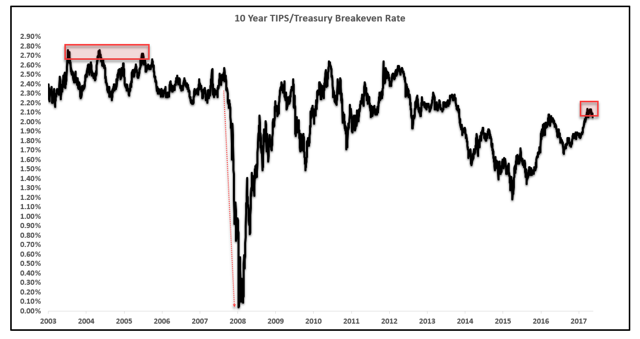

The breakout in inflation expectations should be put in perspective. Below is a chart of the 10-year breakeven rate during this economic cycle, starting in 2010. The market’s inflation expectations reached 2.5% back in 2011-2013 and today, a peak rate of 2.13% caused concern over higher Treasury rates.

10-Year Breakeven Inflation Rate:

Source: FRED, EPB Macro Research

Pulling the chart back to the previous economic cycle shows inflation expectations falling from the last cycle to this cycle. In 2003-2005, inflation expectations over a 10-year period were regularly at 2.70%. What is also noteworthy is the crash in inflation expectations that occurs during recessionary periods. It is important to understand the trend in inflation expectations but also the tail risks that could potentially lead to an adjustment such as the 2008 period. 10-year interest rates clearly plunged along with inflation expectations during the last recession.

10-Year Breakeven Inflation Rate:

Source: FRED, EPB Macro Research

The chart below shows the breakeven inflation rate and the 10-year treasury rate. The two lines are clearly correlated in direction. As inflation expectations rise, interest rates rise and as inflation expectations fall, interest rates fall. The magnitude is not correlated because inflation expectations are only one half of the equation in regards to the drivers of longer-term interest rates. Growth also impacts the level of long-term interest rates.

10-Year Breakeven Inflation Rate:

Source: FRED, EPB Macro Research

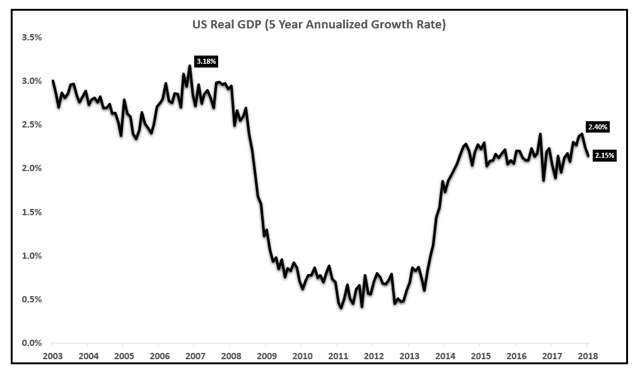

The previous economic cycle had a cycle peak in growth, defined using a 5-year annualized rate, of 3.18%. Today, the growth rate is 103 basis points lower at 2.15%. From the peak in 2007 compared to today, growth is 103 basis points lower, and inflation expectations are roughly 75 basis points lower.

When looking at all the facts, the argument that foreign banks or central banks are the ones who are suppressing rates seems more incorrect.

How can one argue rates should be where they were in the past economic cycle, in the high 4% range, when growth and inflation expectations are 175 basis points lower.

5-Year Annualized Growth:

Source: FRED, EPB Macro Research

If you add 175 basis points to today’s rate of roughly 2.8%, to normalize the growth and inflation expectations, you land at 4.55%, a rate that seems more ‘normal’.

Long-dated interest rates are, for the most part, a function of growth and inflation expectations.

Inflation expectations have peaked and are now headed lower.

It is my view that inflation expectations for the next 10 years will converge to the actual 10-year annualized rate of inflation in the economy which is roughly 50 basis points lower. Holding growth constant means if this prediction holds true, rates will drop roughly 50 basis points.

I also believe, however, that the peak in economic growth is behind us, and growth will begin to decelerate. In fact, there is ample evidence that growth is already starting to decelerate.

Coupling a falling rate of growth with declining inflation expectations will cause a continued fall in nominal long-term treasury rates.

EPB Macro Research is my premium service on Seeking Alpha. EPB Macro Research provides no-spin, unbiased and in-depth macroeconomic analysis that is used to forecast markets and generates a portfolio based on which asset class is likely to outperform over the next 1-2 years. Most economic analysis is biased, unreliable and unaccountable. EPB Macro Research is fully transparent, providing a full track record of all the changes to the model portfolio.