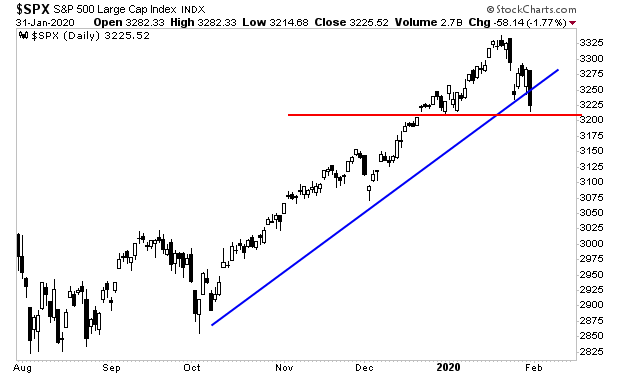

Stocks broke the uptrend (blue line) last week. They only just held critical support (red line). Had they not, it would have been an absolute bloodbath,

The media is blaming the sell-off on coronavirus, but the far more likely candidate is that stocks were extremely overbought and the Fed stopped providing liquidity to the financial system.

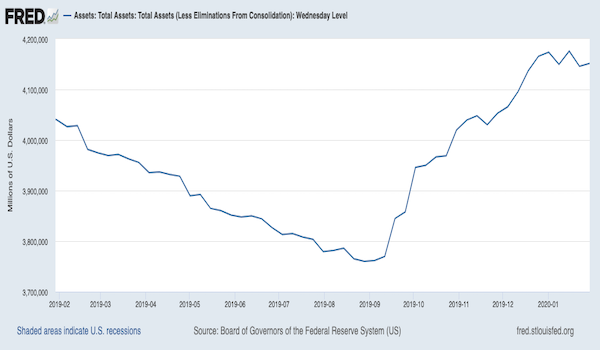

As of last week, the Fed’s balance sheet was actually DOWN for the year. As the below chart shows, the Fed has been pulling liquidity since mid-December, with the Fed’s balance sheet flatlining since that time.

Why the Fed would do this is anyone’s guess. Technically it is engaged in a $60 billion per month QE program. And between this and its various repo programs, its balance sheet had been expanding by $100 billion per month from September up until December of last year.

So… did the Fed intentionally “pull the plug” on the markets?

If so, our original forecast for the S&P 500 to rip higher will be nullified. Organic buying power and buybacks can accomplish a lot… but if the Fed is ACTIVELY pulling liquidity to sabotage the markets, it means stocks are going DOWN no matter what is happening with the economy or investors.

If you haven’t already taken steps to prepare your portfolio for a Fed-induced crash, it’s time to pick up a copy of our Stock Market Crash Survival Guide.

Within its 21 pages we outline which investments willperform best during a market meltdown as well as how to take out “Crash insurance” on your portfolio (these instruments returned TRIPLE digit gains during 2008).

To pick up your copy of this report, FREE, swing by:

http://phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research