the bear market infection is spreading around the world! pic.twitter.com/6QbeKbvx1R

— Alastair Williamson (@StockBoardAsset) October 27, 2018

The market has only just begun a correction from being extended 3-standard deviations above the long-term mean. 1999, 2007 and 2015 were previous instances. $SPY $TLT https://t.co/uSCQxCkyTF pic.twitter.com/JpOsx55amw

— Lance Roberts (@LanceRoberts) October 27, 2018

QT finding traction.

The #moneyprintingpump is turned off. pic.twitter.com/pK1xAMeNip— Chris Carolan (@spiralcal) October 26, 2018

#DJT another WALL👇…of worry

H&S Pattern

Same Structure 2007-08 TOP pic.twitter.com/a30lx1FANe— Antonio Pérez Algás (@apanalis) October 26, 2018

They were all alike. They were the result of an extremely unstable, over leveraged system. (2000 wasn’t a crisis and neither was 1987). Stock declines and crises are different.

1907, 1929, 1998, 2008 were, and there were many similarities https://t.co/Yy4Er0GANu

— OW (@OccupyWisdom) October 27, 2018

Global mkts have lost another $2tn in mkt cap in this week's rout as investors reacted heavily to multiple high-profile 3Q results misses as well as fairly tepid batch of global macro data. Since Jan high, global stocks lost $15tn in value, equal to combined GDP of Eurozone & UK pic.twitter.com/qBAEW4g5Dp

— Holger Zschaepitz (@Schuldensuehner) October 27, 2018

For reference for how emotional cycles/expressions of exogenous market events tracks. Here is a chart we will add more data and content to as time goes. This versions contains $NDX added to the view. All charts are daily scaled to match approx 1st drawdown off the top ref $INDU pic.twitter.com/mI2mD1JQ4j

— mcm-ct.com (@mcm_ct) October 27, 2018

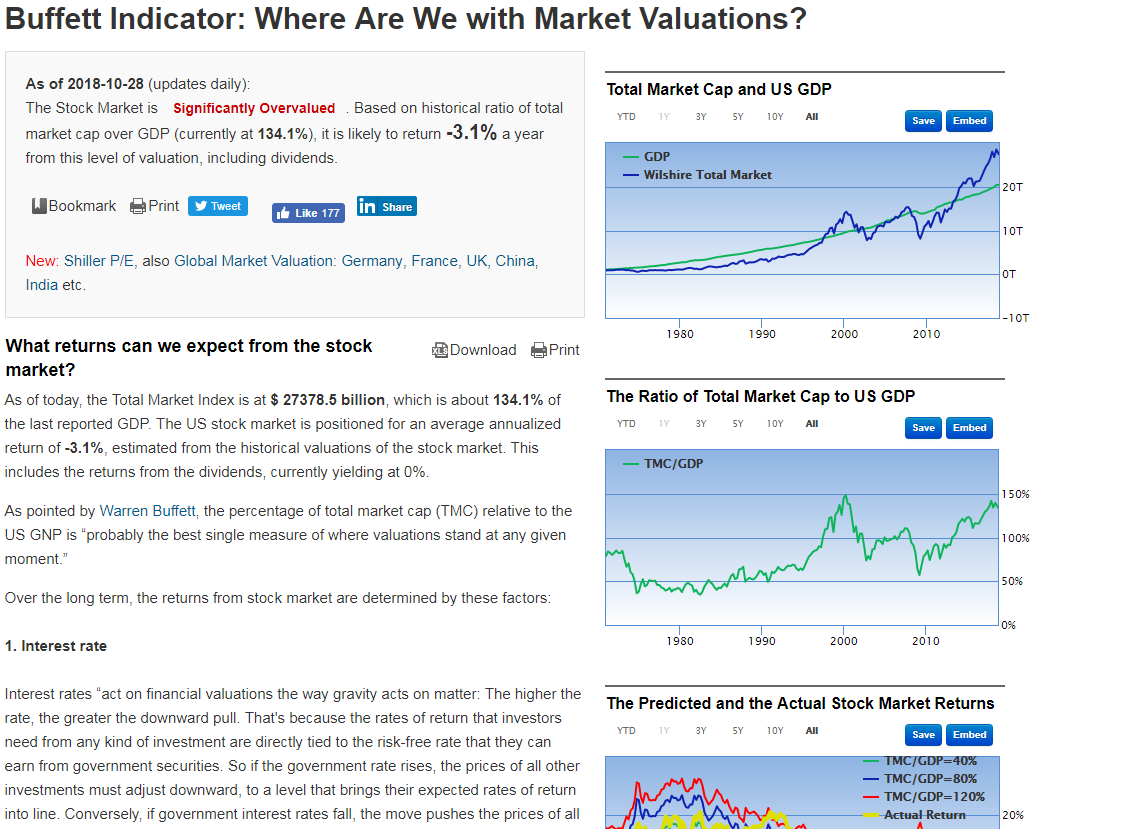

Buffett Indicator: Where Are We with Market Valuations?

https://www.gurufocus.com/stock-market-valuations.php

As of 2018-10-26 The Stock Market is Significantly Overvalued. Based on historical ratio of total market cap over GDP (currently at 134.1%), it is likely to return -3.1% a year from this level of valuation, including dividends.

h/t chillingniples