by Dismal-Jellyfish

Dear Mr. Speaker:

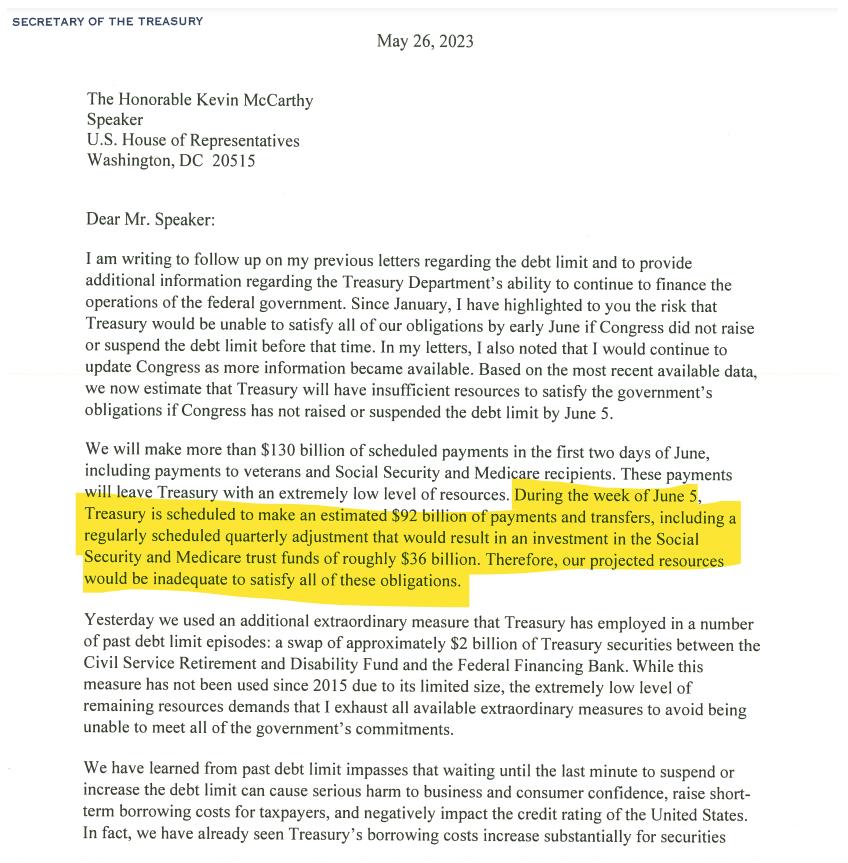

I am writing to follow up on my previous letters regarding the debt limit and to provide additional information regarding the Treasury Department’s ability to continue to finance the operations of the federal government. Since January, I have highlighted to you the risk that Treasury would be unable to satisfy all of our obligations by early June if Congress did not raise or suspend the debt limit before that time. In my letters, I also noted that I would continue to update Congress as more information became available. Based on the most recent available data, we now estimate that Treasury will have insufficient resources to satisfy the government’s obligations if Congress has not raised or suspended the debt limit by June 5.

We will make more than $130 billion of scheduled payments in the first two days of June, including payments to veterans and Social Security and Medicare recipients. These payments will leave Treasury with an extremely low level of resources. During the week of June 5, Treasury is scheduled to make an estimated $92 billion of payments and transfers, including a regularly scheduled quarterly adjustment that would result in an investment in the Social Security and Medicare trust funds of roughly $36 billion. Therefore, our projected resources would be inadequate to satisfy all of these obligations.

Yesterday we used an additional extraordinary measure that Treasury has employed in a number of past debt limit episodes: a swap of approximately $2 billion of Treasury securities between the Civil Service Retirement and Disability Fund and the Federal Financing Bank. While this measure has not been used since 2015 due to its limited size, the extremely low level of remaining resources demands that I exhaust all available extraordinary measures to avoid being unable to meet all of the government’s commitments.

We have learned from past debt limit impasses that waiting until the last minute to suspend or increase the debt limit can cause serious harm to business and consumer confidence, raise short-term borrowing costs for taxpayers, and negatively impact the credit rating of the United States. In fact, we have already seen Treasury’s borrowing costs increase substantially for securities maturing in early June. If Congress fails to increase the debt limit, it would cause severe hardship to American families, harm our global leadership position, and raise questions about our ability to defend our national security interests.

I continue to urge Congress to protect the full faith and credit of the United States by acting as soon as possible.

Sincerely,

Janet L. Yellen

*TREASURY CASH PILE DROPPED TO $38.8B LOWEST AMOUNT SINCE 2017 pic.twitter.com/YE19PyA1M7

— GURGAVIN (@gurgavin) May 26, 2023