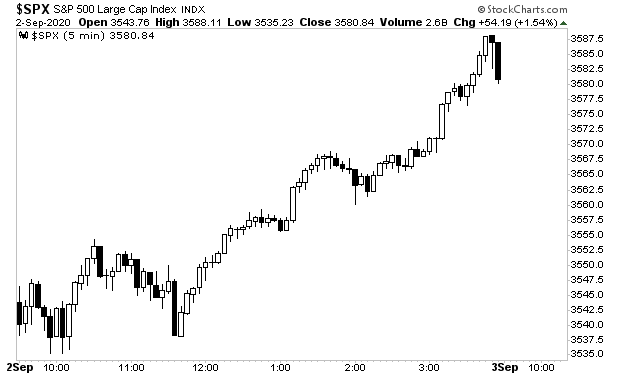

Stocks exploded higher yesterday with a massive intervention coming around 11:30AM.

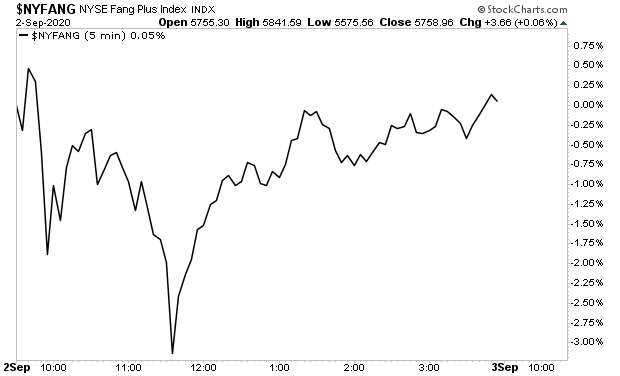

As impressive as this intervention was, it was NOTHING compared to the one that hit FANG stocks. The FANG index soared over 3% when the intervention hit at 11:30AM.

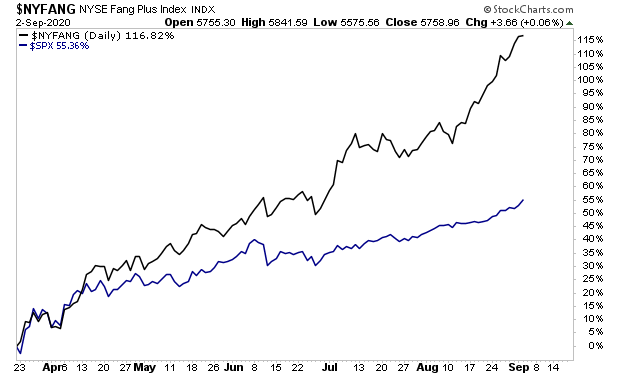

This has been the overall theme since the market bottom in March. The big FANG stocks continue to rally higher and higher, driven by “someone” who wants to drive the markets higher no matter what the real economy is doing.

Take a look at the difference in performance between the FANGs and the S&P 500.

This begs the questions….

Why are these same companies outperforming so much?

And why is it that every time the market starts to breakdown, the FANGs explode higher?

Because these are the companies that central banks are buying.

Together these companies account for over 20% of the stock market. So if central banks can get them to rally,the rest of the market will follow.

As a result of this, front-running central bank actions, is the #1 trading strategy going forward.

At the end of the day, it all boils down to what I’ve been saying since 2017… that the Fed and other central banks are trapped in a vicious cycle through which it INTENTIONALLY creates bubbles to deal with each successive bust.

We had the Tech Bubble in the ’90s.

The Housing Bubble in the mid-00s.

And now the Everything Bubble in 2020.

On that note, we’re putting together an Executive Summary on how to play this move.

It will identify which investments will perform best during the Fed’s next bubble, including a unique play that could more than double the performance of the S&P 500.

This Executive Summary will be available exclusively to subscribers of our Gains Pains & Capital e-letter. To insure you receive a copy when it’s sent out, you can join here:

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research